Market News

TCS Q3 results: Revenue and profit likely to remain flat; focus on AI business outlook, new deal wins and interim dividends

.png)

4 min read | Updated on January 12, 2026, 09:51 IST

SUMMARY

Tata Consultancy Services (TCS) is expected to report steady but muted performance in the third quarter of FY26, with modest revenue growth amid cautious global IT spending. Investors will be closely monitoring AI-led deal wins. Additionally, management’s guidance on growth and the demand outlook will be the key focus.

Stock list

TCS shares are struggling to sustain above 200-day exponential moving average (EMA), which continues to act as a resistance. | Image: Shutterstock

IT giant Tata Consultancy Services (TCS) will kick off the third-quarter earnings season on Monday, January 12. TCS is expected to announce its results after market hours. Hence, the stock is likely to react to the Q3 earnings on Tuesday, January 13.

TCS Q3 revenue and net profit expectation

According to experts, TCS is expected to report low single-digit growth in revenue and net profit. Meanwhile, investors' focus will be on revenue from AI-related services, new deals won, and progress on data centre investments.

The Tata Group company is expected to report a marginal rise of 1% to 3% quarter-on-quarter (QoQ) in revenue, ranging from ₹66,230 to ₹66,730 crore, compared to ₹65,799 crore in the previous quarter and ₹63,973 crore in Q3FY25.

TCS net profit could fare better and could rise by 5 to 7% QoQ to ₹12,710 and ₹12,890 crore during the December quarter. The company reported a net profit of ₹12,075 crore in Q2FY26 and ₹12,380 crore in Q3FY25. Meanwhile, the EBIT margin is expected to remain flat in the range of 25% to 25.4%, while new deal wins are projected between $7 to $9 billion.

Investors focus on TCS AI revenue

Management commentary on AI monetisation and new-age services could be the highlight of the third-quarter earnings. During TCS analyst day 2025, TCS management said it has executed over 5,000 AI engagements, with AI-related services now generating about $1.5 billion in annualised revenue, growing at over 28% YoY and accounting for roughly 5% of total revenues. Investors will also be watching for growth prospects in key sectors, such as financial services, as well as for third interim dividend announcements. The record date for these is Saturday, 17 January 2026.

Ahead of the Q3 result announcement, TCS shares are trading marginally lower down 0.15% at ₹3,203 apeice on NSE. The stock is down over 20% in the last 1-year.

Technical outlook

The technical setup of Tata Consultancy Services is sideways to bearish on the daily chart. The stock is struggling to sustain above its 200-day exponential moving average (EMA), which continues to act as a resistance. Meanwhile, the 50-day EMA is providing immediate support. For the short-term outlook, traders can monitor the range of ₹3,300 and ₹3,150. A breakout or breakdown of this range, supported by short-term EMAs, will provide directional clues. Within the range of ₹3,300 and ₹3,150, the stock may continue range-bound movement.

Options outlook

Open interest data for the 27 January expiry shows significant call writing at the 3,300 strike, signalling strong resistance around this zone. Meanwhile, a significant call and put base was also observed at the 3,200 strike, indicating that market participants are expecting consolidation around this zone.

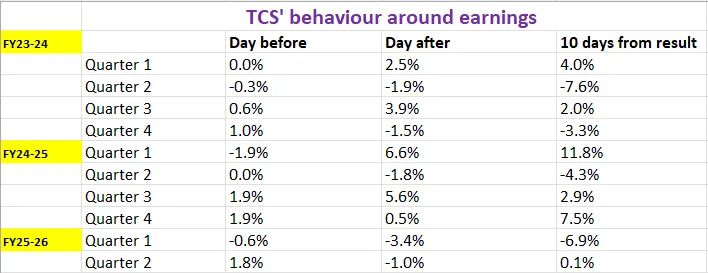

At-the-money (ATM) strike on 11 January is at 3,200 strike and is priced at ₹124, implying an expected price movement of ±3.9% before the expiry of 27 January contracts. To judge whether this is realistic, let’s see how TCS has historically reacted around earnings announcements.

Options strategy and approach

The options market is pricing in a ±3.9% move for TCS in the January expiry. That opens the door for traders to play either side of the volatility.

The long straddle strategy remains ideal for traders expecting a significant price movement or a breakout/breakdown of a price range. This involves buying at-the-money call and put options with the same strike price and expiry date. The strategy generates a profit if the TCS fluctuates by more than 3.9%.

On the flip side, traders anticipating consolidation or sideways movement in TCS may consider a short straddle strategy. This involves selling an at-the-money call and put option with the same strike price and expiry date. The strategy generates a profit if the stock price remains within ±3.9% of the strike price.

Meanwhile, positional or swing traders can consider debit spreads like a bull call spread or a bear put spread based on the breakout or breakdown of the range.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop losses. The information is only for educational purposes. We do not recommend any particular stock, securities or strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story