Personal Finance News

ABSL Mutual Fund launches Aditya Birla Sun Life Crisil 10-Year Gilt ETF; key details and insights

.png)

4 min read | Updated on August 07, 2024, 16:42 IST

SUMMARY

Aditya Birla Sun Life Crisil 10-Year Gilt ETF is a new open-ended ETF aiming to track the CRISIL 10-Year Gilt Index. Open from August 7 to August 12, 2024, it requires a minimum investment of ₹1000 and focuses on government securities with low credit risk but higher interest rate risk.

The performance of the Aditya Birla Sun Life Crisil 10-Year Gilt ETF will be benchmarked to the performance of the CRISIL 10-Year Gilt Index.

Aditya Birla Sun Life Crisil 10-Year Gilt ETF is a new open-ended exchange-traded fund (ETF) offered by Aditya Birla Sun Life Mutual Fund. Launched on August 7, 2024, and closing on August 12, 2024, the fund aims to replicate the performance of the CRISIL 10-Year Gilt Index. As an Other Scheme - Other ETFs category fund, it requires a minimum investment of ₹1000.

What are G secs and why invest in them?

- G-secs are securities issued by the RBI on behalf of the Government of India. They serve as an acknowledgement of money borrowed by the Government, with coupon payments and repayment guaranteed by the central government, giving them a sovereign rating.

- Being sovereign-rated debt instruments, G-secs carry negligible credit risk.

- Increased global demand coupled with a decreased supply of G-secs can create a demand-supply imbalance. This situation presents an opportunity for capital gains from G-sec investments.

Aditya Birla Sun Life Crisil 10 Year Gilt ETF

The investment objective of the Aditya Birla Sun Life Crisil 10-Year Gilt ETF is to generate returns corresponding to the total returns of the securities as represented by the CRISIL 10-year Gilt Index before expenses, subject to tracking errors.

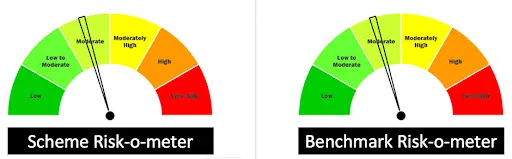

Risk-o-meter:

Potential Risk Class: A-III where, Credit Risk → Relatively Low (Class A) and Interest Rate Risk → Relatively High (Class III)

Funds Allocation

| Types of Instruments | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) |

|---|---|---|

| Government Securities | 95 | 100 |

| T-Bills, cash and cash equivalent | 0 | 5 |

Who should invest in this fund?

This NFO of Aditya Birla Sun Life Crisil 10-Year Gilt ETF is suitable for investors who are seeking Income through exposure to gilt securities over the long term and an open-ended debt ETF that seeks to track CRISIL 10-Year Gilt Index.

Benchmark

The performance of the Aditya Birla Sun Life Crisil 10-Year Gilt ETF will be benchmarked to the performance of the CRISIL 10-Year Gilt Index.

Peer Fund Schemes

| Scheme Name | AUM (Crore) | Expense Ratio (%) | 1 Year Returns (%) | 3 Years Returns (%) | 5 Years Returns (%) | Since Launch Return (%) |

|---|---|---|---|---|---|---|

| Nippon India ETF Nifty 8-13 Year G-Sec Long-Term Gilt | 1809.85 | 0 | 8.91 | 5.48 | 5.52 | 6.83 |

| Mirae Asset Nifty 8-13 year G-sec ETF | 83.17 | 0.1 | 8.91 | - | - | 8.95 |

| LIC MF Nifty 8-13 year G-Sec ETF | 2031.78 | 0.16 | 8.87 | 5.51 | 5.49 | 7.09 |

| SBI Nifty 10 year Benchmark G-Sec ETF | 2956.16 | 0.14 | 8.84 | 4.99 | 4.71 | 6.09 |

| ICICI Prudential Nifty 10 year Benchmark G-sec ETF | 542.99 | 0.14 | 8.8 | - | - | 8.01 |

Who Manages the Scheme?

Bhupesh Bameta has over 16 years of experience in the financial services industry. He joined ABSLAMC in December 2017 as an Analyst, at Fixed Income. He has been working closely with other fund managers and investment team members. Before joining ABSLAMC, he was the Head of Research in the Forex and Rates Desk at Edelweiss Securities Limited, covering global and Indian forex markets and economies. He was also associated with Quant Capital for 6 years as an Economist, covering the Indian and global economy and markets.

Conclusion

The Aditya Birla Sun Life Crisil 10-Year Gilt ETF offers a secure investment in government securities with potential for capital gains. It’s suitable for long-term investors seeking exposure to gilt securities.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story