Personal Finance News

Infosys buyback: How to save tax with capital loss adjustment in Income Tax Return

6 min read | Updated on November 14, 2025, 10:52 IST

SUMMARY

According to Income Tax rules, the cost of acquisition, or the cost at which you had originally purchased the Infosys shares, can be treated as a capital loss and set off against capital gains in the future. You can set off this capital loss against capital gains for up to 8 years.

You can carry forward any unabsorbed capital loss for up to 8 years for setting off in the future. | Image source: Shutterstock

For example, if you receive ₹1,80,000 for 100 Infosys shares tendered in the buyback, you will have to pay tax on the entire amount at the slab rates applicable to you. These slab rates vary from person to person, depending on taxable income and choice of tax regime.

"With respect to the buybacks undertaken on or after 1 October 2024, the income received by shareholders on such buyback is now taxable in their hands. The amount received by a shareholder is deemed to be a dividend under Section 2(22)(f) and is chargeable to tax under the head 'Income from Other Sources'. Accordingly, for resident individuals, the proceeds are taxable at the applicable slab rates," said CA Dr Suresh Surana.

Investors cannot deduct the cost of acquisition from the amount received in the buyback. They have to pay tax on the full amount received. However, there is a way in which they can save tax after the buyback.

How to save tax after buyback

You can save tax by setting off the cost of acquisition as a capital loss against capital gains from various capital assets.

According to Income Tax rules, the cost of acquisition, or the cost at which you had originally purchased shares, can be treated as a capital loss and set off against capital gains in the future. You can set off this capital loss against capital gains for up to 8 years.

"The cost of acquisition of shares is not deductible against the deemed dividend income. The cost of acquisition of the shares will be treated as a notional capital loss under Section 46A, which can only be set off against future capital gains or carried forward for up to 8 years as per Section 74. Also, it is pertinent to note that the shareholders pay tax on the full buyback amount as per the applicable marginal slab rates," said Dr Surana.

Irrespective of whether your capital loss is short-term or long-term, you can set it off only against capital gains from equity, property or any other capital asset, and not against income from other heads. While this set-off will allow you to save taxes, here are some key points you should note to effectively use this feature:

-

Short-term capital loss can be set off only against any short-term or long-term capital gains, but the long-term capital loss can be set off only against the long-term capital gains.

-

You can carry forward any unabsorbed capital loss for up to 8 years for setting off in the future.

-

However, you must file your Income Tax Return (ITR) before the official due date to be eligible for carrying forward unabsorbed losses till 8 years.

"This capital loss, whether short-term or long-term depending on the period of holding, can be set off only against capital gains and not against income from other heads. Accordingly, the loss can be set off against capital gains from property, securities, or other capital assets, subject to the general set-off and carry-forward rules under Sections 70 to 74," said Dr Surana.

"For instance, a short-term capital loss can be adjusted against any capital gain (short- or long-term), whereas a long-term capital loss can be adjusted only against long-term capital gains. Any unabsorbed loss as aforementioned can be carried forward for up to 8 assessment years, provided the income tax return is filed within the due date specified under Section 139(1) of the IT Act," he added.

| Aspect | Details |

|---|---|

| Record date | November 14, 2024 |

| Tax treatment of buyback amount | Entire amount received is treated as deemed dividend under Section 2(22)(f) and taxed under Income from Other Sources at individual slab rates |

| Cost of acquisition | Cannot be deducted from buyback amount; tax is on full amount received |

| Capital loss treatment | Cost of acquisition treated as notional capital loss under Section 46A |

| Set-off rules | - Can set off against capital gains from equity, property, or other capital assets - Short-term loss: can be set off against short-term or long-term gains - Long-term loss: only against long-term gains |

| Carry forward | Unabsorbed capital loss can be carried forward for up to 8 years under Section 74 |

| ITR filing requirement | Must file ITR before due date to carry forward losses |

| Reporting in ITR | From FY 2024-25, Schedule CG has a distinct row for reporting buyback-related capital losses (short-term and long-term) |

| Condition for set-off | Allowed only if corresponding deemed dividend income is reported under Income from Other Sources |

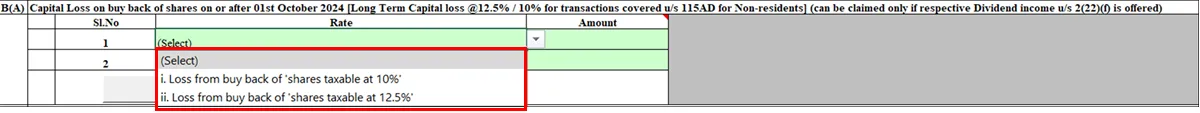

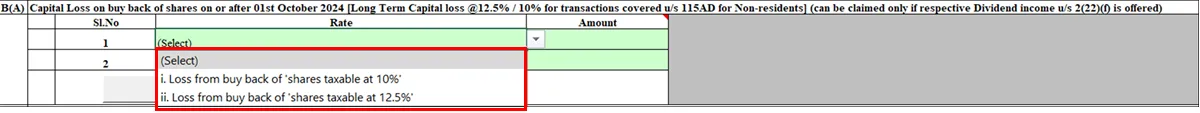

How to report capital loss in ITR

From FY 2024-25, the ITR form provides a distinct row in Schedule CG for reporting capital losses from buybacks. You will be allowed to set off these losses only if you have reported the corresponding deemed dividend under the head "Income from Other Sources".

"The ITR form (for returns to be furnished w.e.f. FY 2024-25) provides a distinct row in Schedule CG (separately for short-term and long-term) for reporting capital losses arising from payments received by shareholders during share buybacks, as governed by Section 68 of the Companies Act, 2013. These losses are allowable, provided the corresponding deemed dividend income is reported under the ‘Income from Other Sources’ head, in line with Section 2(22)(f) of the Income-tax Act," said Dr Surana.

Related News

About The Author

Next Story