Business News

US SEC seeks India’s help in Adani bribery case, says efforts to serve complaint 'ongoing'

.png)

3 min read | Updated on February 19, 2025, 12:15 IST

SUMMARY

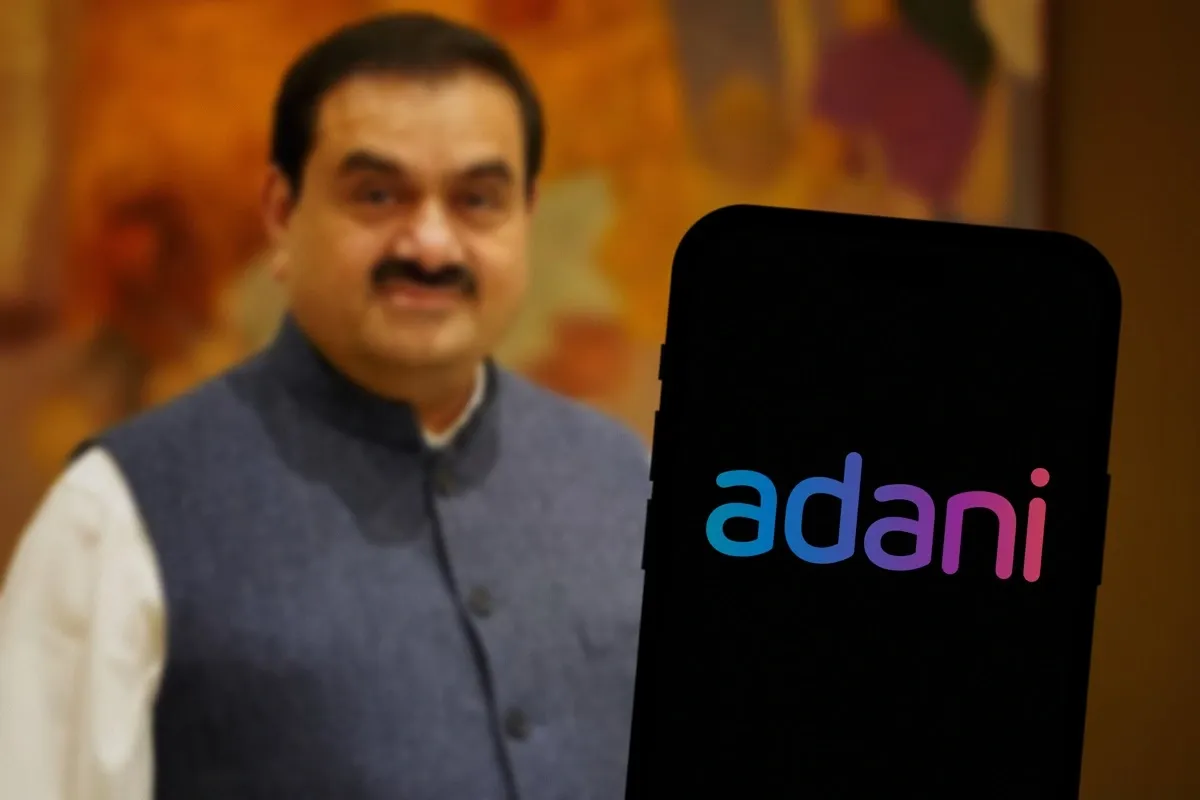

The US Securities and Exchange Commission (SEC) has sought assistance from Indian authorities to serve a legal complaint against Adani Group founder Gautam Adani and his nephew, Sagar Adani, in connection with an alleged $265 million bribery scheme.

Stock list

Gautam Adani, founder chairman of the ports-to-energy conglomerate, his nephew Sagar, and AGEL executive Vneet Jaain were charged with securities fraud conspiracy, wire fraud conspiracy and securities fraud. Image: Shutterstock

The US Securities and Exchange Commission (SEC) has sought assistance from Indian authorities in serving a complaint against Adani Group founder Gautam Adani and his nephew, Sagar Adani, as part of its investigation into an alleged $265 million bribery scheme.

The SEC told a New York district court it was making efforts to serve its complaint and had requested help from India’s ministry of law and justice under the Hague Service Convention, which governs the service of legal documents in cross-border cases.

The regulator, in its court filing, said that both Gautam Adani and Sagar Adani “are located in India, and the SEC’s efforts to serve them there are ongoing, including through a request for assistance to the Indian authorities to effect service under the Hague Service Convention for Service Abroad of Judicial and Extrajudicial Documents in Civil or Commercial Matters.”

The SEC’s complaint, filed on November 20, alleges that Gautam and Sagar Adani violated US federal securities laws by making “false and misleading representations” concerning Adani Green Energy Ltd in connection with a $750 million debt offering in September 2021.

According to the filing, the SEC has contacted the Adanis or their legal representatives and sent them notices requesting a waiver of service.

It said that because the “defendants are located in a foreign country, Rule 4(f) of the Federal Rules of Civil Procedure (FRCP) governs service of the Summons and Complaint.

FRCP 4(f) contains no set time limit for service, and the SEC may serve Defendants “by any internationally agreed means of service that is reasonably calculated to give notice,”... such as the Hague Service Convention.”

In a parallel action, the US Department of Justice (DOJ) in November unsealed criminal charges against Gautam and Sagar Adani, along with Cyril Cabanes, an executive of Azure Power Global Ltd., and other individuals connected to Adani Green and Azure Power.

The DOJ alleges that the Adani Group engaged in a years-long scheme to pay $250 million in bribes to Indian officials in exchange for favourable solar power contracts.

The Adani Group has denied the allegation as “baseless”, pointing to a DOJ statement that says the charges are allegations, and the defendants are presumed innocent until proven guilty.

In January, Adani Green said it had appointed independent law firms to review the US indictment.

Adani Group stocks saw sharp declines in early Wednesday trading. Adani Enterprises and Adani Green Energy were the biggest losers, falling 4.3% and 4.25%, respectively. Adani Ports & SEZ also dropped 2.63%, while Adani Power, Adani Energy Solutions, Adani Total Gas, and Adani Wilmar declined over 2%. Cement stocks Ambuja Cement and ACC also slipped around 2%.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story