ITR filing 2025 Q&A on September 9: New vs Old regime, tax forms, due date and more

5 min read | Updated on September 10, 2025, 08:49 IST

SUMMARY

ITR filing 2025 Q&A (September 9, 2025): The Income Tax Return deadline for AY 2025-26 ends on September 15. Will 2.5 crore returns be filed in 7 days, or will we see another due date extension? This Q&A covers various issues around ITR filing, including queries on ITR due date extension and more.

Here are top updates on Income Tax Return filing, deadline and issues on September 9, 2025. | Image source: Shutterstock

ITR Filing 2025 FAQ: How to select an ITR form based on capital gains type?

ITR filing 2025: When it comes to capital gains, many taxpayers link them only with equity shares and mutual funds. However, there are several other types of capital assets, and gains from these are taxed as capital gains. You need to report such gains correctly in your Income Tax Return form. Here's a detailed guide to help you select the right ITR form based on the capital gains type.September 10, 2025, 08:49 AM

ITR filing 2025 FAQ: Which is the right ITR form for housewives earning from tuition?

ITR-1 and ITR-4 are not applicable in this case, as both forms do not support reporting of capital gains (except long-term capital gains exempt up to ₹1.25 lakhs under section 112A).

ITR-2 may be used if tuition receipts are reported under "Income from Other Sources".

ITR-3 would be required if the tuition receipts are classified as "Income from Profession", considering teaching is a notified profession under Section 44AA of the Income-tax Act.

ITR-4 (Sugam), which allows presumptive taxation under Section 44ADA, is not suitable here as it does not accommodate capital gains income.

Read more detailsSeptember 10, 2025, 07:10 AM

ITR filing 2025 FAQ: Who cannot file ITR-4?

ITR-4 should not be filed by the following taxpayers:

• If you are earning more than ₹50 lakh in a year

• If you are a Director in a company

• If you own more than one house property

• If you have capital gains (profit from selling shares, property, etc.), including long-term gains above ₹1.25 lakh under Section 112A

• If you have held unlisted company shares at any time during the year

• If you own assets outside India or have foreign income

• If you have authority to operate a bank account outside India

• If you have deferred tax on ESOPs

• If you have any brought forward loss or loss to be carried forward under any head of income

September 10, 2025, 07:10 AM

ITR filing 2025 FAQ: Who can file ITR-4?

ITR-4 can be filed by the following taxpayers:

• Individuals, Hindu Undivided Families (HUFs), and Firms (other than LLPs) who are residents

• Those who have income from business or profession calculated on a presumptive basis

• Along with business income, they can also have salary or pension, income from one house property, income from other sources (such as bank interest, family pension, or dividend), and agricultural income up to ₹5,000

September 10, 2025, 07:10 AM

ITR filing 2025 FAQ: What's the key difference in the old and new tax regimes?

When filing an Income Tax Return (ITR), taxpayers are required to choose between the Old Tax Regime and the New Tax Regime. This choice determines how income will be taxed and whether deductions and exemptions can be claimed.The Old Regime continues the traditional system of higher tax rates but provides a wide range of exemptions and deductions under the Income Tax Act, making it more suitable for individuals who plan their finances through investments and savings. In contrast, the New Regime aims to simplify taxation by offering reduced slab rates with minimal exemptions.

The new regime is helpful for taxpayers who prefer a straightforward system without the need for detailed tax planning or documentation.

From FY 2023–24 onwards, the New Regime has been made the default option, though taxpayers retain the flexibility to opt for whichever system benefits them more. (Source: PIB)

September 10, 2025, 08:49 AM

ITR filing FAQ: How many taxpayers have opted for the new regime?

According to PIB, out of the total filings, 72% of taxpayers (5.27 crore) opted for the New Tax Regime, while 28% (2.01 crore) continued with the Old Regime in FY 2023-24.

The e-filing portal also handled record activity on the due date (31 July 2024), with 69.92 lakh returns filed in a single day. Importantly, the tax base continued to expand, with 58.57 lakh first-time filers joining in AY 2024–25.

September 09, 2025, 13:45 PM

ITR filing 2025: Which ITR form is for income from foreign sources?

You should choose ITR 2 or ITR 3 if your total income include income from the following sources:

Income from foreign sources • Foreign Assets including financial interest in any foreign entity • Signing authority in any account outside India

Please note that ITR-3 should be chosen when your income includes earnings from business and profession. In another cases, ITR-2 will be sufficient.

In case of income from foreign sources, it is always better to consult a tax advisor, preferably a chartered accountant.

September 10, 2025, 07:10 AM

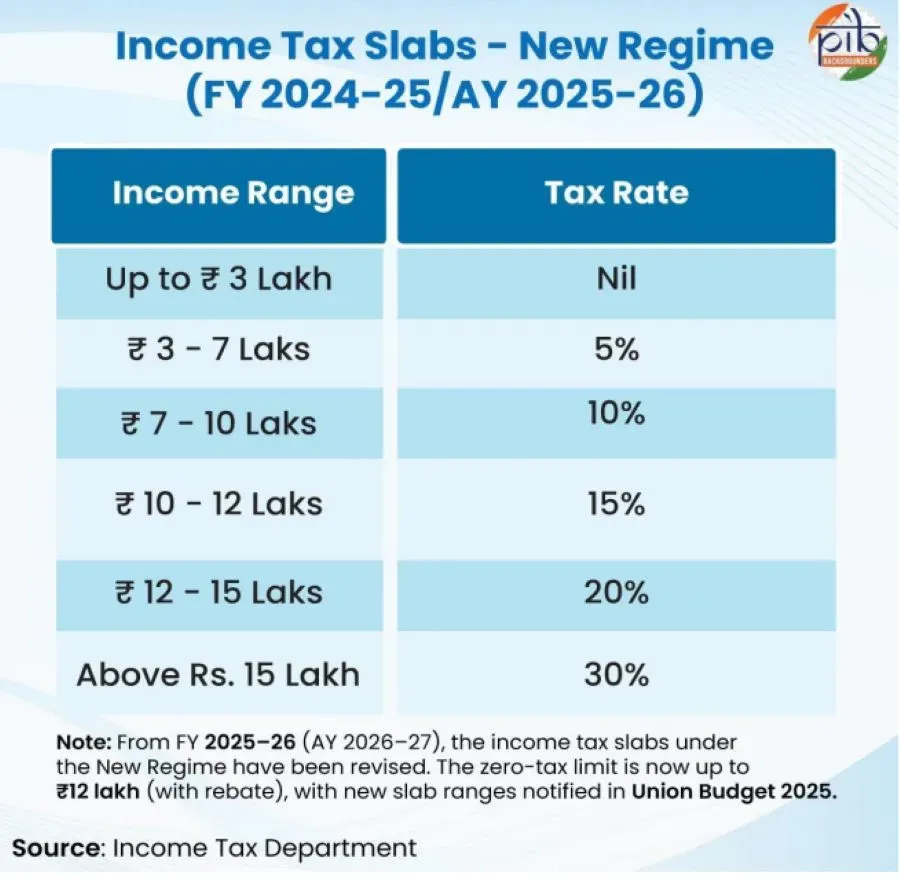

ITR filing 2025 FAQ: What are the Income Tax slabs and rates in new regime?

The following are the tax slab and rates in the new tax regime for individuals, senior citizens and super senior citizens:

September 10, 2025, 07:10 AM

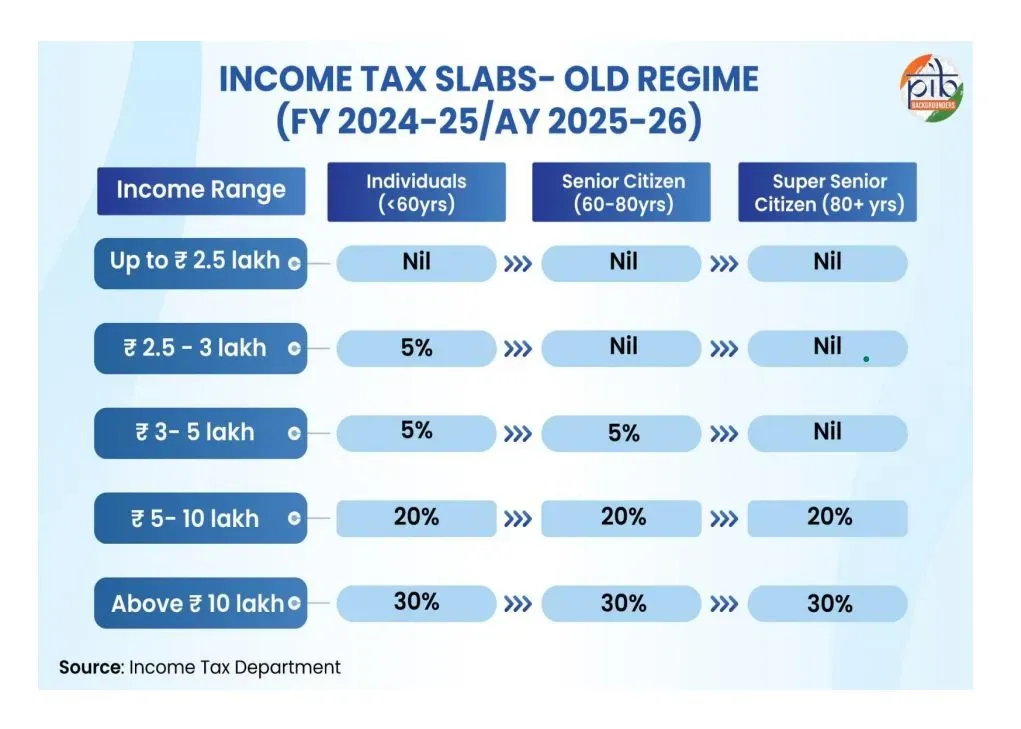

ITR filing 2025: What are the Income tax slabs and rates for individuals and senior citizens in old regime?

The following are the tax slab and rates in the old tax regime for individuals, senior citizens and super senior citizens:

September 10, 2025, 07:10 AM

ITR filing 2025 FAQ: Why is due date extension demand rising?

Ahead of ITR filing deadline, the 'Extend Due Date Immediately' campaign on X by tax professionals continues to gain momentum.

Tax professionals have been citing multiple reasons behind their demand to immediately extend the due date. Some of them are the following:

-

Delay in release of various ITR filing utilities

-

Massive workload cause by delay in utilities

-

More time taken for ITR filing because of additional information asked in ITR for AY 2025-26.

Read full storySeptember 10, 2025, 07:10 AM

-

ITR filing 2025 FAQ: New Tax Regime vs Old Tax Regime compared

Here’s a quick comparison between the Old Tax Regime and the New Tax Regime relevant for ITR filing for AY 2025-26:

Feature Old Tax Regime New Tax Regime Tax Rates Higher slab rates Lower slab rates Exemptions & Deductions Standard Deduction ₹50,000 + multiple exemptions (investments, insurance, home loan interest, etc.) Limited: Standard Deduction ₹75,000, Employer’s NPS contribution, Family pension deduction Investments (80C) Investments in PF, LIC, ELSS, PPF, etc. – up to ₹1.5 lakh Not applicable Medical Insurance (80D) Up to ₹25,000 (₹50,000 for senior citizens) Not applicable Rebate Taxable income up to ₹5 lakh → Nil tax Taxable income up to ₹7 lakh → Nil tax Default Option Optional (must be chosen by taxpayer) Default from FY 2023–24; option to switch to Old Regime if beneficial (Source: PIB)

September 10, 2025, 07:10 AM

'Unexpected' due date extension benefit: Up to 33% more interest on refund for taxpayers

The Income Tax Department extended the due date for AY 2025-26 from July 31, 2025 to September 15, 2025. The extension has resulted in an unexpected financial benefit for taxpayers who are eligible for refunds.

An analysis by DD News says, "Interestingly, the extension brings an unexpected financial benefit: taxpayers can now receive up to 33% more interest on refunds due to the delayed filing window."

However, such interest will be taxable.

September 09, 2025, 10:12 AM

ITR filing deadline 2025: What are the Income Tax forms for salaried taxpayers?

Salaried taxpayers can use an income tax return form based on their sources of income.

ITR-1: If your income is below ₹50 lakh and the source of such income is salary, bank interest, LTCG from equity up to ₹1.25 lakh

ITR-2: If your income is below or above ₹50 lakh and the source of such income is salary, bank interest, capital gains (including STCG and LTCG).

ITR-3: If your income includes salary and income from business and profession.

ITR-4: If your income includes salary and income from presumptive business and profession under sections 44AD, 44ADA, 44AE

September 09, 2025, 10:02 AM

ITR filing 2025: Should you wait for the ITR due date extension?

No. You should not wait for any extension in the due date for AY 2025-26. There are still 7 days left before the September 15 deadline to file your returns.

The Income Tax department has also urged taxpayers to file their returns as early as possible, failing which they may end up paying a late fee of up to ₹5000 and interest charges. (Read about the cost of not filing ITR by the due dateSeptember 10, 2025, 07:10 AM

ITR filing 2025: Is Section 112 LTCG exemption allowed to both residents and NRIs?

Yes. The initial exemption of ₹1.25 lakh under section 112A is available to both residents and non-residents.

As per Section 112A, LTCG exceeding ₹1.25 lakh in a financial year from the transfer of listed equity shares or units of listed equity-oriented mutual funds or units of a business trust (where STT is paid) is taxed at 12.5% (plus surcharge and cess).

However, unlike residents, NRIs are not permitted to adjust their LTCG against the basic exemption limit. Read full storySeptember 10, 2025, 07:10 AM

ITR filing 2025: How many returns have been filed till September 8, 2025?

As per the Income Tax Department's e-filing portal, 5,00,09,951 returns for AY 2025-26 were filed till September 8, 2025. Of these, the taxpayers have verified over 4.72crore returns, while the Income Tax department has processed more than 3.39 crore verified returns.

Data shows that only around 10 lakh returns were filed on September 8.

September 10, 2025, 07:29 AM

ITR filing 2025: 17 FAQs answered on Sep 8

On September 8, 2025, we answered 17 FAQs around Income Tax Return and its deadline. As we start this blog today, you may take a quick look at what we covered yesterday and find answers to a lot of your queries.In today's blog, we will deep dive further into issues you may encounter while filing your returns before the deadline.

Please note that filing ITR before September 15 is mandatory. Do this to avoid penalty and interest charges.

Read: 17 FAQs on ITR filingSeptember 10, 2025, 07:10 AM