Market News

HCL Tech Q4 results: Date, earnings preview, dividend, key technical levels & more

.png)

4 min read | Updated on April 22, 2025, 08:59 IST

SUMMARY

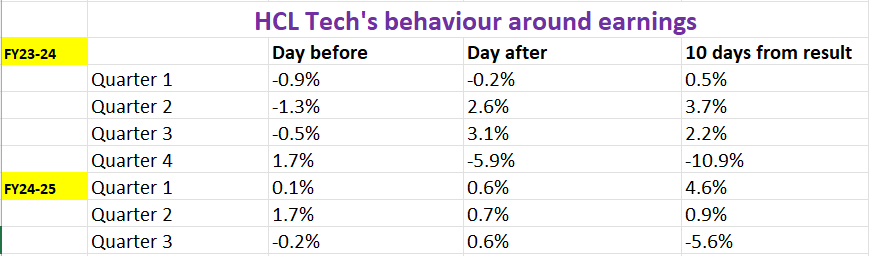

HCL Tech shares have rallied over 10% in the last three weeks and have encountered resistance around its 21-day exponential moving average (EMA) ahead of its earnings. Ahead of the results, traders can monitor the price action around the 21 and 50 EMAs. A close above or rejection of these levels will provide further directional insight.

Stock list

HCL Tech investors will closely watch the revenue and margin guidance for FY26.

HCL Tech is set to announce its quarterly earnings on Tuesday, April 22. Following underwhelming Q4 results from peers like TCS, Wipro, and Infosys, investors are now looking to HCL Tech's results for a turnaround.

According to experts, HCL Tech's Q4 revenue is expected to grow by 6–8% year-on-year, ranging between ₹30,450 and ₹30,730 crore. On a sequential basis, revenue could rise by 2–4%.

Meanwhile, company's net profit could increase by 7–9% year-on-year, ranging between ₹4,250 and ₹4,550 crore. However, sequentially, net profit may see a marginal decline of 1–2%.

The EBIT margin is likely to contract by 60–100 basis points to 16–16.5%, impacted by salary hikes and weaker performance in the software segment. However, rupee depreciation may help offset some of the margin pressure.

Investors will closely watch the company’s revenue and margin guidance for FY26, new deal wins during the March quarter, final dividend announcement for FY25 and management commentary on discretionary spending and the overall demand outlook amid global economic uncertainties and ongoing U.S. tariff concerns.

Ahead of the Q4 results, HCL Tech shares ended the Monday’s session at ₹1,482, up 3%. So far this year, it is down 22.7%.

Technical view

The technical structure of HCL Tech remains weak on the weekly chart as it is currently trading below its 21-week and 50-week exponential moving averages (EMAs). It recently found support at its 200-week EMA and has rallied 10% over the past three weeks. In the coming sessions, traders can watch the range between ₹1,509 and ₹1,303. A breach of this range on a daily closing basis will provide further directional clues. Within this range, the stock may remain range-bound.

.webp)

Options outlook

Open interest data for the April 24 expiry shows heavy call option building at the 1,500 strike, suggesting that traders are anticipating resistance at this level. On the downside, strong put support has formed at the 1,400 strike. Notably, there's also significant call and put activity at the 1,460 strike, suggesting that HCL Tech could trade in a range near this area.

Options strategy for HCL Tech

The options market is pricing in a potential ±4.2% move ahead of the April 24 expiry. In such a scenario, traders can explore straddle strategies to capture the volatility and implied move ahead of the expiry.

About The Author

Next Story