Market News

ITC Q3 results: Revenue and net profit likely to see modest growth; check key technical levels

.png)

4 min read | Updated on January 29, 2026, 10:28 IST

SUMMARY

ITC Q3 results will be announced today. Revenue and profit growth are expected to remain in the low single digits. Cigarette sales and growth in the FMCG and agriculture businesses are expected to boost earnings, although margins could come under pressure due to the impending increase in excise duty.

Stock list

ITC shares have declined over 20% so far this month after the new excise duty on cigarettes, due to come into effect from February 2026.

The diversified conglomerate ITC is set to unveil its third-quarter results on 29 January 2026. The consumer goods giant is expected to report decent Q3 earnings, with revenue and net profit growth in the low single digits.

According to experts, ITC could report standalone revenue growth of between ₹18,550 and ₹19,150 crore, an increase of 6–8%, supported by higher cigarette sales and growth in its agricultural business. In the same quarter last year, ITC reported revenue of ₹17,053 crore, while in the previous quarter it was ₹18,021 crore.

Meanwhile, ITC's net profit could rise by 5.4–7.9% year on year (YoY) to between ₹5,160 and ₹5,280 crore, aided by improvements in the product mix, stable volumes and pricing. The company registered standalone net profits of ₹4,893 crore and ₹5,091 crore in Q3FY25 and the previous quarter, respectively. The cigarettes business is expected to see a 5% increase in volumes, while the FMCG and agri businesses could post healthy growth.

During the quarterly results announcement, investors will closely monitor management's comments on the potential impact on profitability following the recent excise duty increase on cigarettes. They will also closely monitor volume and revenue growth across different business segments, such as FMCG, cigarettes and agribusiness. The impact on demand and overall consumption, especially following the GST rate cut, will also be tracked.

Ahead of the Q3 results announcement, ITC shares closed 0.7% higher at ₹321. So far this month, ITC has fallen by over 20% following the government's announcement of a new excise duty on cigarettes, due to come into effect on 1 February 2026.

Technical view

ITC has experienced a sharp decline from its extended sideways trend, with prices definitively falling below the 21-day and 50-day exponential moving averages (EMAs). The strong bearish candle near the ₹360 zone confirms a loss of momentum and a shift in the short-term trend, while the downward slope of the moving averages indicates ongoing selling pressure. The stock is also trading well below the 200-day EMA, which reinforces the weak medium-term outlook.

On the downside, the ₹325–₹320 zone is a key support area where prices are currently attempting to stabilise. A sustained break below this zone could lead to further downside movement. Conversely, the previous breakdown level near ₹360–₹365 is likely to act as strong resistance.

Options outlook

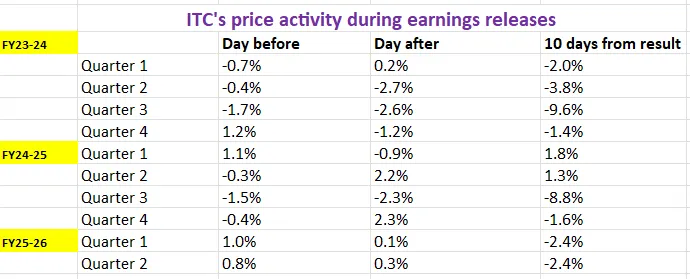

ITC's at-the-money (ATM) strike price for 24 February expiry is 322.5, with both call and put options priced at ₹15.2. This implies that traders are anticipating a price movement of approximately ±4.8%. Before planning options strategies, let's examine ITC’s historical price behaviour during past earnings announcements.

Options strategies for ITC

With the options market implying a potential move of about ±4.8% by 24 February, traders may wish to consider straddle strategies in order to capitalise on their expectations of volatility.

A long straddle involves buying an at-the-money (ATM) call and put option of ITC with the same strike price and expiry date. This strategy is beneficial if the stock price moves sharply — up or down — beyond the implied range of ±4.8%, as gains on one option will outweigh losses on the other.

Conversely, if you expect ITC to remain within a tight range and the actual movement to stay below the implied range by expiry, you may consider a short straddle. This involves selling an ATM call and put option with the same strike price and expiry date. Profits are made from time decay and a drop in volatility, provided the stock remains within a certain range.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story