GST rate cut updates: Changes in GST slab rates, impact, applicable date, lists and FAQs

5 min read | Updated on September 05, 2025, 18:59 IST

SUMMARY

GST news updates today (September 5, 2025): The Goods and Services Tax Council has approved big cuts in GST rates to be applicable from September 22, 2025. Most daily-use items will now be covered under two tax slabs: 5% and 18%. Read this blog for updates on new GST rates, rules, changes, price impact, FAQs, and more.

GST rate change impact on prices of goods and services to bring Diwali early in 2025 | Image source: Shutterstock

GST on batteries: What is the new rate?

Earlier, lithium-ion batteries attracted 18% GST and other batteries attracted 28% GST. , From September 22, all batteries under heading 8507 will be uniformly taxed at 18% GST.

September 05, 2025, 18:12 PM

GST rate cut impact: Will lower tax on renewable devices lead to inverted duty structure?

The Finance Ministry says these goods already faced an inverted duty structure. While reducing the GST rate to 5% will deepen inversion, the mechanism for refund arising out of the inverted duty structure is available. In addition, process reforms will ensure expedited refunds. The objective is to promote renewable energy goods.

September 05, 2025, 18:11 PM

GST 2.0 reforms: What is the GST on non-electronic toys for kids?

The GST on non-electronic toys for kids has been reduced from 12% to 5%.

Toys like tricycles, scooters, pedal cars etc. (including parts and accessories thereof) will be taxed at 5%, according to th Finance Ministry.

September 05, 2025, 16:48 PM

GST rate cut: Why are small agricultural tractors not fully exempted from GST?

The Finance Ministry says the objective is to provide relief to the farmers while not disincentivising domestic producers. "Fully exempting small tractors would be counterproductive. When the rate of tax on any goods is nil, the suppliers cannot claim Input Tax Credit (ITC) on the inputs used in manufacture of the goods and will have to reverse the same. This means that the producers have to absorb this cost which will eventually be passed to the buyers."

September 05, 2025, 15:52 PM

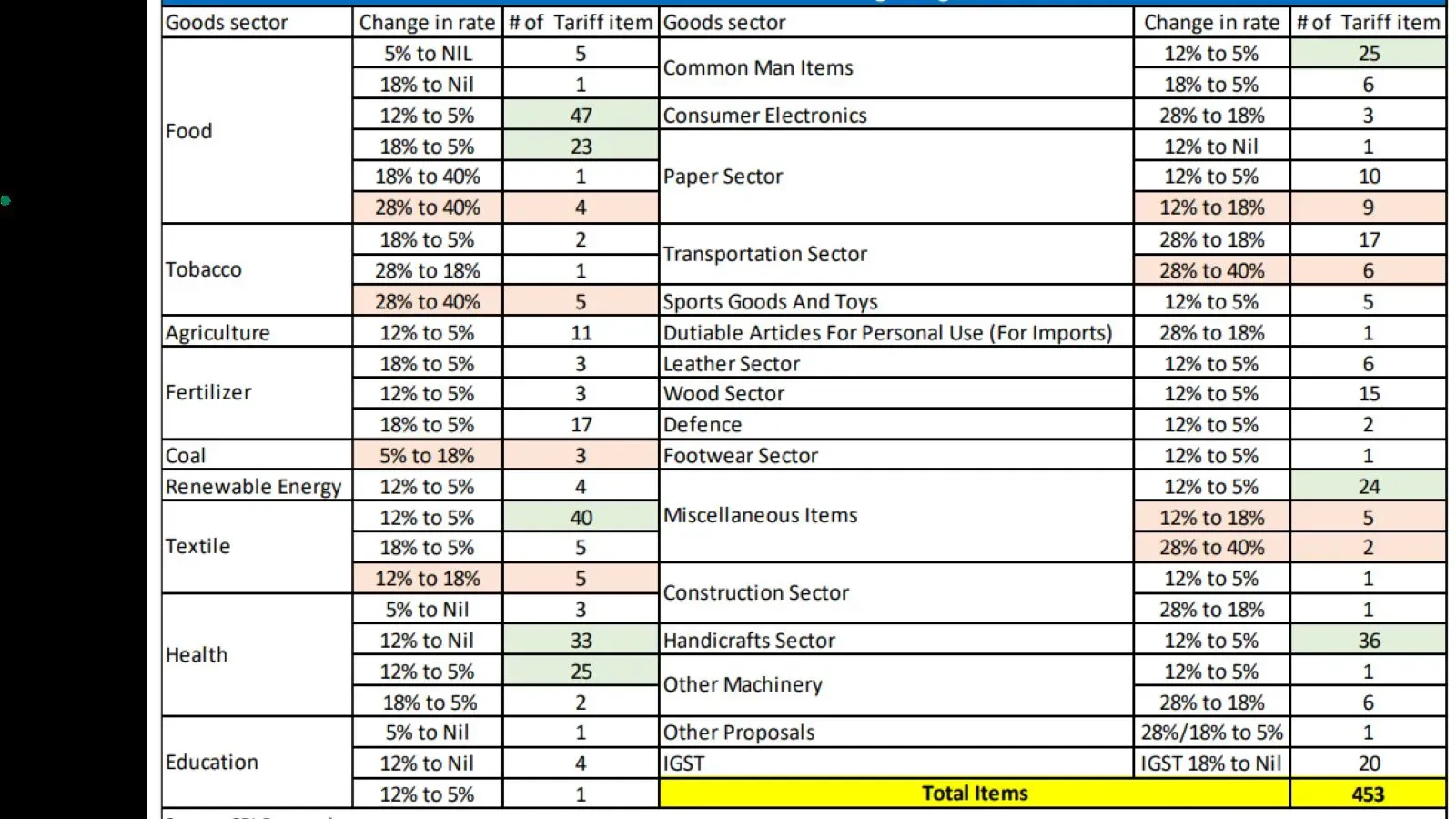

GST rate change: What are the sectors that have seen largest cuts?

Food, health and textile sectors have seen largest cuts in GST rates. Almost 295 goods now have new GST rate of 5%/NIL from earlier 12%.

Sector-wise Number of items having Change in GST rate

Source: SBI Research

September 05, 2025, 15:26 PM

GST rate cut: Is tax on 350cc motorcycles like Royal Enfield 350 18% or 40%?

The 40% GST rate applies only to motorcycles exceeding 350cc. Therefore, the 18% rate also applies to motorcycles of 350cc or lesser than 350cc, according to the Finance Ministry.

September 05, 2025, 15:27 PM

GST rate change impact on motorcycles: Buyers may save 7-8%, says expert

Aalesh Avlani, Co-founder, Credit Wise Capital, says motorbike buyers may be able to save up to 7-*% due to the GST rate change.

"The reduction of GST from 28% to 18% on motorcycles up to 350cc is a positive development for the two-wheeler industry and the customers as well. This change is more in favor of the buyer, as they may expect to save nearly 7-8% on the on-road price of their motorcycles. Since a majority of two-wheeler sales in India fall within this segment, the impact is, thus, going to be widespread and significant".

September 05, 2025, 13:09 PM

GST rate cut impact on small cars: Prices to come down

The Goods and Services Tax (GST) on small cars has been reduced from 28% to 18%.

The Ministry of Heavy Industries says smaller cars in the affordable segment will become cheaper, encouraging first-time buyers and expanding household mobility.

Reduced GST will stimulate sales in smaller cities and towns where small cars dominate.

Higher sales will benefit car dealerships, service networks, drivers, and auto-finance companies.

18% GST will apply to petrol engine cars of <1200 cc and not exceeding 4 meters in length and diesel cars of <1500 cc and not exceeding 4 metres in length. (Source: PIB)

September 05, 2025, 11:51 AM

GST rate hike impact on SUV, XUV, MPV, MUV cars: Buyers to benefit

The 40% Goods and Services Tax (GST) on big cars sounds like bad news for luxury car buyers of big cars like SUVs, MUVs, XUVs or MPVs. But the truth is that it might be an opportune time for buyers, who want to change their cars.

While 40% GST tax sounds like a price hike, it actually replaces a more complicated system of GST plus compensation cess that pushed effective taxes even higher 50%. Experts believe it would make big cars more affordable. Read full storySeptember 05, 2025, 11:13 AM

GST rate cut impact on inflation: It's set to go down further, report says

The rationalisation of GST rates could help lower retail inflation by as much as 75 basis points in FY26, driven by cheaper essential goods and services, SBI Research said in a report.

Of the 453 goods for which rates have been revised, 413 items witnessed a reduction, while only 40 saw an increase. Nearly 295 goods, mostly essentials, have been moved to the 5% or nil tax bracket from the earlier 12%. Read full story

September 05, 2025, 10:39 AM

GST rate cut impact on insurance: How will lower tax help policyholders?

GST on individual health and life insurance premiums (including reinsurance) has been reduced to zero.

Removal of GST would bring down the overall premium and improve affordability. This may help in two ways:

(i) existing households may increase the sum assured in health insurance, and

(ii) may attract new buyers to purchase health and term insurance

Source: SBI Research

September 05, 2025, 10:17 AM

GST rate change impact on bike prices Live: How will lower tax on motorcycles help?

For two-wheelers (Bikes up to 350cc, which incudes bikes of 350cc), the GST rate has been reduced from 28% to 18%.

According to Ministry of Heavy Industries, the lower GST will reduce prices of bikes, making them more accessible to youth, professionals, and lower-middle-class households.

It further says that bikes are the primary mode of transport in rural and semi-urban India. Therefore, cheaper bikes will directly benefit farmers, small traders, and daily wage earners.

The rate cut is further expected to help gig workers and boost their savings through reduced costs and EMI for 2-wheeler loans.

September 05, 2025, 09:28 AM

GST on large cars: Tax reduced to flat 40%

Ministry of Heavy Industries says that the removal of the additional cess has not only reduced the rates but also made taxation simple and predictable.

Even at 40%, the absence of cess will lower the effective tax on larger cars, making them relatively more affordable for aspirational buyers.

Bringing the tax rate to 40% and removing the cess will also ensure that large car makers will be eligible for ITC fully. Previously, ITC could only be utilised up to 28% and not for the cess component. Source: PIB

September 04, 2025, 18:21 PM

GST rate cut impact: Lowers costs to boost credit growth, says SBI Chief

C. S. Setty, Chairman, IBA and SBI says: "Household goods earlier taxed at 12% and 18% now fall under 5% category, which will provide tangible relief in the form of lower costs on essentials and higher disposable incomes. With greater spending power, demand and credit expansion will rise, driving economic growth. In a similar vein, the insurance sector stands to benefit with lower premium and thus better protection coverage and larger insurance penetration."

September 04, 2025, 17:01 PM

GST rate change full list: What are the items with 18% GST?

The GST Council approved a major simplification of the Goods and Services Tax ( GST) structure, reducing the current four-rate system ( 5%, 12%, 18%, and 28%) to just two main slabs- 5% and 18%. “We have reduced the slabs. There shall be only two slabs, and we are also addressing the issues of compensation cess,” Finance Minister Nirmala Sitharaman said at a late evening press conference on September 3, 2025. Here's the list of items with 5% GST.September 05, 2025, 09:28 AM

GST rate change full list: What are the items with 18% GST?

If you have been planning to buy a new TV or upgrade your car, the timing could not be better. In its 56th meeting, the GST Council has delivered a much-awaited tax relief. From air conditioners, TVs, and dishwashers to motorcycles, small cars, cement, and even ambulances, the move aims to make everyday life more affordable and boost consumer spending. Here's the full list of items with 18% GSTSeptember 05, 2025, 09:28 AM

GST rate change full list: What are the items with 40% GST?

The highest 40% slab approved by the 56th GST Council is designed mainly for goods and services that aren’t essential (merit), should be regulated and can generate higher revenue for the government that can be used for public welfare. Check full list here

The highest 40% slab approved by the 56th GST Council is designed mainly for goods and services that aren’t essential (merit), should be regulated and can generate higher revenue for the government that can be used for public welfare. Check full listSeptember 05, 2025, 09:29 AM

GST slab changes 2025: Why 40% rate has been referred to as a ‘special rate’?

The Finance Ministry says the special rate is applicable only on a few select goods, predominantly on sin goods and a few luxury goods, and therefore is a special rate.

Most of these goods attracted Compensation Cess in addition to GST.

Since it has been decided to end the Compensation Cess levy, the Compensation Cess rate is being merged with GST so as to maintain tax incidence on most goods.

On other goods and services, the special rate has been applied as these were already attracting the highest GST rate of 28%. (Source: PIB)

September 05, 2025, 09:29 AM

GST rate cut impact Live: Hotel rooms up to ₹7,500 to become cheaper

Hotel rooms with tariffs up to ₹7,500 per day are set to become cheaper as they will attract a lower GST rate of 5 per cent, without input tax credit (ITC), from September 22. The rate cut is expected to boost tourism.

Currently, hotel rooms with daily tariff of up to ₹7,500 attract 12 per cent goods and services tax (GST) with input tax credit. The GST Council on Wednesday cleared sweeping changes to the indirect tax regime, approving an overhaul of rates by limiting slabs to 5 per cent and 18 per cent effective from September 22, the first day of Navaratri. (PTI)

September 04, 2025, 14:46 PM

GST rate cut Live: Why GST council has not removed tax on raw cotton

The Finance Ministry says that cotton currently attracts GST on a reverse charge basis. This means that agriculturists do not have to pay GST when they supply raw cotton. The reason for taxing cotton in GST is to avoid breakage in the input credit chain and the GST paid on cotton is available as input tax credit for the textile industry. This will ultimately benefit the consumers. (Source: PIB)

September 04, 2025, 14:02 PM

GST rate cut Live: Two services are fully exempted from tax

The GST Council has fully exempted the following services from tax net.

-

All individual health insurance, along with reinsurance thereof

-

All individual life insurance, along with reinsurance thereof

Earlier, these services attracted 18$ GST with ITC.

September 04, 2025, 13:58 PM

-

GST refund: New rule for refund on low-value exports

The GST Council recommended an amendment to section 54(14) of the CGST Act, 2017 to remove the threshold limit for refunds arising out of exports made with payment of tax. This will particularly help small exporters making exports through courier, postal mode etc.

September 04, 2025, 13:51 PM

GST rate cut live: What's new for AC, TVs, and dishwashers

Air Conditioners (ACs), which were previously taxed at 28% will now be taxed under the 18% slab. The reduction in taxes is expected to make the appliance cheaper, especially since the demand for cooling products is rising across the country.

Dishwashers, too, have been shifted from the higher 28% category to 18%, putting them on par with other major domestic appliances. More details hereSeptember 04, 2025, 12:58 PM

GST rates for Gold and Silver jewellery: Has anything changed?

As we are reading about GST slab changes and various items getting cheaper, the GST rate on gold and silver has been kept unchanged.

GST on gold and silver jewellery will remain unchanged at 3%, with an additional 5% on making charges. Meanwhile, Gold coins and bars will continue to have 3% GST. Hence, the GST 2.0 reforms will not have a direct impact on demand for bullions. (Read full story here)September 04, 2025, 12:47 PM

GST rate cut impact Live: Building construction cost can reduce by 3-5%

According to Anuj Puri, Chairman, ANAROCK Group, the reduced GST on construction materials like cement can reduce construction costs by as much as 3-5%.

"Developers, especially those engages in creating affordable housing, will get major relief in terms of cash flows and margins. ANAROCK Research reveals that the affordable housing category (below Rs 40 lakh) has seen its share of total sales decline from 38% in 2019 to just 18% in 2024. The share of new supply dropped even more dramatically from 40% in 2019 to just 12% in H1 2025. The reduced construction costs, if passed on to homebuyers, can boost demand in these segments."

September 04, 2025, 14:46 PM

GST rate cut Live: What has changed for school and stationery items?

GST Council has slashed rates on a range of school and study essentials, exempting many items entirely and cutting rates on others to 5%. Items such as printed maps, atlases, wall maps, topographical plans and globes; pencil sharpeners; pencils, crayons, pastels, drawing charcoals and tailor’s chalk; as well as exercise books, graph books, laboratory notebooks and notebooks have also been moved from the 12% slab to Nil-rated. Check full list hereSeptember 04, 2025, 12:29 PM

GST rate cut on salon, gym, yoga centres: What has changed?

Salon and fitness bills are likely to get cheaper as the GST rate on beauty and physical well-being services, including those at health clubs, salons, barbers, fitness centres, yoga, etc, has been slashed from 18 per cent with Input Tax Credit (ITC), to 5 per cent without tax credit. Also, daily use products like hair oil, toilet soap bars, shampoos, toothbrushes, toothpaste, too, are likely to get cheaper as taxes on them have been cut to 5 per cent from 12/18 per cent currently. (Source: PTI).

September 04, 2025, 12:02 PM

GST rate cut on milk products: Mother Dairy to reduce prices

Mother Dairy has said it will pass on the benefits of the reduction in GST on a wide range of products to consumers.

Manish Bandlish, Managing Director of Mother Dairy, said, " We commend the Union Government's decision to reduce GST rates on a wider range of dairy products, including paneer, cheese, ghee, butter, UHT milk, milk-based beverages, and ice creams."

The move would significantly boost the affordability and accessibility of value-added dairy products for consumers.

"This is a particularly big boost for packaged categories, which are fast-growing favourites in Indian homes and will see stronger demand momentum going forward," Bandlish said.

September 04, 2025, 11:36 AM

GST rate cut: What is the new GST rate for 3-wheelers?

The GST rate on three-wheelers classified under HSN 8703 is 18%. It has been reduced from 28%.

September 04, 2025, 11:17 AM

GST on cars: Which small cars will benefit from the 18% tax?

The Finance Ministry says the GST rate on all small cars has been reduced from 28% to 18%.

For the purposes of GST, small cars meanof Petrol, LPG, or CNG cars with engine capacity up to 1200 cc and length up to 4000 mm, and Diesel cars with engine capacity up to 1500 cc and length up to 4000 mm.

September 04, 2025, 10:47 AM

GST rate cut impact: Will the low rate on medical devices lead to an inverted duty structure?

No. The Finance Ministry says that 5% GST on medical devices is intended to lower the cost of healthcare and thereby benefit patients, particularly the poor.

"This measure does not create any new inverted duty structure as the existing structure already had inverted duty structure although this measure may deepen the inversion. However, under GST, refund of accumulated input tax credit arising on account of inverted duty structure is available to manufacturers," the Finance Ministry said.

The GST Council has also recommended process reforms to enable expedited refunds.

September 04, 2025, 10:37 AM

GST rate cut on medical devices: Does new rate apply to all devices?

According to the Finance Ministry, the rate of 5% applies to all medical devices, instruments, apparatus used in medical, surgical, dental, and veterinary uses. However, some devices are exempted specifically.

September 04, 2025, 10:35 AM

GST rare change impact on motorcycles: What will be costly, what will be cheaper?

The GST Council’s decision to introduce a two-tier structure for motorcycles is set to preserve affordability in India’s commuter and mid-size segments while sharply raising prices of premium bikes. Motorcycles up to 350 cc will be taxed at a lower GST of 18% as against 28%, while those above 350 cc will attract a 40% levy. The new rates will come into effect from September 22. (Read full details on the impact of GST on various bike brands here).September 04, 2025, 10:01 AM

GST on cement: tax cut to 18%, stocks rally

GST rate on cement has been reduced to 18% from 28% earlier during the GST Council meeting. This move is likely to bring big relief for the real estate and infrastructure industry and is expected to boost the demand, especially in the housing sector, as lower construction costs can be passed on to buyers, making housing more affordable.

Cement stocks like UltraTech Cement, Ambuja Cements, ACC Ltd, Shree Cement and others are in the spotlight following the GST rate cut announcement on cement. UltraTech Cement rose over 2.5% in its opening trade, while Ambuja Cement and ACC Ltd are up 2 and 3% respectively. (Read more details here)September 04, 2025, 09:42 AM

New GST rates on casinos, lottery: 40% tax from September 22

The GST Council on Wednesday approved a 40% tax on admission to high-profile sporting events such as the Indian Premier League (IPL) and on activities including casinos, betting, horse racing, lotteries, gambling and online money games.

“For all specified actionable claims including betting, casinos, gambling, horse racing, lottery and online money gaming, GST rate of 40% will apply,” the finance ministry said in a release. (read more details here)September 04, 2025, 09:24 AM

New GST rates for dairy products: Tax reduced on most items

The Goods and Services Tax Council has decided to reduce tax rates on several dairy products. The council decided to make Ultra High Temperature (UHT) milk and paneer completely tax-free by reducing the GST from 5 per cent to zero.

GST on condensed milk, butter, other fats and cheese has been reduced to 5 per cent from 12 per cent. (PTI)

September 04, 2025, 09:22 AM

GST rate cut impact on housing: Move to make home buying affordable, say experts

G Hari Babu, National President of NAREDCO, says, "This move brings special relief to real estate and its allied industries. Lower GST on key materials like cement and steel will directly reduce costs. Projects will become more viable and progress faster. Affordable housing will gain the most, as reduced construction costs can be passed on to homebuyers. This will make homes more accessible and push forward the government’s Housing for All vision."

Dr Niranjan Hiranandani, Chairman, Hiranandani and NAREDCO National, says, "The GST rationalisation is a festive bonanza for Indian consumers and a strategic boost for the economy. By enhancing purchasing power, stimulating consumption, and helping contain inflation, this reform creates a multiplier effect that will propel India’s GDP growth beyond 8%."

"For the real estate and infrastructure sectors, the reduction of GST on critical construction materials like cement and steel from 28% to 18% is a landmark reform. This will significantly ease input costs, improve project viability, and accelerate infrastructure development across the country. Affordable housing, in particular, stands to gain as reduced construction costs can be passed on to homebuyers," he adds.

September 04, 2025, 09:18 AM

GST rate cut impact: Demand boost at a critical time, says Radhika Gupta

Commenting on GST rate cuts, Radhika Gupta of Edelweiss says, "Extremely progressive step at a very critical time that should help boost both demand and sentiment! When the world pushes us into a corner, we push ourselves to fight back harder."

September 04, 2025, 09:14 AM

GST rate cut Live: What are the items that have been exempted from GST?

The GST Council approved limiting slabs to 5 per cent and 18 per cent. As part of these reforms, a wide range of essential and commonly used items will now be exempt from GST. Read full list of such items hereSeptember 04, 2025, 08:28 AM

New GST rates Live: Why is there no change in GST on pan masala, cigarettes from September 22?

The Finance Ministry has said that pan masala, gutkha, cigarettes, chewing tobacco products like zarda, unmanufactured tobacco, and bidi will continue at the existing rates of GST and compensation ces where applicable.

The old rates will continue till loan and interest payment obligations under the compensation cess account are completely discharged. However, GST rate changes on other goods will be implemented from September 22, 2025. (Read more details here)September 04, 2025, 10:11 AM

GST on coal: Why has it been increased?

According to the Ministry of Finance, coal attracted 5% GST+ Compensation Cess of Rs 400/ton earlier. The GST Council has recommended ending Compensation Cess and hence the rate has been merged with GST. There is no additional burden. Therefore, higher GST on coal will not lead to increased electricity bill.

September 04, 2025, 07:34 AM

GST on insurance: What health insurance policies are exempted from tax?

The policies that will be exempted from tax under health insurance are all individual health insurance policies including family floater plans and senior citizen policies and the reinsurance services thereof.

September 04, 2025, 07:11 AM

GST on insurance: What life insurance policies will be exempted from tax?

The policies that will be exempted from tax under life insurance are all individual life insurance policies including term, ULIP, and endowment plans and reinsurance services.

September 04, 2025, 07:10 AM

GST on cars: What has changed in GST for cars and automobiles?

The GST rates for the smaller cars has been reduced from 28% to 18% for cars with an engine displacement of 1200 cc and 4000mm below. Meanwhile, luxury cars or SUVs which are 1200 cc (Petrol) and 1500cc (Disel) and 4000mm will continue to attract a higher GST rate of 40% which is effectively less than 50% earlier, including 28% GST and 22% cess. (Read more details here)September 04, 2025, 07:05 AM

GST on bicycles: What is new GST rate for bicycles?

The GST rate has been reduced to 5% on bicycles and its parts from 12%.

September 04, 2025, 06:45 AM

GST rate cut Live: How will the Simplified GST Registration scheme be implemented?

The GST Council has approved in-principle, the concept of a simplified GST registration mechanism for small suppliers making supplies through e-commerce operators (ECOs) across multiple States facing challenges in maintaining principal place of business in each State as currently required under the GST framework. The detailed modalities for operationalizing the said scheme will be placed before GST Council.

It will ease compliance for such suppliers and facilitate their participation in e-commerce across States. (Source: PIB)

September 04, 2025, 08:28 AM

New GST registration rule: What is Simplified GST Registration scheme?

The GST Council has recommended the introduction of an optional simplified GST registration scheme where registration will be granted on an automated basis within three working days from the date of submission of application in case of low risk applicants and applicants who based on their own assessment, determine that their output tax liability on supplies to registered persons will not exceed ₹2.5 lakh per month (inclusive of CGST, SGST/UTGST and IGST).

The simplified registration scheme will provide for voluntary opting into and withdrawal from the scheme.

September 04, 2025, 07:42 AM

GST rate cut Live: Why some goods have been pushed to the 40% slab?

The special rate is applicable only on few select goods, predominantly on sin goods and few luxury goods and therefore is a special rate. Most of these goods attracted Compensation Cess in addition to GST. Since it has been decided to end the Compensation Cess levy, the Compensation Cess rate is being merged with GST so as to maintain tax incidence on most goods. On other goods and services, the special rate has been applied as these were already attracting the highest GST rate of 28%. (Source: PIB)

September 04, 2025, 08:28 AM

GST rate cut Live: Why have all medicines not been exempted from GST in general?

If drugs/ medicines are fully exempted, the manufacturers/dealers would not be able to claim input tax credit on GST paid on raw materials and will have to reverse the ITC paid on the inputs. This would increase their effective tax incidence and cost of production. This may in turn be passed on to consumers/ patients in the form of higher prices which in turn would make the measure counterproductive. (Source: PIB)

September 04, 2025, 08:28 AM

GST rate cut Live: What is the GST rate on medicines?

All drugs/ medicines have been prescribed a concessional rate of GST of 5%, except those specified at nil rate.

September 04, 2025, 08:29 AM