Business News

Two-wheelers shine, passenger and commercial vehicle segments struggle in November: FADA

.png)

2 min read | Updated on December 09, 2024, 11:11 IST

SUMMARY

FADA highlighted festive-driven momentum in two-wheelers but cited inventory challenges and weak sentiment as hurdles for PV and CV segments.

Stock list

FADA urged OEMs to rationalise stock for a healthier start to 2025.

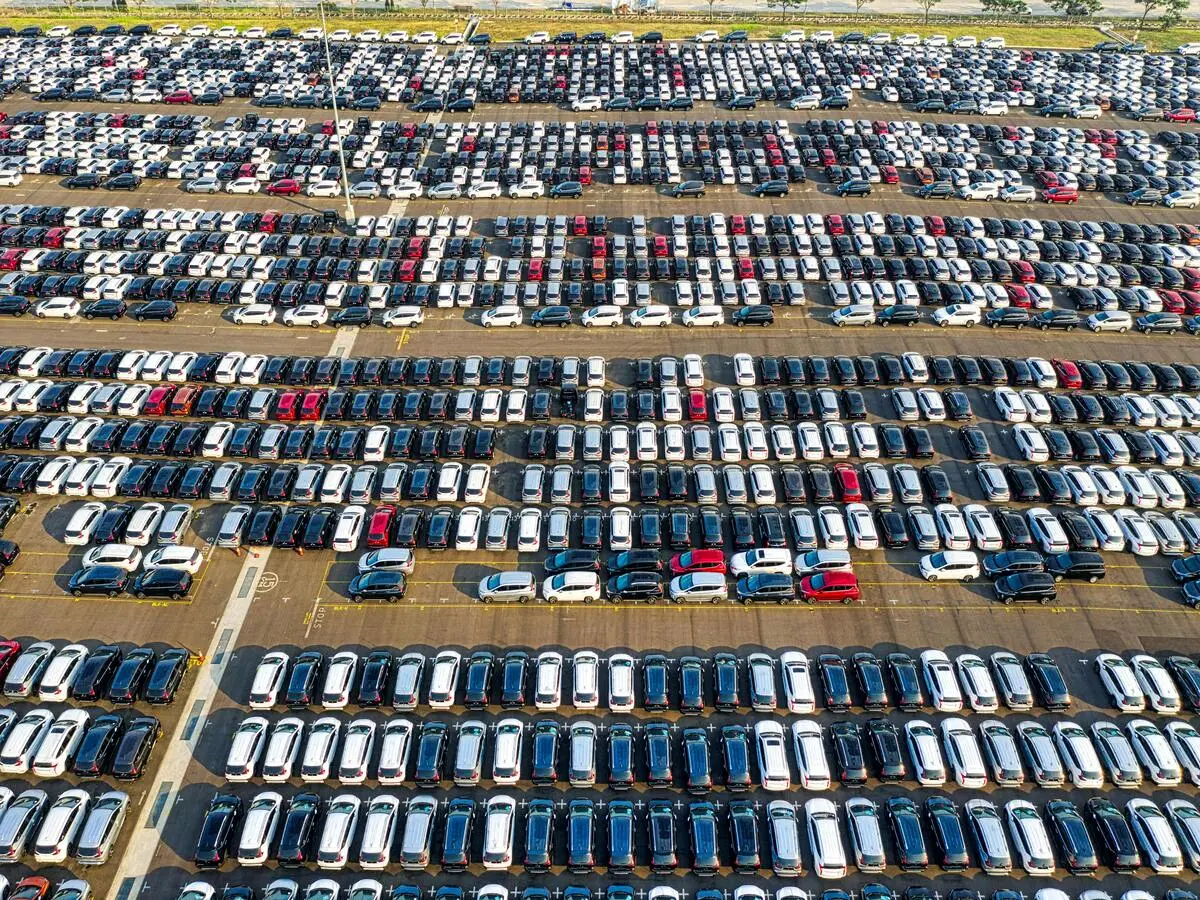

Vehicle retail sales in November 2024 displayed a mixed performance across segments as two-wheelers, three-wheelers, and tractors registered year-on-year (YoY) growth, while passenger vehicles (PV) and commercial vehicles (CV) faced declines, the Federation of Automobile Dealers Associations (FADA) said on Monday.

According to the monthly report, retail sales of two-wheelers, three-wheelers, and tractors increased by 15.8%, 4.23%, and 29.88% YoY, respectively. On the other hand, passenger and commercial vehicle segments experienced YoY declines of 13.72% and 6.08%, respectively.

On a month-on-month (MoM) basis, 2W sales grew 26.67%, achieving record-high November registrations.

“Two-wheelers, buoyed by the festive spillover, grew by 26.67% MoM and 15.8% YoY, achieving record-high November registrations that even surpassed November’23 levels. Still, the marriage season’s contribution fell short of expectations, offering only limited relief from rural India,” FADA president C.S. Vigneshwar said.

PV sales were impacted by weak market sentiment, fewer new launches, and high inventory levels, despite a 10-day reduction in stock.

"FADA continues to urge OEMs to further rationalise inventory so that the industry can enter the new year on a healthier footing, reducing the need for additional discounts," Vigneshwar added.

The CV segment faced challenges including restricted product choices, ageing inventory, weak infrastructure activity, and subdued demand from the coal and cement sectors.

While the immediate outlook for December is mixed, rural stability and potential year-end discounts could lend moderate support to two-wheeler and passenger vehicle sales, according to the report.

In the two-wheeler segment, dealers suggest that while some buyers remain hesitant, others could be drawn by potential year-end discounts and stable rural demand.

“Although momentum may not be robust, incremental schemes and easing inflation could lend mild support, placing 2W on a cautiously positive footing,” it said.

The passenger vehicle segment shows signs of cautious optimism. Heavy discounts and improved product availability are expected to counter weak consumer sentiment and the usual year-end slowdown, FADA said. While some customers prefer deferring purchases for 2024 models, attractive year-end promotions and aggressive offers might help improve sales compared to November.

The commercial vehicle category continues to face headwinds, with subdued infrastructure activity and consumer preferences for newer model-year vehicles dampening demand. However, selective OEM incentives and year-end offers could provide a limited uplift.

“On balance, while the CV segment’s expectations are not uniformly positive, there is some hope that targeted incentives and stable financing conditions could prevent a sharper decline,” it added.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story