Personal Finance News

Is the gold bull run 2025 over or expected to continue? 7 key FAQs answered for investors

4 min read | Updated on October 09, 2025, 10:04 IST

SUMMARY

Gold bull run 2025: There are no red flags in the gold price rally, as per a report by DSP Mutual Fund. However, the current gold price has exceeded the DSP MF's theoretical price framework and approached the fair-value zone, leaving investors with no margin of safety.

The current bull run will be over only when the gold price peaks. | Image source: Shutterstock

While no one can predict what the future holds for the yellow metal, data-based insights from the past and prudent asset allocation may help investors in making the best decisions aligned with their financial goals, even during this gold bull run.

In the latest edition of its Netra report, DSP Mutual Fund has compiled valuable insights that could be very useful for investors. We break down some of the key takeaways from the report in this article:

1. Is the bull run over?

The current bull run will be over only when the gold price peaks. The report is not sure about whether gold price has already peaked or if there is still some room for further increase.

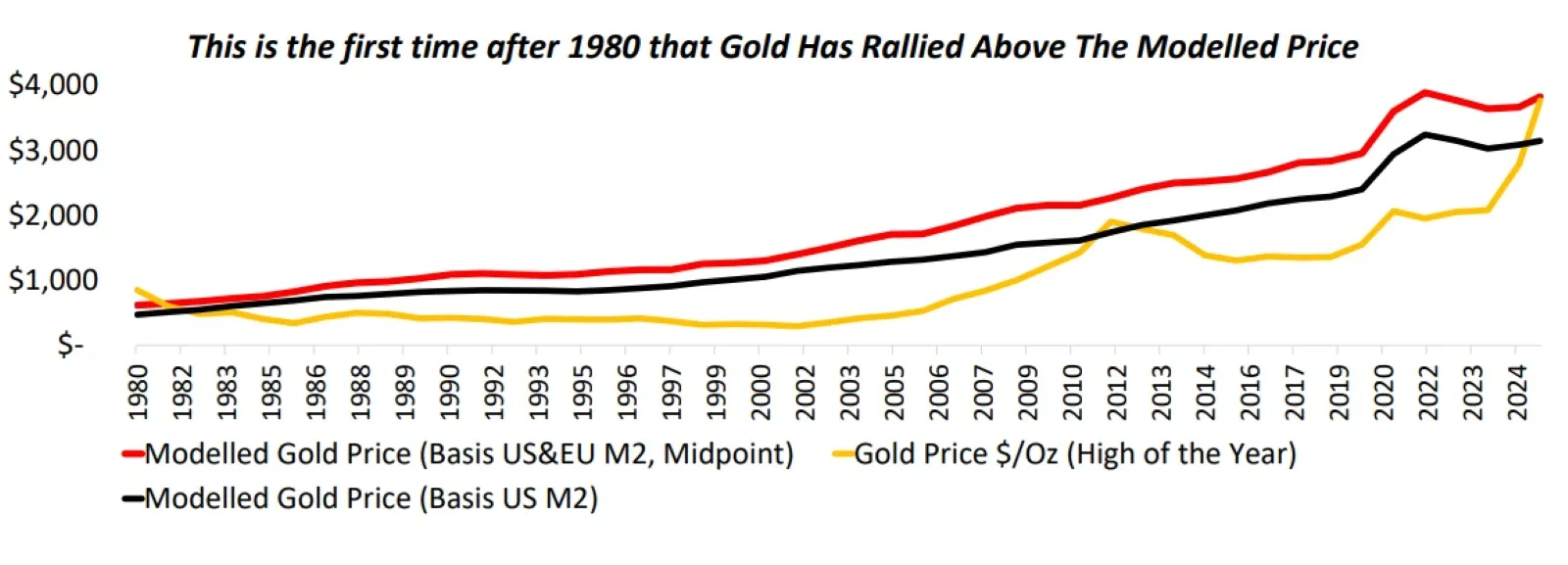

However, investors may note that gold as a store of value is now close to its fair price and the margin of safety is no longer present.

"We don’t know whether gold has peaked. Both the theoretical price framework and price momentum (3-year price CAGR) suggest the margin of safety is no longer present," the report said.

"Difference between US CPI 10yr CAGR and Gold Prices 10yr CAGR that peaked at 6.9% in 2012 is now at 9.5%. Another signal that Gold as a store of value is close to fair price," it added.

2. Has gold witnessed steep drawdowns in past?

Yes. The yellow metal witnessed up to 26% fall from its peak during the 2000-2011 bull market.

The report said, "During the 2000–2011 bull market, gold suffered a sharp 26% drawdown from its peak during the Global Financial Crisis (GFC)."

3. What happened after the sharp fall?

After the 26% drawdown due to the Global Financial Crisis, gold resumed the uptrend afterwards. However, the global sell-off during the financial crisis triggered forced selling in gold, especially by investors who were nursing losses elsewhere.

"The 'sell what you can' dynamic drove the GFC crack in gold prices," the report said.

4. Are there any red flags in gold bull run now?

The report says currently, there are no red flags. However, the current gold price has exceeded the DSP Mutual Fund's theoretical price framework and "approached the fair-value zone."

Source: DSP Mutual fund

5. What should investors do?

The yellow metal price may have more room for growth. However, the report says investors may think about their gold allocation as below:

- Do nothing and hold on

Why? The report said that in past cycles, gold prices went up to 40% above the theoretical price frameworks but left investors "dependent on market sentiment and with no margin of safety"

- Reduce gradually

Why? The report suggests that it is time to turn conservative. "Trim about 5% per week to cut at least half (or more) of the overweight position i.e., sell into strength between $3860 to $4000. This is the time to turn conservative."

"The gold bull market seems far from over, but it may pause for an extended period, and meaningful pullbacks could offer chances to add," it added.

6. Are steep drawdowns possible now?

Yes, it's possible according to the report. "This is not a call on the end of the bull market, it may well continue, but steep drawdowns are possible."

7. How can investors benefit from sharp corrections?

Yes. "Investors can still benefit from those drawdowns if they stick to prudent asset allocation."

Prudent asset allocation requires investors to spread their investments across multiple asset classes in ratios best suited for their financial goals.

Related News

About The Author

Next Story