Market News

Kotak Mahindra Bank Q1 Results Highlights: Net profit zooms 81% YoY to ₹6,249 crore, NII up 10%

.png)

4 min read | Updated on July 20, 2024, 17:27 IST

SUMMARY

Kotak Mahindra Bank Q1 Results Highlights: The net profit posted by the lender includes the gain of ₹2,730 crore made through divestment of stake in Kotak General Insurance. If that is excluded, then the net profit stands only 2% higher YoY at ₹3,520 crore.

Stock list

Along with Kotak Mahindra Bank, the results of HDFC Bank, Yes Bank, and RBL Bank were also declared on July 20

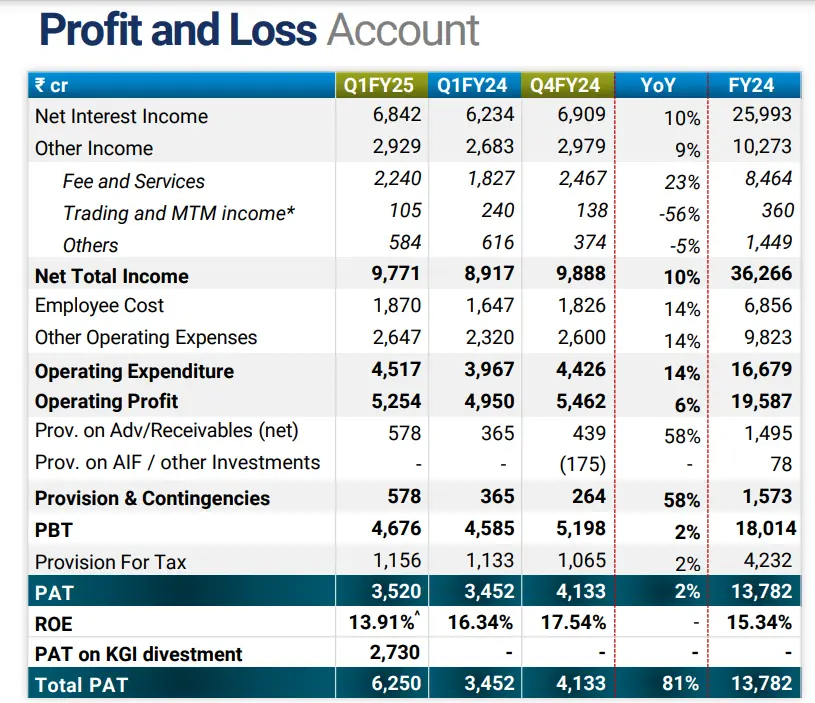

Kotak Mahindra Bank recorded a sharp 81% year-on-year surge in its standalone net profit for Q1FY25 at ₹6,249 crore. However, this comprised a gain of ₹2,730 crore made through divestment of stake in Kotak General Insurance.

The net interest income grew 10% YoY to ₹6,842 crore during the quarter under review, as compared to ₹6,234 crore in the year-ago period.

Kotak Mahindra Bank Q1 Result: Key Highlights

Kotak Mahindra Bank Q1 Results LIVE Update at 02:00 pm: Total deposits up 21% YoY

- Average total deposits grew to ₹4,35,603 crore in Q1FY25 compared to ₹361,295 crore in Q1FY24, up 21% YoY.

- Average current account deposits grew to ₹62,200 crore in Q1FY25 compared to ₹59,431 crore in Q1FY24, up 5% YoY.

- Average savings account deposits rose to ₹1,22,105 crore in Q1FY25 compared to ₹119,817 crore in Q1FY24, up 2% YoY.

- The current account savings account (CASA) ratio as of June 30, 2024 stood at 43.4%.

Kotak Mahindra Bank Q1 Results LIVE Update at 01:55 pm: Operating profit up 6% YoY

- Operating profit for Q1FY25 increased to ₹5,254 crore from ₹4,950 crore in Q1FY24, up 6% YoY.

- Fees and services for Q1FY25 increased to ₹2,240 crore from ₹1,827 crore in Q1FY24, up 23% YoY, the lender said in a release.

Kotak Mahindra Bank Q1 Results LIVE Update at 01:47 pm: NII rises 10% YoY

- The bank's net interest income has climbed 10% YoY to ₹6,842 crore during the quarter under review, as compared to ₹6,234 crore in the year-ago period.

- The net interest margin (NIM) was 5.02% for Q1FY25.

Kotak Mahindra Bank Q1 Results LIVE Update at 01:42 pm: Net profit zooms 81% YoY to ₹6,249 crore

-

Kotak Mahindra Bank's standalone net profit in the quarter ended June 2024 jumped 81% year-on-year to ₹6,249 crore. In the June 2023 quarter, the lender had reported a net profit of ₹3,452 crore.

-

The net profit posted by the lender includes the gain of ₹2,730 crore made through divestment of stake in Kotak General Insurance. If that is excluded, then the net profit stands only 2% higher YoY at ₹3,520 crore.

Kotak Mahindra Bank Q1 Results LIVE Update at 12:05 pm: What the estimates suggest

- The net profit is likely to grow by 7.2% YoY to ₹3,702 crore, as per the average of estimates shared by eight brokerages.

- The NII is estimated to increase by 13% YoY to ₹7,087 crore.

Kotak Mahindra Bank Q1 Results LIVE Update at 11:20 am: How the bank performed in the preceding quarter

- In the preceding quarter - Q4FY24 - the bank's net profit had grown 18% YoY to ₹4,133 crore.

- The net interest income had climbed 13% YoY to ₹6,909 crore.

Kotak Mahindra Bank Q1 Results LIVE Update at 10:35 am: Shares settled in red day before release of results

Shares of the lender settled in the red on Friday, a day before the release of June 2024 quarter results. The scrip last traded at ₹1,821.6 apiece on the NSE, down 0.28%.

The bank's net profit is likely to grow by 7.2% to ₹3,702 crore, as against ₹3,452 crore in the year-ago period, according to the average of estimates shared by eight brokerages.

The net interest income (NII), which is the difference between interest earned and interest paid, is estimated at ₹7,087 crore in the June 2024 quarter, which will be 13% higher as compared to ₹6,234 crore clocked in the June 2023 quarter.

Related News

About The Author

Next Story