Market News

Reliance Q2 results: Revenue, net profit may see double-digit growth; Check options strategy and key technical levels

.png)

4 min read | Updated on February 12, 2026, 13:25 IST

SUMMARY

Reliance Industries will announce its September-quarter results on Friday, October 17. Analysts expect a broadly positive performance supported by solid contributions from oil-to-chemicals, retail, and telecom arms. Technically, the stock remains range-bound between ₹1,320 and ₹1,500, with a breakout above ₹1,450 likely signalling bullish momentum, while a fall below ₹1,320 could invite further pressure.

Stock list

Net profit is expected to increase by 10–11% year on year, reaching ₹21,320–21,475 crore. | Image: Shutterstock

Oil-to-telecom conglomerate Reliance Industries will announce results for the September quarter on Friday, 17 October. According to experts, Reliance is expected to deliver a decent performance this quarter, thanks to growth in key areas such as oil-to-chemicals (O2C), retail and telecoms.

Reliance Industries’ consolidated Q2 revenue is expected to increase by 8-11% year on year to ₹2.52-2.57 lakh crore, with a 2-5% sequential rise also anticipated. The company reported revenue of ₹2.31 lakh crore in the same quarter last year, and ₹2.43 lakh crore in Q1 FY26.

Net profit is expected to increase by 10–11% year on year, reaching ₹21,320–21,475 crore. In Q2 FY25, the company reported a net profit of ₹19,323 crore, compared to ₹30,783 crore in the previous quarter.

Furthermore, Reliance Industries’ consolidated EBITDA could rise by 14-16% YoY to a range of ₹44,550 to ₹44,850 crore, aided by growth across different business segments.

Investors will be closely tracking Reliance Industries' Q2 results in order to assess the performance of its retail, telecom and oil refining businesses. Management commentary on the overall business scenario will also be closely monitored.

Ahead of the Q2 results announcement on Thursday, October 16, Reliance Industries shares are trading 1% higher at ₹1,378. So far this year, Reliance shares have provided investors with a return of over 13%.

Technical view

Reliance Industries continues to trade within a descending channel, facing consistent resistance from a downward sloping trendline near ₹1,480–₹1,500. The stock has made multiple failed attempts to break above this zone since mid-2024, marking it as a strong supply region.

On the downside, the support base near ₹1,340–₹1,320, highlighted by the horizontal green band, has held firm on several occasions. Price is currently oscillating between this well-defined support and resistance zone, indicating a sideways consolidation phase.

The 21-EMA (₹1,388) and 50-EMA (₹1,374) are converging closely, showing indecisive momentum in the near term, while the 200-EMA (₹1,257) remains far below, reflecting long-term trend stability. A sustained move above ₹1,420–₹1,450 could trigger a recovery toward ₹1,500–₹1,550, while a breakdown below ₹1,320 may signal further weakness toward ₹1,250.

Options outlook

As of 16 October, the options market suggests that Reliance Industries could experience a price movement of approximately ±3%, based on an at-the-money (ATM) strike price of 1,400 of 28 October expiry.

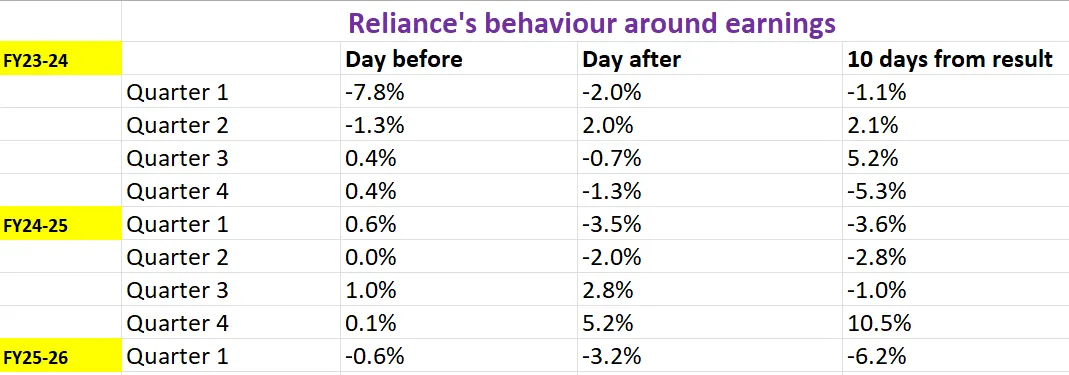

To gain a more in-depth understanding of Reliance Industries' historical volatility and trends, it is beneficial to analyse its price behaviour around earnings announcements.

Strategies based on options data

With options data pricing in a possible price swing of ±3%, traders can consider a range of volatility-based strategies in Reliance Industries.

-

Long straddle: This strategy is ideal for those expecting a significant price movement, regardless of direction. It involves buying an ATM call and an ATM put option with the same strike price and expiry date. A sharp movement of more than ±3% in either direction allows for potential profits. The risk is limited to the combined premium paid for both options.

-

Short straddle: This is suitable when traders expect volatility to decrease and stock to trade within a defined range after earnings. In this case, both an ATM call and an ATM put option with the same strike and expiry are sold. This strategy is profitable if the share price of Reliance Industries remains within the implied ±3% range after the announcement, as both options could expire worthless.

Meanwhile, traders expecting a break above ₹1,420 resistance or a break below ₹1,320 signal can consider directional spreads like Bull Put Spreads or Bear Call Spreads. These strategies allow traders to align their positions with their expectations for both price direction and volatility, helping manage risk and potential return.

About The Author

Next Story