Personal Finance News

SEBI’s proposed new mutual fund rules: Lower expenses, more transparency. 13 things investors should know

6 min read | Updated on October 29, 2025, 09:42 IST

SUMMARY

The markets regulator has released a Consultation Paper on Comprehensive Review of the SEBI (Mutual Funds) Regulations, 1996, proposing major changes that aim to make mutual fund investing cheaper, simpler, and more transparent.

SEBI has invited public comments and suggestions on the draft Mutual Fund Regulations before finalising them. | Image: Shutterstock

The market regulator has released a Consultation Paper on Comprehensive Review of the SEBI (Mutual Funds) Regulations, 1996, proposing major changes that aim to make mutual fund investing cheaper, simpler, and more transparent.

Here are 13 key takeaways for mutual fund ( MF) investors from SEBI’s Consultation Paper:

1.SEBI has proposed reducing the Total Expense Ratio (TER) charged by mutual funds to make investing more cost-effective for investors.

2.For open-ended mutual funds, SEBI has suggested a cut of up to 0.15% in TER, while for closed-ended mutual funds, a reduction of up to 0.25% is proposed.

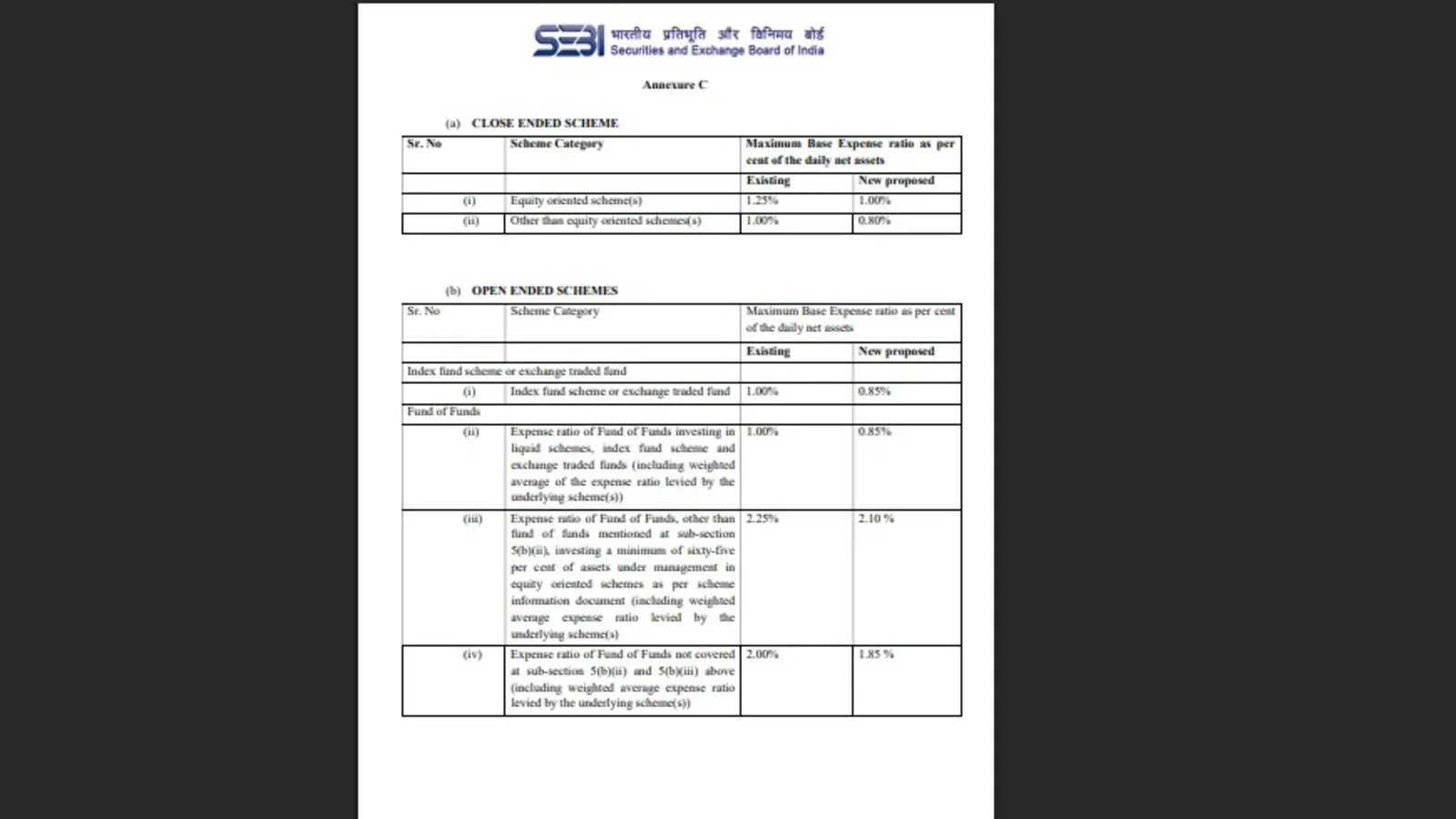

3.Under the new proposal, the TER limits for close-ended schemes will be revised as follows: for equity-oriented schemes, the TER will be reduced from 1.25% to 1.00%, and for non-equity-oriented schemes, from 1.00% to 0.80%.

4.For open-ended schemes, the index funds and exchange-traded funds (ETFs) will see their TER reduced from 1.00% to 0.85%. Similarly, Fund of Funds (FoFs) investing in liquid schemes, index funds, or ETFs (including the weighted average of underlying expenses) will also have a cut from 1.00% to 0.85%.

5.FoFs investing at least 65% of their assets in equity-oriented schemes will see their TER reduced from 2.25% to 2.10%, while other FoFs will have a reduction from 2.00% to 1.85%.

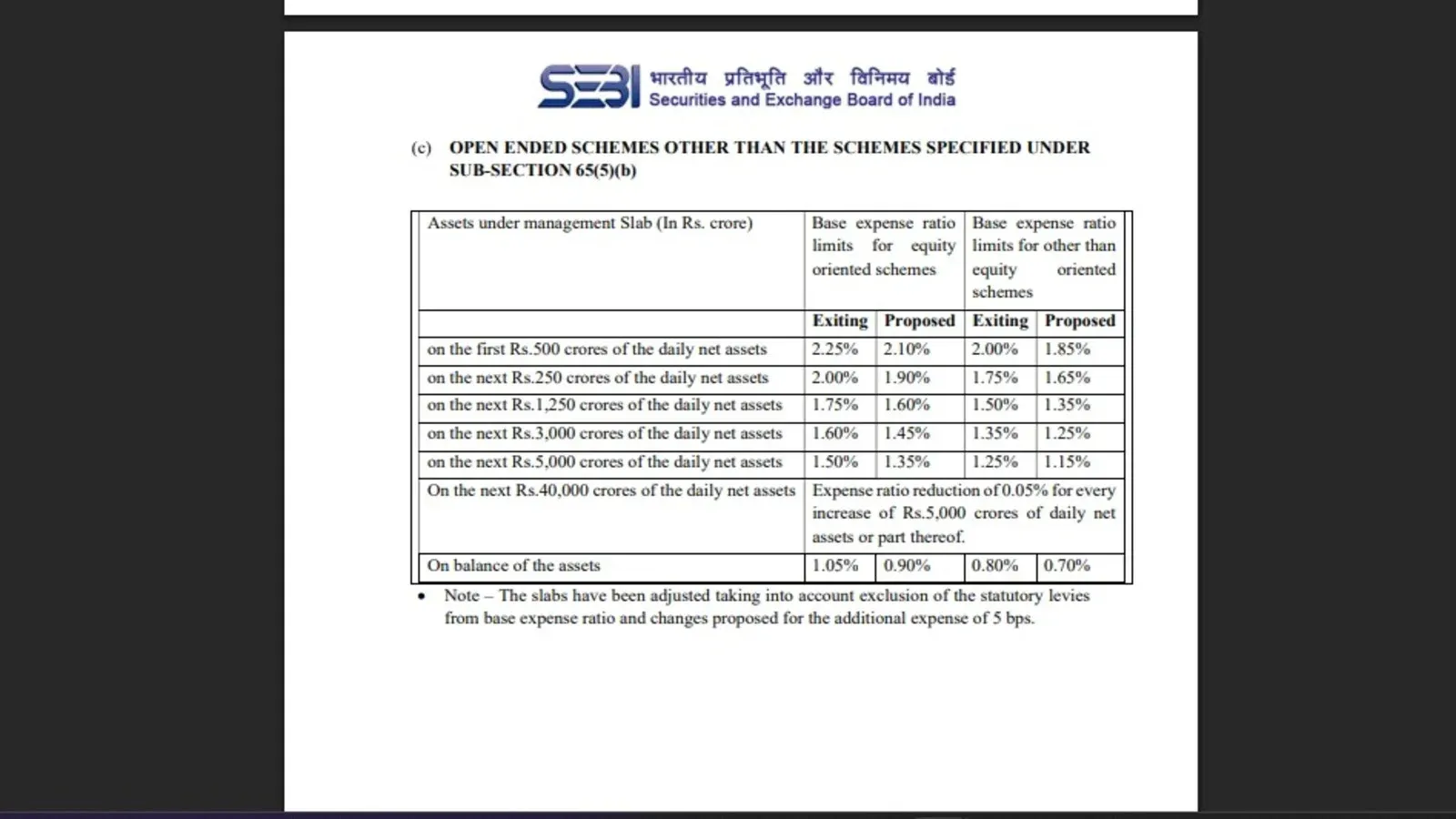

6.For asset-based slabs, the TER applicable to the first ₹500 crore of daily net assets will drop from 2.25% to 2.10% for equity funds and from 2.00% to 1.85% for non-equity funds.

7.Subsequent slabs also see reductions ranging between 0.10% to 0.15%, with the lowest slab (for assets above ₹40,000 crore) witnessing a 0.05% reduction for every ₹5,000 crore increase in daily net assets. The TER on the balance assets will reduce from 1.05% to 0.90% for equity schemes and from 0.80% to 0.70% for non-equity schemes.

- The capital markets regulator has also proposed a sharp reduction in the brokerage fees that mutual funds pay for their trades.

From 12 bps to 2 bps (cash market)

From 5 bps to 1 bps (derivatives)

- Statutory levies (GST, STT, CTT, stamp duty) will now be charged separately from TER. This ensures greater transparency.

"With a view to facilitate greater clarity and transparency, it is proposed to exclude all statutory levy i.e. STT, GST, CTT, and Stamp duty from the expense ratio limits along with the present permissible expenses for brokerage, exchange and regulatory fees. Presently, GST on management fees is permitted over and above the TER limit. However, all other statutory charges are part of the overall TER limit specified for mutual fund schemes. The expense ratio limits are proposed to be exclusive of statutory levy, so that any change in statutory levy in future are passed on to the investors," said SEBI.

This means that in the future, statutory taxes and government levies will be charged separately rather than being included within TER. For investors, this change enhances fee transparency, making it easier to see the true cost of fund management, and ensures that mutual funds cannot hide regulatory costs within the TER.

10.Additional 5 bps charge allowed earlier to fund houses (for schemes with exit load) will be removed, further reducing costs for investors.

"The provision for additional expense of 5 bps allowed to the AMCs to charge the mutual fund schemes, was transitory in nature. Therefore, with an objective to rationalize cost for unitholder, this expense charged to the scheme has been removed from the draft MF Regulations," SEBI said in the Consultation Paper on Comprehensive Review of the SEBI (Mutual Funds) Regulations, 1996.

- SEBI has proposed a framework allowing AMCs to charge performance-linked expense ratios, meaning investors pay more only when funds deliver better-than-benchmark returns.

"Differential expense ratio (new Regulation), a provision enabling expense ratio to be charged based on performance of a scheme has been introduced, and the same shall be voluntary for AMCs. A detailed framework in this regard shall be finalised separately in consultation with stakeholders," said SEBI.

This approach, once finalised, could reward strong fund performance while ensuring that investors only pay higher costs when fund managers deliver above-average results.

-

SEBI aims to prevent double-charging for research (one under management fees and another via brokerage), protecting investors from hidden costs. Clear rules reaffirm that fund launch and marketing expenses must be borne by the AMC, not investors.

-

Regulations will be rewritten using simpler language and clear tables, including eligibility criteria, investment limits, and valuation norms.

| Sr. No | Particulars | Proposal Summary |

|---|---|---|

| 1 | Additional 5 bps charge (Reg. 52(6A)(c)) | Removed to rationalize costs; expense ratio slabs revised upward by 5 bps. |

| 2 | Expense ratio & statutory levy (Reg. 52) | Statutory levies (STT, GST, etc.) excluded from TER; TER revised downward accordingly. |

| 3 | Brokerage & transaction charges (Reg. 52) | Brokerage capped at 2 bps (cash) & 1 bps (derivatives); other costs on actuals; statutory levies outside TER. |

| 4 | Disclosure of Total Expense Ratio | TER must include all relevant heads; mandatory disclosure introduced. |

| 5 | Differential expense ratio | Performance-based TER allowed; optional for AMCs; framework to be finalized. |

| 6 | Expenses before allotment (Reg. 52(2), 52(4), 52(4A)) | All pre-allotment expenses to be borne by AMC/Trustees/Sponsors. |

| 7 | Restriction on AMC business (Reg. 24(b)) | Ensures fair treatment of retail investors vs. large structured investors. |

| 8 | Valuation Guidelines (Reg. 47 & Eighth Schedule) | All valuation norms consolidated in Master Circular; broad principles retained in MF Regulations. |

Overall, this proposal aims to lower investor costs, enhance transparency, and ensure that economies of scale achieved by mutual funds are passed on to investors.

Related News

About The Author

Next Story