Personal Finance News

Axis Mutual Fund launches of Axis Nifty 500 Index Fund to Diversify and Grow with India's broader market coverage

.png)

5 min read | Updated on June 27, 2024, 10:12 IST

SUMMARY

Axis Nifty 500 Index Fund launched by Axis Mutual Fund (AMF) is an open-ended index fund designed to mirror the Nifty 500 TRI. The fund will start receiving subscriptions on June 26 and will continue until July 9, 2024, giving wide-ranging exposure to 500 companies representing more than 94% of the country's listed entities, having no entry charge and a minimum subscription is ₹100.

Axis Mutual Fund introduces Axis Nifty 500 Index Fund

Axis Mutual Fund's Axis Nifty 500 Index Fund is an open-ended index fund that aims to provide returns that closely match the total returns of the Nifty 500 TRI, subject to tracking errors. There is no assurance that the investment objective will be achieved. The new fund offer will be open for subscription from June 26th, 2024 to July 9th, 2024. There is no entry load, but an exit load of 0.25% applies if redeemed or switched out within 15 days from the date of allotment. The minimum subscription amount is ₹100.

Why invest in the Nifty 500?

Investing in the Nifty 500 index can be important due to its broader market coverage and diversification. The Nifty 500 includes the top 500 companies, providing exposure to over 94% of India's listed companies. This index offers a wider sector representation, including industries like capital goods, realty, textiles, media & entertainment, and consumer services, which are not present in the Nifty 50. This broader sector exposure can potentially reduce risk and increase growth opportunities.

Additionally, the Nifty 500 index covers large-cap, mid-cap, and small-cap segments, offering a balance between stability and growth. Large caps provide stability in volatile markets, while mid and small caps offer higher growth potential.

Historical data shows that the Nifty 500 has outperformed the Nifty 50 over long-term investment periods, making it a viable option for investors seeking diversified and potentially higher returns.

| Year | India's Rank | Nominal GDP (US$ bn) | Shares of Global GDP |

|---|---|---|---|

| 2014 | 10 | 2,039 | 2.60% |

| 2022 | 5 | 3,339 | 3.40% |

| 2027 E | 3 | 5,153 | 4.00% |

The potential rise in the GDP growth and its impact on per capita consumption may lead to strong earnings growth across the sectors. The NIFTY 500 consists of all major sectors in the economy with judicious representation in the portfolio as well.

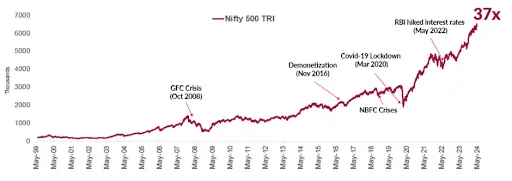

Journey of Nifty 500

Investing ₹1 lakh in May 1999 would have grown to ₹37.65 Lakh in Nifty 500 (15.66% CAGR)

Axis Nifty 500 Index Fund

The investment objective of the Axis Nifty 500 Index Fund is to provide returns before expenses that closely correspond to the total returns of the Nifty 500 TRI, subject to tracking errors. There is no assurance that the investment objective of the Scheme will be achieved.

Benchmark

The performance of the Bandhan Nifty Total Market Index Fund will be benchmarked to the performance of Nifty 500 TRI.

Risk-o-meter:

Funds Allocation

| Types of Instruments | Risk Profile | Minimum Allocation | Maximum Allocation |

|---|---|---|---|

| Securities covered by Nifty 500 Index | Very High | 95% | 100% |

| Debt & Money Market instruments | Low | 0% | 5% |

Who Should Invest?

This NFO of Axis Nifty 500 Index Fund is suitable for investors who are a long-term wealth creation solution and an index fund that seeks to track returns by investing in a basket of Nifty 500 TRI stocks and aims to achieve returns of the stated index, subject to tracking error.

Investing in the Nifty 500 Index Fund allows you to be part of this dynamic growth story. The Nifty 500 Index is the most inclusive benchmark in the Indian market, covering nearly 90% of the nation’s listed companies.

By investing in the Nifty 500, you are not just diversifying your portfolio; you are embracing the full spectrum of Bharat’s economic landscape.

Peer Mutual Fund Schemes

| Scheme Name | AUM (Crore) | Expense Ratio (%) | 1 Year Returns (%) | 3 Years Returns (%) | YTD Returns (%) | Since Launch Returns (%) |

|---|---|---|---|---|---|---|

| UTI Nifty 500 Value 50 Index Fund | 308.39 | 1.03 | 90.97 | - | 28.94 | 85.22 |

| Motilal Oswal Nifty 500 Index Fund | 1130.1 | 0.88 | 39.02 | 18.13 | 14.93 | 20.71 |

| HDFC BSE 500 Index Fund | 130.49 | 0.97 | 38.22 | - | 14.79 | 40.62 |

Who Manages the Scheme?

Karthik Kumar holds an M.B.A. degree, a C.F.A. from the USA, and a B.E. in Mechanical Engineering. His educational background combines technical and financial expertise. Karthik has accumulated 14 years of experience in the finance industry.

Sachin Relekar earned his Master of Management Studies from Mumbai University. With over two decades in the field, Sachin has developed extensive knowledge and skills in fund management. He brings 22 years of experience in the finance sector.

Conclusion

The Axis Nifty 500 Index Fund offers a diversified investment opportunity by covering the top 500 companies in India, providing exposure to various sectors and market caps. Managed by experienced professionals, this fund is suitable for investors looking for long-term growth and stability. Investing in the Nifty 500 allows participation in India's dynamic economic growth.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story