Personal Finance News

How to get your old unpaid dividends back at an IEPFA centre

.png)

3 min read | Updated on August 21, 2025, 12:07 IST

SUMMARY

When a company's dividends remain unclaimed for seven consecutive years, they are transferred to the Investor Education and Protection Fund (IEPF). Similarly, any shares for which dividends have gone unclaimed for seven years are also transferred to the IEPF

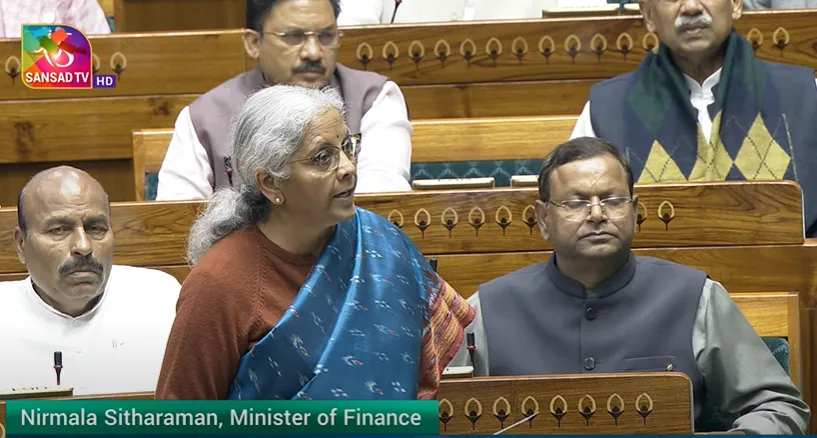

When a company's dividends remain unclaimed for seven consecutive years, they are transferred to the Investor Education and Protection Fund (IEPF). | Image: Shutterstock

The Investor Education and Protection Fund Authority (IEPFA) is a government body under the Ministry of Corporate Affairs in India. Its primary role is to manage and administer the Investor Protection Fund. This includes making refunds of shares, unclaimed dividends, matured deposits/debentures etc. to investors. IEPFA, in collaboration with SEBI, CDSL, NSDL, BSE and NSE, has successfully opened three Niveshak Seva Kendras in Hyderabad, which started operations on 16th August 2025. These kendras have been set up to provide faster, easier and more accessible solutions to investors, particularly in matters related to unclaimed dividends and KYC/nomination updates.

⦁ Direct facilitation of unpaid dividend transfers. (pending for 6–7 years) ⦁ Hassle-free updates of KYC and nomination details. ⦁ For Physical Folios: Submit ISR-1/ ISR-2/ISR-3 forms to update KYC. Once updated, all pending dividends will be credited. ⦁ For Demat Accounts: Update bank details with your Depository Participant (DP) to receive unpaid dividends.

Similarly, any shares for which dividends have gone unclaimed for seven years are also transferred to the IEPF. To get your old, unpaid dividends (and associated shares) back, you must follow a structured process involving both the company and the IEPF Authority.

Before you can file a claim with the IEPF Authority, first get an "Entitlement Letter" from the company or its Registrar and Transfer Agent (RTA). This letter confirms your unclaimed dividends and shares that were transferred to the IEPF. You can find the company's Nodal Officer details on their website to request this letter.

-

The claim process is initiated by filing an online application in Form IEPF-5.

-

Go to the official IEPF website at www.iepf.gov.in.

-

Under the "Services" section find the link for "IEPF-5."

-

You will be redirected to the Ministry of Corporate Affairs (MCA) portal.

-

Log in with your MCA credentials.

-

In case you don't have an account, you will need to register as a new user.

-

Fill in all the required details, including your personal information, the company's Corporate Identification Number (CIN), details of the shares and dividends you are claiming, and your bank and Demat account information.

-

After successfully filling and uploading the form, an online acknowledgement with a Service Request Number (SRN) will be generated.

-

After the online submission, you must send a set of physical documents to the company's Nodal Officer. This step is for the company to verify your claim.

Upon receiving the physical documents, the company's Nodal Officer will verify your claim. They will then submit an online verification report to the IEPF Authority, confirming that your claim is legitimate.

You can visit an IEPFA Help Centre (available in some cities) for:

-

In-person support

-

Form filling guidance

-

Submitting physical forms (some centres forward them to the company)

Related News

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story