Personal Finance News

Navigating volatility: A case for quality in equity investments

SUMMARY

During volatile times, quality as a factor tends to perform better than other factors such as value, momentum, alpha and even the broader markets. Since 2010, there have been six broad bear phases, when the quality index (Nifty 200 Quality 30 TRI) performed better than all the mentioned factors and the broader index (Nifty 200).

During volatile times, quality as a factor tends to perform better than other factors. | Representational image source: Shutterstock

Today, in the stock market everyone—be it a fund manager or an investor—wants to buy that car which is expected to be sturdy (fundamentals being strong), fuel efficient (at a reasonable valuation) and comfortable (for the journey to be smooth), barring a few bumpy roads in between.

What this means is buying quality, be it a car or a company, which should be able to withstand any weather, which has been pretty rough in recent times.

Let us just rewind a bit to remind ourselves what the financial markets have seen in the last couple of years. An increasing interest-rate regime, the highest rate of inflation in the US in the last 40 years, the Russia-Ukraine war, the Israel-Gaza conflict, India-Pakistan tensions, Iran-Israel war, crude oil crossing $110 per barrel and then falling below $60 per barrel, global tech sector layoffs, Trump tariffs, outrageous market valuations, cooling inflationary scenario with interest rate cuts, yen carry trade, de-dollarisation to dollar supremacy, etc.

Frankly speaking, it is an uphill task to manage portfolios when the domestic and global scenario is going through so much uncertainty.

And this is exactly where the need for a quality fund manager, a quality stock portfolio and an investor who chooses quality over other themes arises.

What is quality in equity markets? To quote Mr. Warren Buffett: “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” In today’s equity market, quality is determined based on fundamentals and valuation. When any one of them is missing, we see a drawdown in the equity markets.

After the peaks of September 2024, it has been evident that not every stock will keep rising unless it has strong reported earnings, guidance and valuations. In the last 6-7 months, we have seen companies with a PE of 70 or 80, but reporting 10% earnings growth and missing estimates. Further, multiple critical events have taken place, including the Trump tariffs, the Russia-Ukraine escalation, the India-Pakistan conflict and the Iran-Israel war. In such scenarios, equity markets can witness steep corrections, as has been seen in the past.

The active mutual fund approach has always been a bottom-up stock selection that fits certain key parameters, such as healthy ROE, ROCE, free cash flows, low-to-zero debt levels, steady earnings growth, improving margins, increasing market share, but all of it at a reasonable valuation.

During volatile times, quality as a factor tends to perform better than other factors such as value, momentum, alpha and even the broader markets. Since 2010, there have been six broad bear phases, when the quality index (Nifty 200 Quality 30 TRI) performed better than all the mentioned factors and the broader index (Nifty 200). Now this is a quality index that is rule based and not actively managed by a fund manager. However, as mentioned before, a quality fund manager who can build a quality stock portfolio at a reasonable price should be able to perform reasonably better not just in a drawdown phase, but overall too.

Let's look at another data point that proves why quality is better, especially in the current market situation.

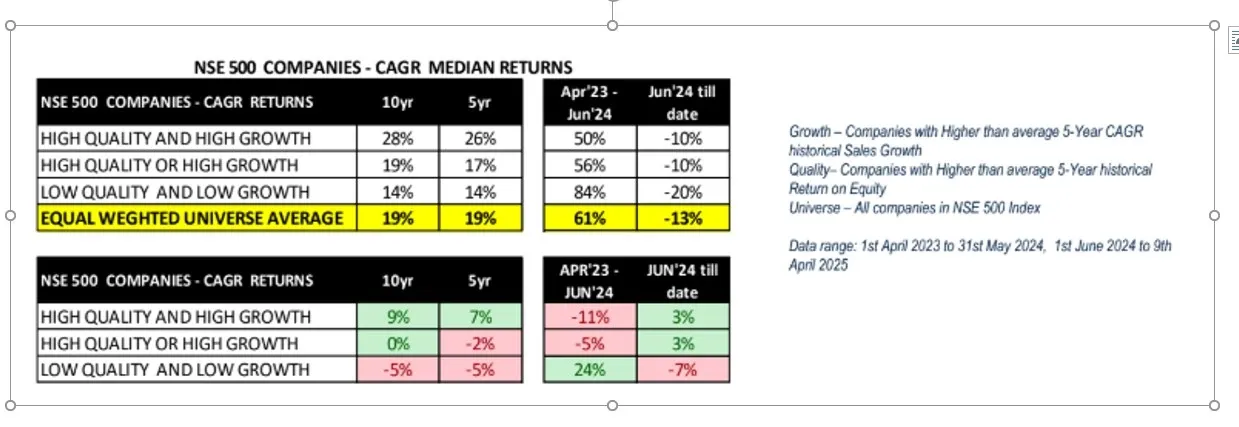

Historically, over a 10-year and 5-year period, the median returns of high-growth and good-quality companies have been far superior to those of weaker quality and slow-growth companies.

Within NSE 500 companies, in the 14-months till May 31, 2025, weaker quality and slow-growth companies have delivered significantly higher returns than ones with good quality and high growth.

However, this is changing. Since June 2024, the market has once again started rewarding high-growth and high-quality companies.

In conclusion, at this point in time, we continue to be in an uncertain market, with several economic and geopolitical tensions. To safeguard our portfolio from bigger drawdowns, which could come anytime in the broader markets, it is important to hedge it by building a quality-driven portfolio.

Related News

About The Authors

Next Story