Market News

Tata Motors Q2 Results: Net profit drops 11% to ₹3,343 crore; firm says growth impacted due to external challenges

4 min read | Updated on November 08, 2024, 16:56 IST

SUMMARY

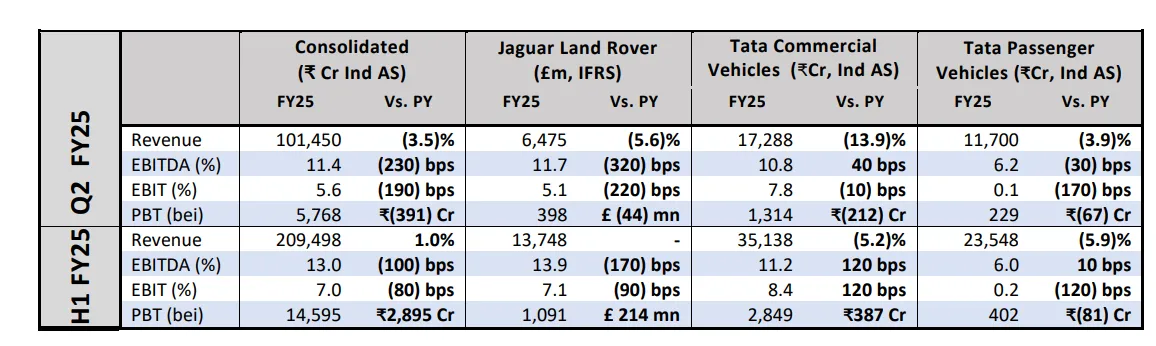

Total revenue from operations came in at ₹101,450 crore, down 3.49% against ₹105,129 crore logged in the September 2023 quarter. Basic earnings per share (EPS) for the quarter under review stood at ₹9.72 against ₹9.81 in the year-ago period.

Stock list

Total revenue from operations came in at ₹101,450 crore, down 3.49% against ₹105,129 crore logged in the September 2023 quarter.

Total revenue from operations came in at ₹101,450 crore, down 3.49% against ₹105,129 crore logged in the September 2023 quarter.

Basic earnings per share (EPS) for the quarter under review stood at ₹9.72 against ₹9.81 in the year-ago period.

In its earnings release, the auto major said "Tata Motors delivered revenues of ₹101.5K crore (down 3.5%), EBITDA at ₹11.6K crore (11.4%, down 230 bps), and EBIT of ₹5.6K crore (5.6%, down 190 bps) in a challenging external environment. PBT (bei) for Q2 FY25 stood at ₹5.8K crore, down ₹391 crore, while net profit was ₹3.5K crore. For H1 FY25, the business reported a strong PBT (bei) of ₹14.6K crore, an improvement of ₹2.9K crore over the previous year."

Jaguar Land Rover (JLR) revenue was down by 5.6% to £6.5b. JLR's performance was impacted by temporary supply constraints, which resulted in EBIT margins of 5.1% (down 220 bps). CV revenues were down by 13.9%, but EBITDA margins improved to 10.8% (up 40 bps) on favourable pricing and material cost savings despite adverse volumes.

PV revenues were down by 3.9%, but EBITDA margins were steady at 6.2% (down 30 bps) through mix improvements and cost reduction actions.

Commenting on the outlook, Tata Motors said, "We remain cautious on near-term domestic demand. However, the festive season and substantial investments in infrastructure should help bolster it. JLR wholesales are expected to improve sharply as supply challenges ease. Overall, we expect an all-round improvement in performance in H2 FY25 and the business to become net debt free by this year."

PB Balaji, Group Chief Financial Officer, Tata Motors, said: “Growth in the quarter was impacted due to significant external challenges as highlighted earlier. Overall, the business fundamentals remain strong, and we remain focused on our agenda of driving growth, competitiveness, and free cash flows. As the supply challenges ease and demand picks up, we are confident of steady improvement in our performance and delivering a strong H2.”

JLR Financials

JLR delivered an eighth successive profitable quarter, despite temporary aluminum supply constraints, according to the press release. Revenue for the quarter was £6.5 billion, down 5.6% versus Q2 FY24, while H1 FY25 revenue at £13.7 billion was flat yoy. EBIT margin was 5.1% in Q2 FY25, down 220 bps compared to Q2 FY24, while H1 FY25 EBIT margin was 7.1%.

The decrease in profitability YoY reflects lower wholesales and increased VME, FMI, and selling costs, partially offset by prioritisation of Range Rover production and material cost improvement.

VME stands for variable marketing expense, while FMI is acronym for fixed marketing investments.

PBT in Q2 FY25 was £398 million, down from £442 million a year ago, while H1 FY25 profit before tax was £1,099 million, up 25% YoY. Free cash flow for the quarter was £(256) million, again reflecting constrained production and wholesale volumes, the earnings release added.

JLR Outlook

The company said that both production and wholesale volumes are expected to pick up strongly in the second half as the aluminum supply situation normalises, and it will continue its diligent management of costs. "We hold our full-year guidance for revenue of c. £30 billion, EBIT margin ≥8.5% EBIT, and achieving a positive net cash position."

Results were declared after stock market hours. Shares of Tata Motors ended 1.72% lower at ₹805.70 apiece on the BSE.

About The Author

Next Story