Personal Finance News

Top stocks bought and sold by mutual funds in September 2024

.png)

3 min read | Updated on October 16, 2024, 20:24 IST

SUMMARY

In September 2024, mutual funds made significant investments in large-cap stocks like Varun Beverages and Infosys, while selling major holdings such as ICICI Bank and Tata Motors. Despite rising redemptions and a decline in net inflows, the industry saw a record in SIP inflows.

Top stocks bought and sold by mutual funds in September 2024

Mutual fund industry saw a rise in redemptions, increasing by 20.6% month-on-month to ₹47,400 crore. Consequently, net inflows decreased by 12.3%, falling to ₹36,400 crore in September from ₹41,500 crore in August.

The total assets under management (AUM) of the mutual fund industry saw a modest 0.6% month-on-month rise, reaching ₹6.71 lakh crore. This growth was driven by equity funds, which increased by ₹1,07,400 crore, balanced funds rising by ₹16,700 crore, and other exchange-traded funds (ETFs) adding ₹15,900 crore. In contrast, liquid funds and income funds experienced significant declines, with their AUM shrinking by ₹91,700 crore and ₹12,400 crore, respectively.

Systematic Investment Plan (SIP) inflows also hit a record high of ₹24,510 crore in September, marking a 4.1% month-on-month increase and an impressive 52.8% growth year-on-year. The investors continued to show a strong preference for mutual funds.

What Mutual Funds Bought?

(Source:Rupeevest)

(Source:Rupeevest)In September 2024, mutual funds made significant investments in large-cap stocks. Varun Beverages from the FMCG sector saw a purchase of ₹5,753.75 crore, while Infosys attracted ₹3,300.47 crore. Reliance Industries ₹2,582.52 crore, Samvardhana Motherson International ₹2,429.53 crore, and Trent (₹2,059.97 crore). In the large-cap segment, the new entry was Adani Enterprises.

In the mid-cap category, mutual funds added Phoenix Mills ₹6,004.58 crore from the construction sector, GE T&D India ₹4,257.28 crore, Prestige Estates Projects ₹1,492.53 crore, another construction sector stock, Sona BLW Precision Forgings ₹1,200.98 crore, and General Insurance Corporation of India ₹831.5 crore. Yes Bank was the new entry by the mutual fund in the midcap space.

Among small-cap stocks, major addition was Krishna Institute of Medical Sciences ₹12,745.3 crore, Sapphire Foods India ₹8,621.31 crore, VST Industries ₹2,800.31 crore, Indigo Paints ₹968.41 crore, and K.P.R. Mill ₹812.67 crore.

Mutual funds added 11 new stocks to their portfolios in September 2024. The largest investment was in Bajaj Housing Finance Ltd, with ₹1,740 crore. PN Gadgil Jewellers and SpiceJet Ltd followed with ₹483 crore and ₹305 crore, respectively.

Other IPO additions included Kross Ltd (₹110 crore), Western Carriers India Ltd (₹68.94 crore), Northern ARC Capital (₹37 crore), KRN Heat Exchanger & Refrigeration Ltd (₹20 crore), and Diffusion Engineers Ltd (₹18.15 crore).

What Mutual Funds Sold?

(Source:Rupeevest)

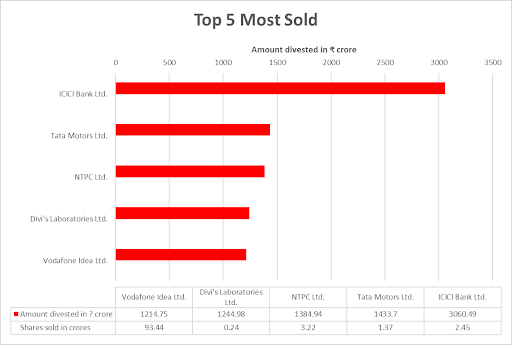

(Source:Rupeevest)In the large-cap category, mutual funds sold ICICI Bank ₹3,060.49 crore, Tata Motors ₹1,433.7 crore, NTPC ₹1,384.94 crore, Divi's Laboratories ₹1,244.98 crore, and Sun Pharmaceutical Industries ₹724.29 crore. The mutual fund houses made a complete exit from IRFC.

In the mid-cap category, Vodafone Idea ₹1214.75 crore, Bharat Forge ₹677.52 crore, Voltas ₹645.14 crore, Kalyan Jewellers India ₹514.42 crore, and Mankind Pharma ₹489.63 crore were sold by mutual funds.

In the small-cap category, mutual funds sold Central Depository Services ₹621.6 crore, Zee Entertainment Enterprises ₹424.17 crore, Kaynes Technology India ₹324.76 crore, Granules India ₹321.7 crore, and IIFL Finance ₹320 crore.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story