Personal Finance News

SBI Mutual Fund to drive returns with the launch of first-ever automotive active fund: SBI Automotive Opportunities Fund; details inside

.png)

4 min read | Updated on May 17, 2024, 17:31 IST

SUMMARY

SBI Mutual Fund has launched SBI Automotive Opportunities Fund, which is the first actively managed automotive sector mutual fund in India. It aims to make equity investments in the automotive and allied industries, thus positioning itself to take advantage of the growth and export potentials of the sector.

SBI Mutual Fund to drive returns with the launch of first-ever automotive active fund: SBI Automotive Opportunities Fund; details inside

The nation's first Indian automotive and allied sectors active managed mutual fund scheme has been launched by SBI Mutual Fund--India's leading asset management company. SBI Automotive Opportunities Fund is now in its new public fund offer (NFO) phase. This fund seeks to take advantage of the auto industry's strong performance and bright prospects signalled by high disposable income levels combined with low penetration rates.

Even when the SBI fund appears similar to the market’s different funds, it’s worth mentioning that funds like Mirae Asset Global Electric & Autonomous Vehicles ETFs FoF focus on electric and auto-pilot global companies.

SBI Mutual Fund believes India, which is already a major player in automobile manufacturing and components; it has great potential to increase its exports. The fund house says the increasing demand for premium cars and the growing acceptance of electric vehicles are crucial factors for a hopeful investment climate in the sector. This fund targets taking advantage of these developments, hence giving a chance for investors who may wish to exploit the fast-growing domestic automotive industry.

"The Indian Automotive Industry is running in top gear as our country is a force to be reckoned with in terms of production of vehicles and auto exports while our burgeoning domestic market demands safer and premium vehicles. In addition, the manufacturing of auto parts and ancillaries contributes to almost 30 per cent of the manufacturing ecosystem, providing wealth-creation opportunities for investors in the long term. I believe policy reforms and a defined roadmap with the industry provide momentum and an opportunity for investors to benefit from India’s growing automotive ecosystem," said D P Singh, Deputy MD and Joint CEO, SBI MF.

SBI Automotive Opportunities Fund

The SBI Automotive Opportunities Fund was launched on May 17, 2024. This thematic fund invests in equity and equity-linked instruments of companies involved in the automotive and allied businesses sector, both in India and globally. The scheme's goal is to generate long-term capital appreciation for its investors. The New Fund Offer (NFO) is open for subscription until May 31, 2024, with a minimum investment of ₹5,000. There is no entry load, but an exit load of 1% applies if units are redeemed within one year from the allotment. This exit load becomes nil after one year.

The investment objective of the SBI Automotive Opportunities Fund is to generate long-term capital appreciation to unit holders from a portfolio that is invested in equity and equity-related instruments of companies engaged in automotive & allied business activities theme. However, there can be no assurance that the investment objective of the Scheme will be realized.

Benchmark

The fund house compares the performance of the SBI Automotive Opportunities Fund to Nifty Auto TRI.

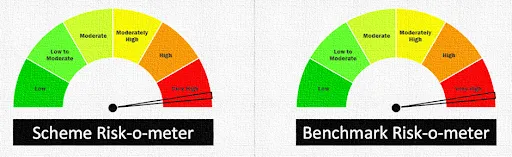

Risk-o-meter:

| Types of Instruments | Risk Profile | Minimum Allocation | Maximum Allocation |

|---|---|---|---|

| Equities of companies engaged in automotive & allied business activities theme (including equity derivatives) | Very High | 80% | 100% |

| Equity (including equity derivatives) | Very High | 0% | 20% |

| Debt and money market | Low to Medium | 0% | 20% |

| REITs and InvITs | Medium to High | 0% | 10% |

Who should invest in this scheme?

The NFO for SBI Automotive Opportunities Fund is acceptable for those who want long-term capital gains from equities investing in firms operating within or poised to benefit from the expansion of the automotive industry and allied applications thereof.

Who Manages the Scheme?

Tanmay Desai, who is 40 years old and has over 6 years of experience in Indian capital markets, has been managing the scheme since it was started. He has a B.E in Electronics, an MBA in Finance and is a CFA Level III candidate (USA). He has worked for around fifteen years which gives him a broad perspective and he is very well skilled at what he does.

Pradeep Kesavan, the dedicated fund manager who facilitates overseas investments, is 44 years old. He has been in charge since its formation. He has a B. Com and an MBA in Finance and is a CFA (UCSA). SBIFML welcomed Kesavan in July 2021, he has been in the financial services sector for more than 18 years imparting valuable knowledge to his current role.

The SBI Automotive Opportunities Fund offers a unique investment opportunity for those seeking long-term capital appreciation by leveraging the growth prospects of India's automotive industry, supported by rising domestic demand, increasing exports, and advancements in electric vehicles.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story