Market News

Titan Q1 results: Revenue, net profit likely to see moderate growth; check earnings preview and key technical levels

.png)

3 min read | Updated on August 07, 2025, 12:25 IST

SUMMARY

Titan is set to announce its Q1 FY26 results on 7 August, with revenue expected to rise 13–17% YoY, led by steady growth in jewellery, watches, and eyecare segments. Technically, Titan is consolidating near key moving averages, with ₹3,500 and ₹3,300 as critical breakout levels.

Stock list

Titan technical structure is at a crucial juncture and is consolidating around its 50 and 200-day exponential moving averages (EMAs).

Titan will announce its June quarter results on 7 August 2025. The company is expected to report double-digit revenue growth across various business sectors.

According to the company's quarterly business update, Titan expects jewellery segment revenue to grow by 18% year-on-year (YoY). This is lower than the 25% YoY growth reported in the previous quarter and is mainly due to gold price volatility.

Meanwhile, Titan's other businesses, such as watches and eyecare, are expected to report growth of 23% and 12% YoY, respectively. During Q1 of FY26, the Tata Group company opened 10 new stores across its different verticals, bringing its total store count to 3,322.

According to experts, Titan’s standalone Q1 revenue could increase by 13–17% YoY to ₹15,100–₹15,650 crore, while its net profit may rise by 14–18% YoY to ₹823–₹855 crore, though this could remain flat on a sequential basis.

Titan reported revenue of ₹13,266 crore in Q1 FY25, compared to ₹14,916 crore in the previous quarter. Its net profit stood at ₹715 crore in Q1FY25 and ₹871 crore in Q4FY25.

During the quarterly results announcement, investors will closely watch the management’s commentary on the demand outlook, especially with gold prices trading near record highs. They will also monitor key metrics such as same-store sales growth (SSSG), revenue growth, and margins across different segments.

Ahead of the Q1 results announcement, Titan shares are trading around ₹3,400 apiece on Thursday, August 7, down 0.3%.

Technical view

The technical structure of Titan is at a crucial juncture and is consolidating around its 50 and 200-day exponential moving averages (EMAs). Additionally, on the weekly timeframe, it is trading in a downward trending channel, indicating range-bound structure.

Meanwhile, for short-term clues, traders can monitor the price action between immediate resistance of ₹3,500 and support zone of ₹3,300. A breakout from this zone on a closing basis will provide further directional insights.

Options outlook

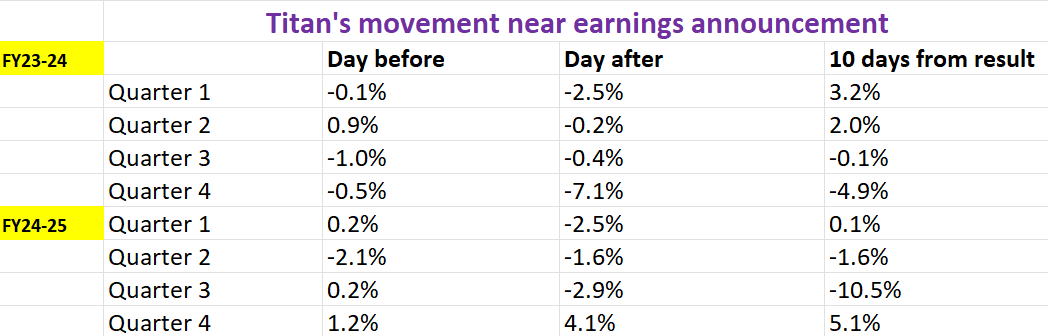

As of 7 August, the at-the-money (ATM) strike for Titan’s 28 August expiry stands at 3,400, with both the call and put options trading at ₹161. This pricing reflects an implied move of approximately ±6.7% by expiry. To assess how this expected move compares, let’s examine Titan’s stock performance around its earnings announcements over the past eight quarters.

Options strategy for Titan

The options market is anticipating a potential move of ±6.7% for Titan. Traders looking to benefit from this anticipated volatility could consider long or short volatility strategies; straddles are a popular choice here.

A long straddle involves buying both at-the-money call and put options with the same strike price and expiry date. This strategy is profitable if the stock price moves by more than ±6.7%.

In contrast, a short straddle involves selling both the ATM call and put options. This approach profits when the stock remains within the implied range post-earnings, benefiting from time decay and a drop in implied volatility.

For those with a directional bias, spreads offer a more targeted approach. With resistance near ₹3,500 and support zone of ₹3,300, traders with a bullish view might consider a bull put spread, while those expecting downside break can look for a bear call spread.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story