Personal Finance News

Motilal Oswal Mutual Fund Launches Motilal Oswal Multi-Cap Fund; Here are the full details

.png)

6 min read | Updated on May 28, 2024, 17:12 IST

SUMMARY

Motilal Oswal Mutual Fund has launched a new multi-cap fund targeting long-term growth by investing in large, mid, and small-cap companies. The scheme offers diversification, with a minimum investment of ₹500, and no exit load after 15 days.

Motilal Oswal Mutual Fund Launches Motilal Oswal Multi-Cap Fund; Here are the full details

Launched today on May 28, 2024, the Motilal Oswal Multi-Cap Fund is an open-ended scheme aiming for long-term capital growth by investing in a mix of large, mid, and small-cap companies. Think of it as a basket with eggs from all coop sizes! The key thing to remember is that there is no guarantee of how it will perform, but it offers diversification across the market. You can invest a minimum ₹500 and there's no exit load if you redeem after 15 days from the allotment, but there's a 1% charge if you redeem earlier. The offer closes on June 11th, 2024.

“India is currently experiencing a mini-Goldilocks moment. Indian economy, while not being immune to the global turmoil has demonstrated strong performance across key indicators with GDP expected to grow to $30 trillion by 2047. The coming few years will be a transformative phase for the Indian economy. Solid macroeconomic conditions, healthy corporate earnings, peaking of interest rates, moderate inflation print, and ongoing policy momentum will help drive this growth in equity markets too. We firmly believe in the medium-term India trajectory and have conviction in selected domestic cyclical themes,” said Prateek Agrawal, MD and CEO of Motilal Oswal Mutual Fund.

Why to Invest in Multicap Funds?

Over the last year, the market has gone up, and valuations in some sectors are raising concerns. In February end, SEBI stated that midcap and small-cap stocks might be overvalued. Long-term prospects for Indian equities are still promising, notwithstanding, short-term global risk factors such as the timing of the US Federal Reserve’s interest rate cuts, geopolitical tensions in the Middle East, and their effects on crude oil prices and inflation could lead to volatility in the market.

Large-cap stocks are better performing during high volatility than mid and small-cap stocks. Despite this, midcaps and small caps always have higher growth rates leading to increased wealth accumulation. Therefore, among the various suitable ways the individual can balance risk and return in their long-term wealth creation process is by using two multi-cap portfolios.

Source: Advisorkhoj Research. (Data as of March 28, 2024)

Motilal Oswal Multi Cap Fund

The primary objective of the Motilal Oswal multi-cap fund is to achieve long-term capital appreciation by predominantly investing in equity and equity-related instruments of large, mid, and small-cap companies. However, there can be no assurance that the investment objective of the scheme will be realised.

Benchmark

The performance of the Motilal Oswal multi-cap fund is benchmarked against Nifty 500 Multicap 50:25:25 Index TR.

Risk-o-meter:

Funds Allocation

| Types of Instruments | Risk Profile | Minimum Allocation | Maximum Allocation |

|---|---|---|---|

| Equity is as follows: Equity - Large Cap companies Equity - Mid-Cap companies Equity - Cap companies | Very High | 75% 25% 25% 25% | 100% 50% 50% 50% |

| Debt and Money Market and Debt Schemes of Mutual Fund. | Low to Moderate | 0 | 25 |

| REITs and InvITs | Very High | 0 | 10 |

Who Should Invest?

This NFO is intended for investors seeking capital appreciation on a long-term basis through investment in large-cap, mid-cap, and small-cap stocks, equity, and equity-related instruments. Those who want diversification among the broader category can think of investing in this mutual fund scheme.

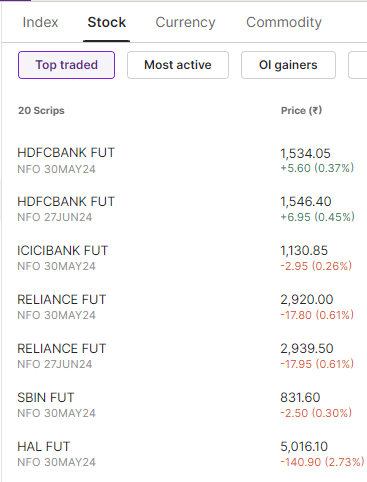

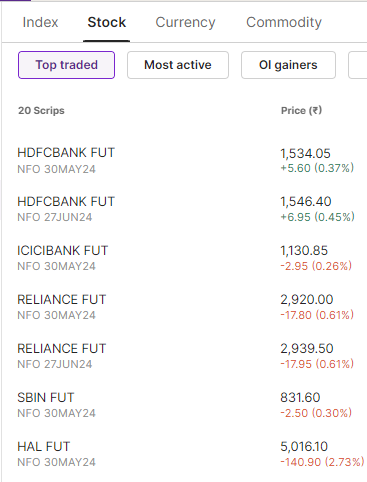

Peer Schemes

| Scheme Name | AUM (Crore) | Expense Ratio (%) | 1 Year | 3 Years | 5 Years | 10 Years | Since Launch Ret (%) |

|---|---|---|---|---|---|---|---|

| Returns (%) | Returns (%) | Returns (%) | Returns (%) | ||||

| Category Average | - | - | 46.2 | 22.4 | 21.08 | 17.22 | 24.01 |

| Quant Active Fund | 9790.64 | 1.72 | 54.16 | 24.7 | 29.21 | 22.36 | 19.98 |

| Nippon India Multi Cap | 30500.56 | 1.61 | 52.14 | 31.54 | 21.28 | 17.17 | 18.8 |

| Baroda BNP Paribas Multi Cap Plan A | 2423.51 | 2.04 | 45.7 | 23.47 | 21.19 | 15.4 | 17.08 |

| Invesco India Multi Cap | 3345.28 | 1.91 | 42.32 | 18.86 | 19.86 | 16.66 | 16.36 |

| Sundaram Multi Cap Fund | 2497.78 | 1.99 | 42.82 | 20.47 | 17.66 | 15.46 | 15.97 |

| ICICI Prudential Multi Cap | 11881.69 | 1.76 | 46.32 | 22.4 | 18.82 | 16.27 | 15.48 |

| NIFTY 500 TRI | - | - | 39.79 | 19.63 | 18.46 | 15.04 | 12.71 |

Data As of May 27, 2024

Who Manages the Scheme?

Ajay Khandelwal is a seasoned fund manager aged 44. He has 13 years’ experience in this field and holds CFA Level 3, a PGDM (MBA) from TAPMI, and a Bachelor’s degree in Electrical Engineering. He used to be the manager for the Small Cap Fund at Canara Robeco.

Niket Shah aged 37 years is Vice President – Associate Fund Manager at Motilal Oswal Asset Management who holds an MBA in Finance and has 13 years’ experience involving Motilal Oswal Securities, Edelweiss Securities, and Religare Capital Markets.

Santosh Singh, who is 44 years old, is a Chartered Accountant and a CFA charter holder with more than 15 years of experience working on the Motilal Oswal Balanced Advantage Fund where he works. Previously he was the Head of Research at Haitong International Securities.

Atul Mehta is 35 years old and has had 15 years of experience as a CFA Charter holder after attaining a Master of Commerce degree.

42-year-old Rakesh Shetty manages several funds at Motilal Oswal. He has also worked as an equity trader, fixed-income trader, and ETF manager.

Ankush Sood, 25, manages Foreign Securities at Motilal Oswal. Ankush has a B.Tech and an MBA in Finance and Analytics. Ankush has previously worked in Institutional Sales Trading.

Investing in Motilal Oswal's multi-cap fund provides an opportunity for capital appreciation across diverse market segments, backed by strong economic indicators and strategic sector allocations. Ideal for investors seeking balanced risk and long-term growth potential in Indian equities.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story