Market News

Dixon Technologies: Q1 Earnings preview, technical levels and options outlook ahead of results

.png)

3 min read | Updated on July 22, 2025, 08:43 IST

SUMMARY

Dixon Technologies’ shares have surged over 8.5% this month ahead of its June quarter results, buoyed by major strategic deals and forming a bullish engulfing candle on the daily chart. The pattern will get confirmed if the close of the subsequent candle is above the high of the reversal pattern.

Stock list

Dixon Technologies shares will remain in focus ahead of its Q1FY26 result announcement.

Electronics manufacturer Dixon Technologies will announce its results for the June quarter on Tuesday, 22 July 2025.

Ahead of the announcement of its Q1 results, the company’s shares have risen by over 2%. So far this month, Dixon Technologies' stock has surged over 8.5%, in response to the multiple strategic deals announced by the company.

The company acquired a 51% stake in Q Tech India to manufacture and supply camera and fingerprint modules for mobile handsets, IoT systems, and automotive applications.

The company also entered into a joint venture with Chongqing Yuhai on 15 July to manufacture and supply precision components for laptops, mobile phones, IoT devices, automotive products and more.

Experts believe that these new deals will strengthen the company’s position in the smartphone and electronics manufacturing segment. Moreover, Dixon Technologies is likely to benefit further under the Electronics Component Manufacturing Scheme.

In the same quarter last year, Dixon Technologies reported revenue of ₹6,580 crore, while net profit stood at ₹140 crore. In the previous quarter, the company reported revenue of ₹10,293 crore with a net profit of ₹465 crore.

Technical view

Shares of Dixon Technologies jumped over 2% and formed a bullish engulfing candle on the daily chart. It is a two-candle reversal pattern in which a large bullish candle (green) completely engulfs a smaller bearish candle (red), signalling a potential change from a downward trend to an upward trend. However, the pattern gets confirmed if the close of the subsequent candle is above the high of the reversal pattern.

Options outlook

The open interest data of Dixon Technologies for 31 July expiry has the highest call options base at 17,000 strike, hinting at resistance for the stock around this zone. Additionally, the put base was observed at 15,000 strike, pointing at support around this zone.

Meanwhile, the at-the-money strike of Dixon Technologies as of 21 July is at 16,250 strike and is priced at ₹1,000. This indicates that the options market is pricing a ±6% move ahead of 31 July expiry.

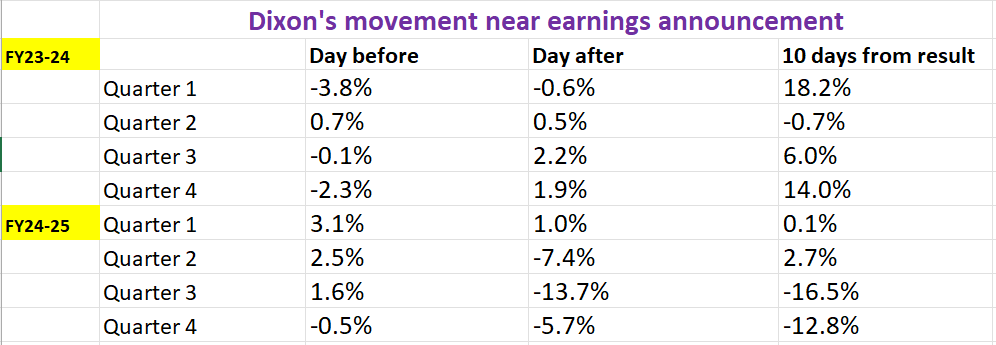

To plan and an options strategy, it's important to review how Dixon Technologies has historically reacted to past earnings announcements.

Options strategy for Dixon Technologies

With an implied movement of ±6% from the options market, traders can create Long or Short Straddles to capitalise on anticipated volatility and price movements.

Simply put, when you opt for a Long Straddle strategy, you are purchasing both an at-the-money (ATM) call and put options of Dixon Technologies with the same strike price and expiry. This approach capitalises on the stock price moving significantly, beyond ±6%, in either direction.

On the contrary, a Short Straddle is a strategy which involves selling the ATM call and put option of the same strike price and expiry . This strategy benefits if the stock remains range-bound, moving less than ±6% before the expiry of the contracts.

Meanwhile, traders who expect confirmation of the bullish engulfing pattern can consider a bull call spread strategy. It involves buying a call option while simultaneously selling a higher strike call with the same expiration, reducing cost while capping potential gains.

Disclaimer Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story