Personal Finance News

Mahindra Manulife Mutual Fund launches Mahindra Manulife Manufacturing Fund – details inside

.png)

6 min read | Updated on May 31, 2024, 20:04 IST

SUMMARY

Mahindra Manulife Mutual Fund launched the Mahindra Manulife Manufacturing Fund, an open-ended fund focused on manufacturing sector stocks. The fund, open for subscription from May 31 to June 14, 2024, requires a minimum investment of ₹1,000 and carries no entry load but may have an exit load if units are sold within three months.

Mahindra Manulife Mutual Fund Launches Mahindra Manulife Manufacturing Fund – Details Inside

Mahindra Manulife Mutual Fund just launched a new fund named Mahindra Manulife Manufacturing Fund. This fund aims to grow your investment over the long term by focusing on stocks of companies involved in manufacturing. It is an open-ended fund, so you can buy or sell units whenever possible. It is important to note that this is a thematic fund, meaning it invests in one particular sector, which can be risky.

There is no upfront fee to invest (entry load), but you might get charged an exit load if you sell your units within 3 months of buying them. The minimum investment is ₹1,000 and you can add more. The fund is open for subscription starting today, May 31, 2024, and closes on June 14, 2024.

Why Invest in the Manufacturing Theme?

Investing in the manufacturing sector in India is becoming increasingly attractive due to several key factors driving its growth. Government initiatives such as "Make in India" and "Atmanirbhar Bharat" are central to this shift, with policies designed to boost local production through incentives like the Production Linked Incentives (PLI) scheme.

The Indian government has committed significant resources to improve infrastructure, with major investments in roads, railways, and ports, facilitating better logistics and reducing costs for manufacturers. This infrastructure push is supported by an increasing power capacity, ensuring a reliable electricity supply for industries, a critical component for manufacturing growth.

Furthermore, global trends are favourable for India's manufacturing sector. With companies seeking to diversify their supply chains away from China to mitigate risks of overdependence, India stands to gain significantly. The country is poised to become a major supplier to the revitalizing manufacturing sectors in the West, particularly for ancillary and component production.

Data supports this potential: India's capital expenditure (capex) has seen substantial growth, with central and state capex increasing from ₹2 trillion in FY10 to an estimated ₹8.5 trillion in FY24. This economic environment makes manufacturing a promising theme for investment in India, poised to contribute significantly to the nation's GDP and employment in the coming years.

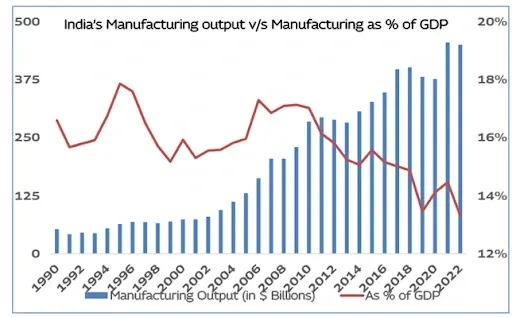

India’s GDP is expected to grow rapidly, manufacturing may have a major role While Manufacturing has grown, it has made a smaller proportion of the economy over time:

Mahindra Manulife Manufacturing Fund

The Mahindra Manulife Manufacturing Fund shall seek to generate long-term capital appreciation by investing predominantly in equity and equity-related securities of companies engaged in manufacturing themes. However, there is no assurance that the objective of the Scheme will be achieved

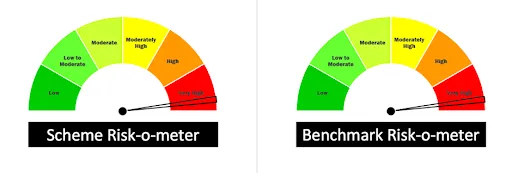

Benchmark

Risk-o-meter:

Funds Allocation

| Types of Instruments | Risk Profile | Minimum Allocation | Maximum Allocation |

|---|---|---|---|

| Equity - Manufacturing theme | Very High | 80% | 100% |

| Equity - Other | Very High | 0% | 20% |

| Debt and Money Market | Low to Moderate | 0% | 20% |

| REITs & InvITs | Very High | 0% | 10% |

Who Should Invest?

Mahindra Manulife Manufacturing Fund is for people looking to build wealth over time while investing mainly in shares associated with the manufacturing field with an open-ended scheme aimed at appreciation of equity investments, and equity-related instruments connected with this sector.

Peer Schemes

| Scheme Name | AUM (Crore) | Expense Ratio (%) | Returns (%) | |||

|---|---|---|---|---|---|---|

| 1 Year | 3 Years | 5 Years | Since Launch | |||

| ICICI Prudential Manufacturing Fund | 3882.89 | 1.9 | 66.95 | 30.24 | 25.7 | 23.6 |

| Kotak Manufacture in India Fund | 1933.15 | 2.02 | 50.8 | - | - | 28.08 |

| Aditya Birla Sun Life Manufacturing Equity | 950.24 | 2.33 | 47.16 | 16.97 | 18.02 | 12.31 |

| quant Manufacturing Fund | 651.73 | 2.32 | - | - | - | 53.58 |

| Axis India Manufacturing | 4683.25 | 1.83 | - | - | - | 27.74 |

| Canara Robeco Manufacturing | 1241.89 | 2.1 | - | - | - | 15.52 |

| Category Average | - | - | 54.97 | 23.6 | 21.86 | 23.1 |

| NIFTY 500 TRI | - | - | 36.06 | 18.72 | 18.12 | 12.66 |

Who Manages the Scheme?

Renjith Sivaram Radhakrishnan is forty-four years old, he has an MBA in Finance and a BTech in Mechanical Engineering. In June 2023, he took up the role of a Fund Manager & Research Analyst at Mahindra Manulife Investment Management Pvt. Ltd. (MMIMPL). Before this position, he worked as an analyst at MMIMPL, ICICI Securities, Antique Stock Broking and B&K Securities. He is also involved in managing Mahindra Manulife Business Cycle Fund, Mahindra Manulife Equity Savings Fund and Mahindra Manulife Multi Asset Allocation Fund.

Manish Lodha has been Fund Manager at MMIMPL since December 2020, a B.Com (H) graduate, qualified CS and CA. Before this current position, he served as an Assistant Fund Manager at Canara HSBC OBC Life Insurance Co Ltd and Research Analyst at Kotak Mahindra Mutual Fund. He acts alongside other co-managers in the management of various funds like Mahindra Manulife ELSS Tax Saver Fund, Multi Cap Funds, and Mid Cap Funds among others.

Pranav Nishith Patel, aged 40, is a software engineer who has a degree in IT as well as a postgraduate. He has worked for MMIMPL since April 2002 as an Equity Fund Analyst and previously served as an employee of MSCI Services Pvt. Ltd and FICCI. Pranav Nishith Patel, who is 40 years old, specialises in overseas investment management within Mahindra Manulife funds such as Short Duration Fund or Asia Pacific REITs FOF, acting in the capacity of a fund manager exclusively in this area and working with various other professionals in the team.

The Mahindra Manulife Manufacturing Fund offers an opportunity for investors seeking long-term capital appreciation through the manufacturing sector. Managed by experienced professionals, the fund leverages India's favourable economic environment and government initiatives. While thematic funds carry risks, the potential benefits from India's growing manufacturing sector and infrastructure improvements make this fund a compelling option for investors focused on sector-specific growth.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story