Personal Finance News

Aditya Birla Sun Life Mutual Fund Launches ABSL Crisil IBX Gilt June 2027 Index Fund; details inside!

.png)

3 min read | Updated on May 23, 2024, 20:23 IST

SUMMARY

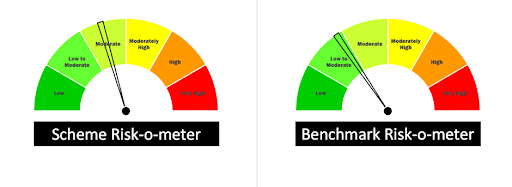

Aditya Birla Sun Life Mutual Fund offers investors the opportunity to invest in the new Crisil IBX Gilt June 2027 Index Fund, an open-ended target maturity fund. Its main aim is to invest mainly in government securities that mature in June 2027. It is a low-cost, passive investment with low credit risk, which has only moderate interest rate risk.

ABSL launches ABSL Crisil IBX Gilt June 2027 Index Fund

Aditya Birla Sun Life Mutual Fund has launched a new open-ended target maturity index fund named Aditya Birla Sun Life Crisil IBX Gilt June 2027 Index Fund. The fund aims to mirror the returns of the CRISIL IBX Gilt Index - June 2027, with investment open until June 4, 2024. There is no minimum investment required for the direct plan, but a minimum of ₹1,000 for the regular plan. This scheme offers investors a chance to invest in government securities maturing in June 2027.

The scheme has a target maturity approach, investing 98% in G-secs & 2% in T-bills. Only fixed coupons bearing plain vanilla G-Sec will be eligible for the index. The eligible period of inclusion is securities maturing between January 1, 2027, to June 30, 2027.

The feature of this scheme is that it is a low-cost passive investing strategy, with target maturity that focuses on sovereign G-secs; to lock in current high yields with an additional potential to earn capital gains over a long duration.

Aditya Birla Sun Life Crisil IBX Gilt June 2027 Index Fund

The investment objective of the Aditya Birla Sun Life Crisil IBX Gilt June 2027 Index Fund is to generate returns corresponding to the total returns of the securities as represented by the CRISIL IBX Gilt Index – June 2027 before expenses, subject to tracking errors

Benchmark

The performance of the Aditya Birla Sun Life CRISIL IBX Gilt June 2027 Index Fund is benchmarked against the CRISIL IBX Gilt Index – June 2027. The constituents of the index are

| Asset Class | Issuer | Weightage |

|---|---|---|

| Gilt | 07.38% CGL 2027 | 68.07% |

| 06.79% CGL 2027 | 15.72% | |

| 07.38% CGL 2027 | 14.22% | |

| T-Bills | TB-23/05/24-91D | 0.67% |

| TB-09/05/24-91D | 0.67% | |

| TB-16/05/24-91D | 0.67% |

Funds Allocation

| Types of Instruments | Risk Profile | Minimum Allocation | Maximum Allocation |

|---|---|---|---|

| Instruments forming part of the CRISIL IBX Gilt Index – June 2027 | Moderate | 95% | 100% |

| Debt/Money Market, cash and cash equivalent | Low | 0% | 5% |

What are G secs and why invest in them?

The RBI issues G-secs on behalf of the Government of India as debt instruments for borrowed money. Thus, they are backed by the central government and have a sovereign rating. G-secs have very low credit risks due to being sovereign debt instruments secured by the central Government of India’s guarantee. G-secs tend to be highly liquid because there is strong trading and high demand.

Who Manages the Scheme?

Bhupesh Bameta is a 44-year-old, considerably skilled individual who holds a B.Tech degree in Computer Engineering and a CFA Charter from the CFA Institute based in the United States. His career as a financial services industry specialist spans a time of sixteen years providing him with immense knowledge in real-time data trading. Bameta started working at Aditya Birla Sun Life AMC (ABSLAMC) last December is a recent event in his life because he only joined as an analyst focusing on fixed income but later moved to other roles within the investment team where he worked closely with others.

The Aditya Birla Sun Life Crisil IBX Gilt June 2027 Index Fund presents an attractive opportunity for investors to lock in current high yields with low credit risk, aiming to mirror the performance of the CRISIL IBX Gilt Index – June 2027

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story