Personal Finance News

Top stocks bought and sold by mutual funds in October 2024

.png)

3 min read | Updated on November 18, 2024, 18:24 IST

SUMMARY

In October 2024, mutual funds made significant investments in large-cap stocks like Reliance and Dr Reddy’s Lab while selling major holdings such as Cholamandalam Investment and Finance and Indian Oil Corp. Equity funds witnessed 21.69% growth in inflows, and inflows into ETFs soared to a new high. The industry saw a record in SIP inflows.

In large-cap stocks, Reliance Industries were bought whereas Cholamandalam Investment and Finance Company were sold by mutual funds in October 2024

In October, investments in mutual funds saw a significant rise, as equity funds increased by 21.69% to reach ₹41,887 crore. The Total Assets Under Management (AUM) rose to ₹67.25 lakh crore, and inflows into ETFs soared to ₹13,441.8 crore.

All three segments — small-cap, mid-cap, and large-cap — saw strong demand during the month. Large-cap funds saw nearly doubled inflows as compared to September, which surged to ₹3,452 crore. Mid-cap funds had a 50% jump in net inflows, totalling ₹4,683 crore, while small-cap funds saw a 23% rise in net inflow, attracting ₹3,772 crore.

Inflows into New Fund Offers (NFOs) significantly declined, dropping to ₹6,078 crore from ₹14,575 crore in September.

In October, the mutual fund industry saw remarkable growth in Systematic Investment Plans (SIPs). A total of 63,69,919 new SIPs were registered, contributing to a record SIP AUM of ₹13,30,429.83 crore. The SIP contribution reached an all-time high of ₹25,322.74 crore, up from ₹24,508.73 crore in September 2024

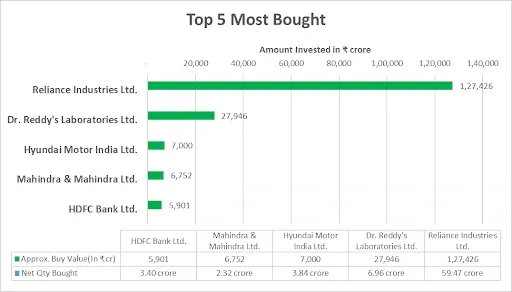

What Mutual Funds Bought?

In October 2024, mutual funds made notable investments in large-cap stocks. Reliance Industries, the largest conglomerate in India, saw the highest purchase at ₹1,27,426 crore, followed by Dr. Reddy's Laboratories (₹27,946 crore) in healthcare. Hyundai Motor India and Mahindra & Mahindra, both from the automobile and ancillaries sector, attracted ₹6,999.78 crore and ₹6,751.57 crore, respectively. HDFC Bank saw an addition of ₹5,900.98 crore.

In the mid-cap category, Waaree Energies bought for a total value of ₹1,423.39 crore, while Coforge attracted ₹1,293.1 crore. IDFC First Bank and Bharat Heavy Electricals saw investments of ₹974.53 crore and ₹830.07 crore, respectively, while Marico in FMCG saw a total buying value of ₹687.34 crore.

Among small-cap stocks, HEG in the capital goods sector witnessed purchases worth ₹2,334.25 crore, followed by Power Mech Projects (₹1,569.35 crore) and Afcons Infrastructure (₹1,023.78 crore) in infrastructure. Sansera Engineering in automobile and ancillaries and Jindal Saw Ltd. in metals saw additions of ₹730.59 crore and ₹657 crore, respectively.

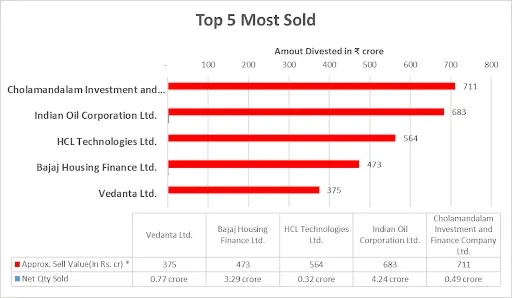

What Mutual Funds Sold?

In the large-cap category, mutual funds sold Cholamandalam Investment and Finance Company (₹710.64 crore), Indian Oil Corporation (₹683.46 crore), HCL Technologies Ltd. (₹564.08 crore), Bajaj Housing Finance Ltd. (₹473.42 crore), and Vedanta Ltd. (₹375.1 crore).

In the mid-cap category, Torrent Power Ltd. saw sell-offs amounting to ₹592.34 crore, followed by Voltas (₹518.76 crore), Max Financial Services (₹517.34 crore), Steel Authority of India (₹418.17 crore), and Mphasis (₹363.29 crore).

In the small-cap category, mutual funds sold RBL Bank (₹838.55 crore), Central Depository Services (₹510.4 crore), Multi Commodity Exchange of India (₹436.42 crore), Vedant Fashions (₹410.47 crore), and Piramal Enterprises (₹349.06 crore).

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story