Market News

Asian Paints Q2 results: Revenue likely to remain flat amid weak demand, while profit could see double-digit growth

.png)

4 min read | Updated on November 12, 2025, 09:17 IST

SUMMARY

Asian Paints will announce its September results on 12 November 2025. Analysts expect revenue growth of just 1–2% amid monsoon disruptions and competition, but net profit could rise by 15–22% due to the low base of the same quarter last year.

Stock list

Market expects move of ±3.8% in Asian Paints based on options data. | Image: Shutterstock

India’s largest paint manufacturer, Asian Paints, will announce its results for the September quarter on 12 November 2025. The company is expected to report flat revenue growth due to increased competition and an extended monsoon season, which may have affected demand during the quarter.

According to experts, Asian Paints could report a 1–2% year-on-year (YoY) rise in consolidated revenue, which could be in the range of ₹8,130–₹8,190 crore. Meanwhile, its net profit could see a sharp, double-digit rise of 15–22%, due to a low base in the same quarter last year, when an impairment loss of ₹180 crore was recognised.

Meanwhile, volume growth is expected to be in the range of 4% to 6%, and the EBITDA margin is likely to improve by 110 to 130 basis points to 16.3% to 16.7%, supported by lower raw material prices.

In Q2FY25, the company registered a consolidated revenue of ₹8,028 crore, compared to ₹8,939 crore in the previous quarter. Asian Paints' net profit stood at ₹694 crore in the September quarter of FY25, compared to ₹1,117 crore in the previous quarter.

Investors will be closely watching sales and volume growth, along with key performance metrics, during the quarterly results announcement. Management commentary on demand outlook and rising competition intensity will also be important. Investors will also be looking forward to the company's announcement of an interim dividend.

Ahead of the Q2 results announcement, Asian Paints ended the day 0.2% higher at ₹2,657. So far this year, Asian Paints shares have delivered a return of over 16% to investors.

Technical view

Asian Paints has been in a steady recovery phase since establishing a support level around the ₹2,200–2,250 mark earlier this year. On the weekly chart, the stock has reclaimed its 21-week and 50-week exponential moving averages (EMAs).

However, price has entered into the crucial resistance zone of ₹2,700, which aligns with 200-week exponential moving averages. If the stock closes above this zone for an extended period, it could trigger a breakout towards the ₹2,850–2,900 levels, which would confirm medium-term strength. On the downside, immediate support has shifted to the ₹2,480–₹2,500 zone. As long as the stock remains above this zone, the trend will remain positive.

Options outlook

The at-the-money (ATM) strike for Asian Paints' 25 November expiry is ₹2,660, with a combined option premium of ₹101. This implies that the market expects a move of about ±3.8% from the closing price on 11 November.

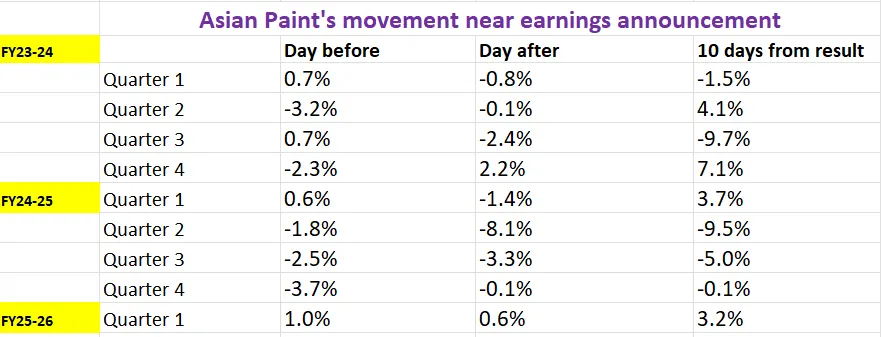

Let’s examine how Asian Paints stock has reacted to its quarterly earnings announcements over the past two years to gain insights into its price movements.

Options strategy for Asian Paints

Given the implied move of ±3.8% from the options data, traders can initiate either a long or short volatility trade, taking into account the price movement. To trade based on volatility, a trader can take a Long or Short Straddle route.

About The Author

Next Story