Personal Finance News

Nippon India Growth Fund reaches historic milestone, NAV surpasses ₹4,000 amid strong performance

.png)

4 min read | Updated on July 16, 2024, 19:24 IST

SUMMARY

Nippon India Growth Fund has surpassed an NAV of ₹4,000 for the first time in July 2024, with the regular plan at ₹4,008. The fund, managing ₹30,838.94 crore AUM, has delivered returns with a CAGR of 23.14% since inception, beating its benchmarks.

Nippon India Growth Fund reaches historic milestone, NAV surpasses ₹4,000 amid strong performance

The Net Asset Value (NAV) of Nippon India Growth Fund crossed ₹4,000 for the first time in July. As of July 15, 2024, the current NAV of the fund's regular plan is ₹4,008. The fund size is ₹30,838.94 crore with an expense ratio of 1.61%. The fund, which has been open-ended since its inception on October 8, 1995, continues to attract significant interest.

Returns by the Fund

The Nippon India Growth Fund has delivered a return of 23.14% since its inception. The fund is benchmarked against the Nifty Midcap 150 TRI. It has provided the following returns:

- 59.02% in the last 1 year

- 29.23% in the last 3 years

- 29.45% in the last 5 years

- 21.01% in the last 7 years

- 20.12% in the last 10 years

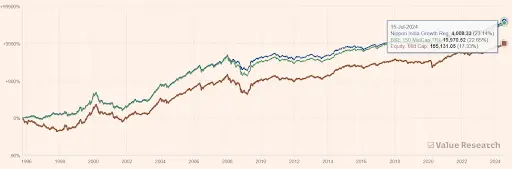

Growth in NAV since its inception:

At inception, the NAV was at ₹10, and it has climbed to ₹4,008, representing a growth of 39,980% since inception, with a CAGR of 23.14%. The fund has created significant wealth for investors by delivering phenomenal returns. The Nippon India Growth Fund has achieved a CAGR of 23.14%, outperforming the BSE Midcap 150, which had a CAGR of 22.65%, and the Equity Midcap category, which had a CAGR of 17.33% since the fund's inception. Notably, the fund began outperforming the BSE Midcap 150 after 2006, as illustrated in the graph above.

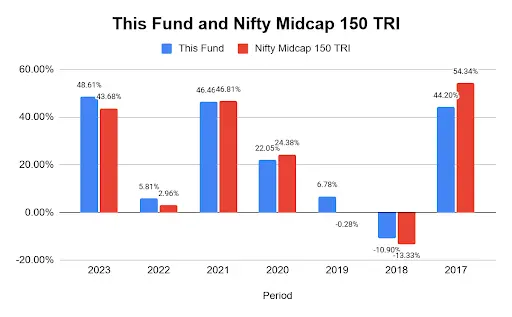

Below is the performance of the fund with respect to Nifty Midcap 150 TRI

The fund has outperformed the index in 2023, 2022, 2019, and 2018. In addition, it has marginally underperformed the index in 2021, 2020, and 2017.

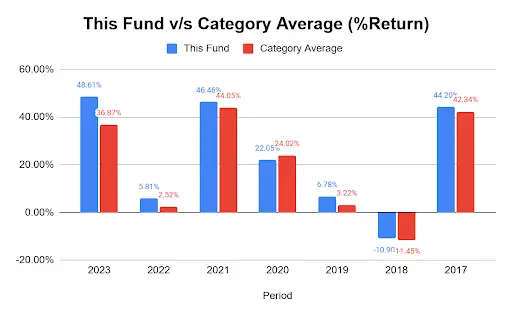

Performance of Fund v/s Category Average

The fund has significantly outperformed its category average, with 2020 being the only year it underperformed. This demonstrates the expertise of the fund managers managing the Nippon India Growth Fund. The fund has consistently outperformed its category peers, showcasing the manager's skill in navigating the market.

Calculation SIP of ₹10,000 Since its Inception

_Source: Value Research _

If you had invested ₹10,000 monthly into the fund, the total current value of your investment would be ₹22,32,87,144, based on a total invested amount of ₹33,60,000. This investment has yielded a CAGR of 23.81%.

Below is the breakdown of investing ₹10,000 at different time periods:

| Period Invested for | ₹10000 Invested on | Latest Value | Absolute Returns | Annualised Returns |

|---|---|---|---|---|

| 1 Year | 14-Jul-23 | 15942.4 | 59.42% | 59.02% |

| 2 Year | 15-Jul-22 | 20677.1 | 106.77% | 43.72% |

| 3 Year | 15-Jul-21 | 20322.5 | 103.22% | 26.64% |

| 5 Year | 15-Jul-19 | 33496.5 | 234.97% | 27.32% |

| 10 Year | 15-Jul-14 | 56983.6 | 469.84% | 18.99% |

| Since Inception | 08-Oct-95 | 3611525.5 | 36015.25% | 22.70% |

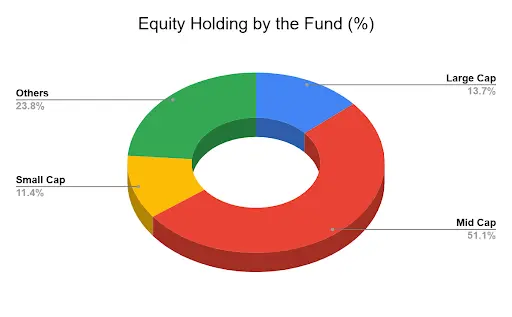

Constituents of the Fund

The fund has an equity holding of 98.5% of the total portfolio, with the remaining 1.5% in other assets. It primarily invests in mid-cap stocks, followed by large-cap and small-cap stocks.

The total number of stocks held by the fund is around 95, with the top 10 stocks accounting for 23.24% of the fund's weight and the top 3 sectors comprising 18.86% of the fund's weight with 7.2% holdings in Pharmaceuticals, 6.84% in Auto Components & Equipments and 5% in Financial Institution, respectively as on 30 June 2024 on the moneycontrol website.

About the Fund Manager

The Nippon India Growth Fund is managed by Rupesh Patel, who has been in charge since January 2023 and brings over 25 years of experience to the role. Sanjay Doshi, the Assistant Fund Manager, supported him, who also started managing the fund in January 2023 and has more than 19 years of experience in the industry.

The Nippon India Growth Fund's achievement of a ₹4,000 NAV highlights its consistent performance, making it a compelling choice for long-term investors.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story