Market News

HCL Tech Q3 results | How to trade in HCL Tech ahead of its third quarter earnings?

.png)

4 min read | Updated on January 13, 2025, 11:12 IST

SUMMARY

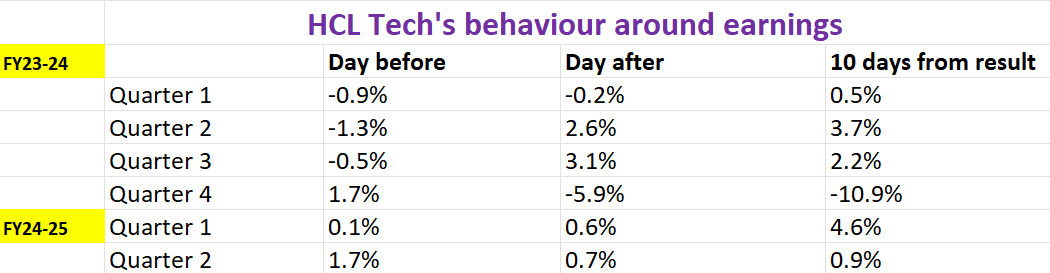

Shares of HCL Tech closed at a record high last week, gaining over 2%. With technical structure supporting continued bullish momentum, the options market is implying a potential ±5% ahead of 30 January.

Stock list

HCL Tech open interest data of the 30 January expiry shows a significant concentration of call options at 2,000 strike.

HCL Technologies (HCL Tech) will announce its quarterly earnings on Monday, January 13. After TCS, it will be the second major IT firm to announce its December quarter results.

HCL Tech's Q3 revenue for FY24-25 is expected to grow 5-6% year-on-year, reaching ₹30,050 to ₹30,180 crore. Sequentially, revenue may rise by 4-4.8%. Meanwhile, net profit is projected to increase 5-6% annually to ₹4,450-₹4,600 crore, with a higher sequential growth of 7.5-8.5%.

The company’s Earnings Before Interest Tax (EBIT) margins are expected to improve, driven by operational efficiencies and cost optimisation. The EBIT margin is likely to expand by 40-50 basis points, reaching 19-19.3% compared to 18.6% in the previous quarter.

Investors will focus on HCL Tech's revenue growth guidance, new deal wins in Q3, management’s insights on discretionary spending in the services segment, and the overall demand outlook.

Ahead of the Q3 result announcement, HCL Tech shares are trading 0.20% lower at ₹1,992 per share at 11:00 am on Monday, January 13. This month, the stock has gained over 4%, and it has surged 30.7% in the calendar year 2024, outperforming the NIFTY50 index, which rose 8.8% during the same period.

Technical View

HCL Tech shares hit a fresh all-time high on January 10, closing the week above the previous week's high and gaining over 2%, signaling continued bullish momentum.

The stock is currently trading above key short-term exponential moving averages (EMAs), including the 21-day and 50-day EMAs. This suggests that the bullish trend may persist unless the stock slips below the immediate support level of ₹1,930. A close below the ₹1,900 support zone and the 21-day EMA would indicate a pause in momentum.

Options build-up

The open interest data of the 30 January expiry shows a significant concentration of call options at the 2,000 strike. This indicates that the market participants are expecting HCL Tech to take resistance around this zone. On the flip side, the put base was established at 1,900 strike and significant additions were also seen at 1,960 strike, indicating that HCL Tech may take support around these zones.

Options strategy for HCL Tech

With the options market expecting a price movement of ±5% before 30 January expiry, traders can consider Long and Short Straddle strategies to capitalise on the expected volatility.

Disclaimer Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story