Personal Finance News

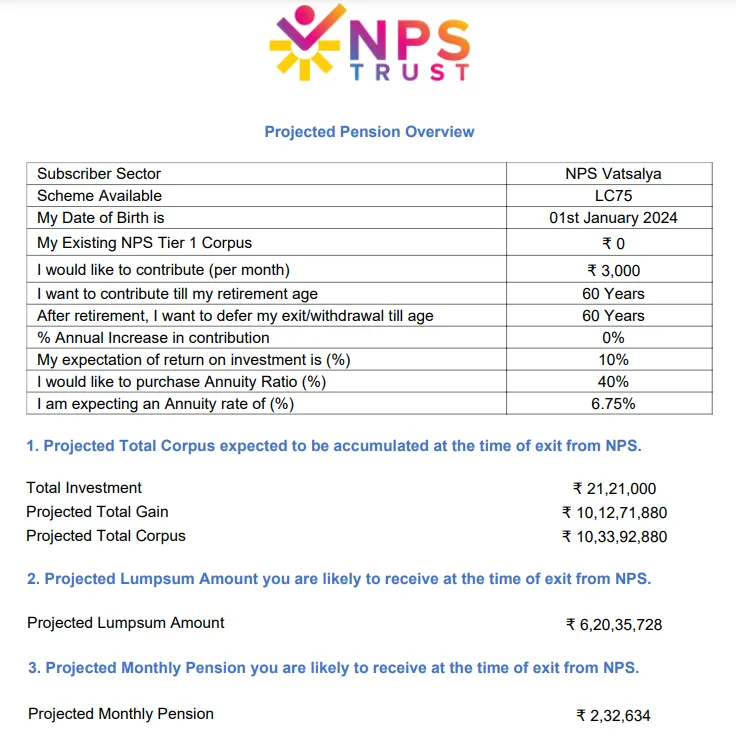

NPS Vatsalya calculator: Saving ₹100/day from age 1 may give ₹6 crore lump sum, ₹2.3 lakh pension

.png)

3 min read | Updated on February 28, 2025, 09:02 IST

SUMMARY

The final returns from investments under NPS Vatsalya will depend on multiple factors such as the performance of the various assets in which the scheme will invest, the total amount, and the duration of the investment. However, Parents can get a rough estimate of final returns using the NPS Vatsalya calculator available on the NPS Trust website.

LC75 is one of the many investment choices available under the NPS Vatsalya scheme. | Representational image source: Shutterstock

The National Pension System (NPS) Vatsalya is a government-backed pension scheme designed exclusively for minors. It allows parents to open an NPS account for their children aged below 18 years with an annual contribution of just ₹1000.

By opening an NPS Vatsalya account, parents can give their children the advantage of early investment while also imparting essential money management skills during the investment journey.

The scheme aims to generate long-term returns by investing in a mix of equity and debt assets.

Since the scheme's launch in September 2024, several parents have been curious about how much money their children can accumulate by starting investments at an early age, such as from age 1.

Well, the final returns from investments under NPS Vatsalya will depend on multiple factors such as the performance of the various assets in which the scheme will invest, the total amount, and the duration of the investment.

To give you an idea, we ran the calculator with the following assumptions:

- Monthly investment: ₹3000 (by saving ₹100 daily)

- Starting age: 1

- Contribution till age 60

- Expected return: 10%

- Expected annuity rate: 6.75%

- Annuity purchase ratio: 40%

- Investment choice: LC75 (75% equity and 25% debt)

The calculator shows that even a small daily saving of ₹100 from a child's age of 1 can help accumulate a lump sum of over ₹6.2 crore and a monthly pension of ₹2.3 lakh (see below).

If we assume a higher return of 11%, the projected lump sum withdrawal would be ₹9.6 crore, and the monthly pension would grow to ₹3.6 lakh.

However, if we assume a moderate return of 8% during the investment period, the lump sum grows to ₹2.5 crore, and the monthly pension to ₹97,000.

Please note that a high return of 10-11% over a very long term may not be possible. However, investors can make up for it by increasing their contribution by a small amount every year. For example, increasing the annual contribution in the above scenario by just 1% at an assumed annualised return of 8% could lead to a lump sum withdrawal of ₹9.8 crore and a monthly pension of ₹3.7 lakh.

Investment choices

LC75 is one of the many investment choices available under the NPS Vatsalya scheme, which allocates 75% of an investor's money to equity and 25% to debt securities.

Other investment choices under NPS Vatsalya are LC50 (50% equity, 50% debt); LC25 (25% equity, 75% debt) and active choice, which all you to actively decide allocation of funds across equity (up to 75%), corporate debt (up to 100%), government securities (up to 100%) and alternate asset (5%).

Related News

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story