Personal Finance News

ABSL Mutual Fund launches Aditya Birla Sun Life Crisil-IBX AAA NBFC-HFC INDEX-Sep 2026 Fund; Key details and insights

.png)

3 min read | Updated on October 01, 2024, 18:00 IST

SUMMARY

Aditya Birla Sun Life Crisil-IBX AAA NBFC-HFC Index-Sep 2026 Fund is a new open-ended Target Maturity Index Fund launched on September 30, 2024, and closing on October 7, 2024. It aims to track the CRISIL-IBX AAA NBFC-HFC Index, with no exit load and a focus on stability and moderate interest risk.

ABSL Mutual Fund launches Aditya Birla Sun Life Crisil-IBX AAA NBFC-HFC INDEX-Sep 2026 Fund; Key details and insights

Aditya Birla Sun Life Crisil-IBX AAA NBFC-HFC INDEX-Sep 2026 Fund is a new open-ended Target Maturity Index Fund offered by Aditya Birla Sun Life Mutual Fund. Launched on September 30, 2024, and closing on October 7, 2024, the fund aims to track the performance of CRISIL-IBX AAA NBFC-HFC Index – Sep 2026. The Fund does not have any exit load structure and one can invest a minimum of ₹1000 in the fund.

Aditya Birla Sun Life Crisil-IBX AAA NBFC-HFC INDEX-Sep 2026 Fund

The investment objective of the Aditya Birla Sun Life Crisil-IBX AAA NBFC-HFC INDEX-Sep 2026 is to generate returns corresponding to the total returns of the securities as represented by the CRISIL-IBX AAA NBFC-HFC Index – Sep 2026 before expenses, subject to tracking errors.

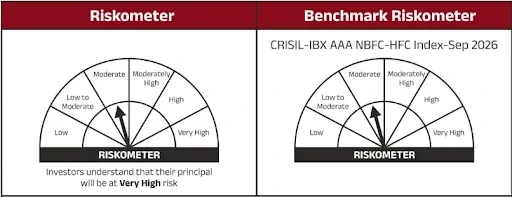

Risk-o-meter:

Potential Risk Class: A-III where,

Credit Risk → Relatively Low (Class A) and Interest Rate Risk → Moderate (Class II)

Funds Allocation

| Types of Instruments | Minimum Allocation (% of Total Assets) | Maximum Allocation (% of Total Assets) |

|---|---|---|

| Instruments forming part of the CRISIL-IBX AAA NBFC-HFC Index – Sep 2026 | 95 | 100 |

| Debt and Money Market Instruments (including Cash and Cash Equivalent) | 0 | 5 |

Who should invest in this fund?

This NFO of Aditya Birla Sun Life Crisil-IBX AAA NBFC-HFC INDEX-Sep 2026 is suitable for investors who prefer a defined investment horizon. Also, for those who are comfortable with some level of risk but prefer stability, the fund aims to generate a return by tracking the CRISIL-IBX AAA NBFC-HFC Index – Sep 2026.

Benchmark

The performance of the Aditya Birla Sun Life Crisil-IBX AAA NBFC-HFC INDEX-Sep 2026 will be benchmarked to the performance of the CRISIL-IBX AAA NBFC-HFC Index – Sep 2026.

Who Manages the Scheme?

Harshil Suvarnkar has an overall experience of 14 years in the financial services industry. Prior to joining ABSLAMC, he was associated with Indiabulls Housing Finance Limited for 10 years as Head - Markets, Treasury handling treasury investments, Asset Liability Management (ALM) and capital market borrowing.

Vighnesh Gupta has over 6 years of experience in the Financial markets. He has been associated with ABSLAMC as a Research Analyst since August 2020. Prior to joining ABSLAMC, he has worked with different companies of Aditya Birla Group. He was also associated with Ernst & Young as Executive - Assurance.

Conclusion

The Aditya Birla Sun Life Crisil-IBX AAA NBFC-HFC INDEX-Sep 2026 Fund offers a return from the instruments forming part of CRISIL-IBX AAA NBFC-HFC Index – Sep 2026. It’s suitable for investors who prefer a defined investment horizon but are suitable for some level of risk and prefer stability.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story