Personal Finance News

Kotak Mutual Fund resumes lumpsum investments in small-cap funds citing stable market conditions – Full details inside

.png)

4 min read | Updated on July 03, 2024, 15:08 IST

SUMMARY

Citing reduced political uncertainty and favourable economic conditions, Kotak Mutual Fund has now reopened its small-cap fund. However, it is important to note that caution should not be ignored because these stocks are associated with high volatility.

Kotak Mutual Fund resumes lumpsum investments in small-cap funds citing stable market conditions – Full details inside

Kotak Mutual Fund has reopened its small-cap fund allowing new investments from, July 2, 2024. The fund was closed to new lumpsum investments in March 2024 due to the high valuations of small-cap stocks. This resumption comes as political uncertainties from India's recent elections have been resolved, leading to a more stable market environment.

Kotak Mutual Fund said that the reduced political uncertainty has lowered market volatility, making it a better time for small-cap stocks. They also highlighted the potential for earnings growth in small companies, which are expected to benefit from the expanding economy.

However, Kotak MF advised investors to keep their expectations realistic and not to over-invest based on recent strong performance. Where small-cap stocks have performed well, with the Nifty Small Cap 250 TRI index returning 68.75% over the past year, future returns might not be as high.

This move follows a broader trend where many fund houses, including SBI MF, Nippon MF, and Tata MF, restricted inflows into their small-cap funds due to high valuations. The Association of Mutual Funds in India (AMFI) had also recommended measures to protect investors in small and mid-cap schemes given the recent heavy inflows.

Kotak Small-Cap Fund Review

Kotak-Small Cap Fund (formerly Kotak-Mid-Cap-Growth) is an equity fund from Kotak Mahindra Mutual Fund, launched on February 24, 2005. It falls under the Equity: Small Cap category, benchmarked against the NIFTY Small-cap 250 TRI. With a total expense ratio (TER) of 1.65% as of May 31, 2024, this open-ended scheme requires a minimum investment and top-up of ₹100.

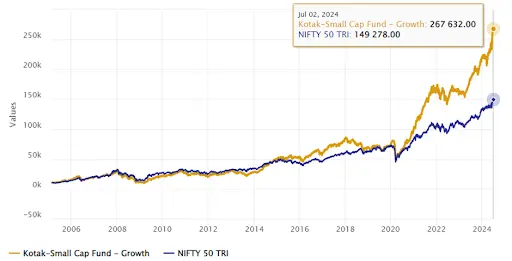

As of 31st May 2024, the fund manages assets worth ₹15,282.62 crore, has a turnover rate of 19.27%, and imposes an exit load of 1% for redemptions within 365 days on units exceeding 10% of the investment. The NAV on July 2, 2024, stood at ₹267.63. The fund has achieved a CAGR of 18.5% since inception, outperforming its benchmark, which has a CAGR of 17.37%.

If you had invested ₹10,000 at the start of this fund on February 24, 2005, your investment would have turned ₹2,62,632 on July 02, 2024.

Historical Returns

| Kotak-Small Cap Fund - Growth | Equity: Small Cap | NIFTY SMALLCAP 250 TRI | |

|---|---|---|---|

| CAGR since inception | 18.50% | 23.98% | 17.37% |

| 1 Year | 44.86% | 51.50% | 65.37% |

| 3 Year | 23.41% | 26.55% | 27.95% |

| 5 Year | 30.11% | 29.68% | 28.67% |

| 10 Year | 20.87% | 20.17% | 17.16% |

Fund Performance in Bear and Bull Phase

| Down Market Performance in the Last 5 Years | Up Market Performance in the Last 5 Years | ||

|---|---|---|---|

| Month | Kotak-Small Cap Fund | Month | Kotak-Small Cap Fund |

| Mar-20 | -30.63 | Nov-20 | 14.08 |

| May-22 | -5.96 | Feb-21 | 13.92 |

| Feb-20 | -4.97 | Jun-20 | 12.54 |

| Feb-22 | -4.8 | Apr-20 | 11.87 |

| Jun-22 | -4.18 | Aug-20 | 11.29 |

| May-20 | -3.37 | Jun-24 | 9.62 |

| Oct-23 | -3.21 | Jan-20 | 9.16 |

| Jan-22 | -2.25 | May-21 | 8.8 |

| Feb-24 | -1.8 | Nov-23 | 8.74 |

| Mar-23 | -1.63 | Sep-19 | 7.56 |

AUM Distribution

The allocation of the fund is heavily skewed towards small-cap stocks, which constitute 73.95% of the portfolio. Mid-cap stocks make up 14.31%, while large-cap stocks represent only 4.88%, and others account for 6.86%. The fund's top holdings include Cyient Ltd. at 3.6%, Carborundum Universal Ltd. at 3.52%, Techno Electric & Engineering Company Ltd. at 3.45%, and Blue Star Ltd. at 3.35%.

Risk Ratios

The Kotak Small Cap Fund has a standard deviation of 13, which indicates the level of volatility in its returns. It has a Sharpe ratio of 1.18, meaning it provides a good return for the amount of risk taken. The fund's alpha is 2.61, suggesting it has outperformed its benchmark by 2.61%. Additionally, the beta is 0.66, showing that the fund is less volatile than the market.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story