Market News

Maruti Suzuki Q3: Revenue, profit likely to see double-digit growth led by strong volume; key technical levels to watch

.png)

4 min read | Updated on January 28, 2026, 12:48 IST

SUMMARY

Maruti Suzuki is expected to report strong Q3 earnings, driven by festive demand, increased sales and improving margins. However, the stock remains under pressure after falling below key moving averages and reaching long-term support levels. Investors will be focusing on management's comments regarding demand, exports and rising competition in the context of the India-EU trade deal.

Stock list

So far this month, Maruti Suzuki shares are trading over 8.7% lower. | Image: Shutterstock

Automobile giant Maruti Suzuki India is set to announce its results for the December quarter on January 28, 2026. The largest car manufacturer in India is expected to report positive quarterly earnings, driven by increased sales and strong demand during the festive season.

According to experts, Maruti Suzuki's revenue could increase by 30–33% year-on-year (YoY) to between ₹50,450 crore and ₹50,900 crore, while its net profit could grow by 24–30% YoY to between ₹4,410 crore and ₹4,590 crore. Higher profitability could come on the back of a rebound in sales volume due to the festive season, post-GST demand recovery and better product mix.

Meanwhile, EBITDA margin for the December quarter is expected to expand by 50 to 70 basis points to 11.5 to 11.8%, while sales volumes could rise 17% to 19% YoY. Investors will keep an eye on the management commentary on demand trends, export volumes and near-term outlook.

Ahead of the Q3 result, Maruti Suzuki shares are trading 1.9% lower at ₹14,948 as of 12:11 pm on Wednesday January 28. The stock has declined for second stright day after the announcement of the India-EU trade deal, which will reduce tariffs on imports of EU-made cars to 10% from as high as 110%. Experts believe lower tariffs could increase competition in domestic automobile markets. So far this month, Maruti Suzuki shares are trading over 8.7% lower.

Technical view

Maruti Suzuki has entered a clear corrective phase after failing to remain above the ₹17,300–17,400 resistance zone. The recent breakdown below the 21-day and 50-day exponential moving averages (EMAs), followed by a decisive close near ₹15,250, signals weakening short-term momentum.

The price is currently approaching a crucial support zone of the 200-day EMA. A sustained break below this zone could lead to a deeper retracement. Unless Maruti decisively reclaims the ₹15,900–16,000 zone, the stock is likely to remain under pressure, with any rebound facing selling pressure from higher levels.

Options outlook

As of January 27, Maruti Suzuki's February expiry at-the-money ( ATM ) strike was at 15,400, with both call and put options priced at ₹977. This implies an expected price movement of ±6.4% for the 24 February expiry.

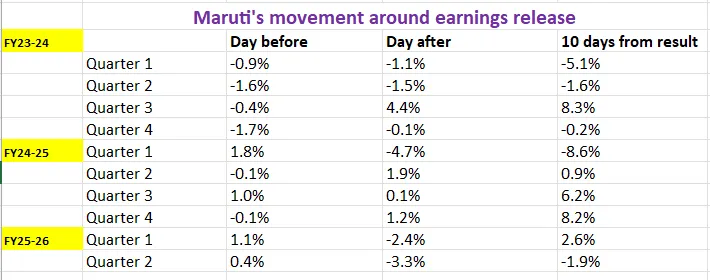

Before considering options strategies, let's take a look at how Maruti Suzuki’s stock has performed during the past two years around earnings announcements.

Options strategies for Maruti Suzuki

With the options market implying a potential move of ±6.4% for Maruti Suzuki ahead of the 24 February expiry, traders may consider both volatility-based and directional strategies.

For volatility based approach, a long straddle involves buying an at-the-money (ATM) call and put option with the same strike price and expiry date. This allows the trader to profit from large price swings in either direction. This strategy is beneficial when the actual price movement exceeds the projected range, making it ideal for those anticipating a breakout or breakdown.

Conversely, a short straddle involves selling both an ATM call and put. It suits traders anticipating muted price action. If the stock remains stable and moves by less than the expected ±6.4%, the seller keeps the premium received.

Meanwhile, for those seeking a directional approach, bull put spreads or bear call spreads offer a more controlled risk-reward approach.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story