Market News

Nokia, Nvidia, Apple, Microsoft: Tech shares buzzed in US trade on Tuesday; here is everything you need to know

.png)

3 min read | Updated on October 29, 2025, 07:46 IST

SUMMARY

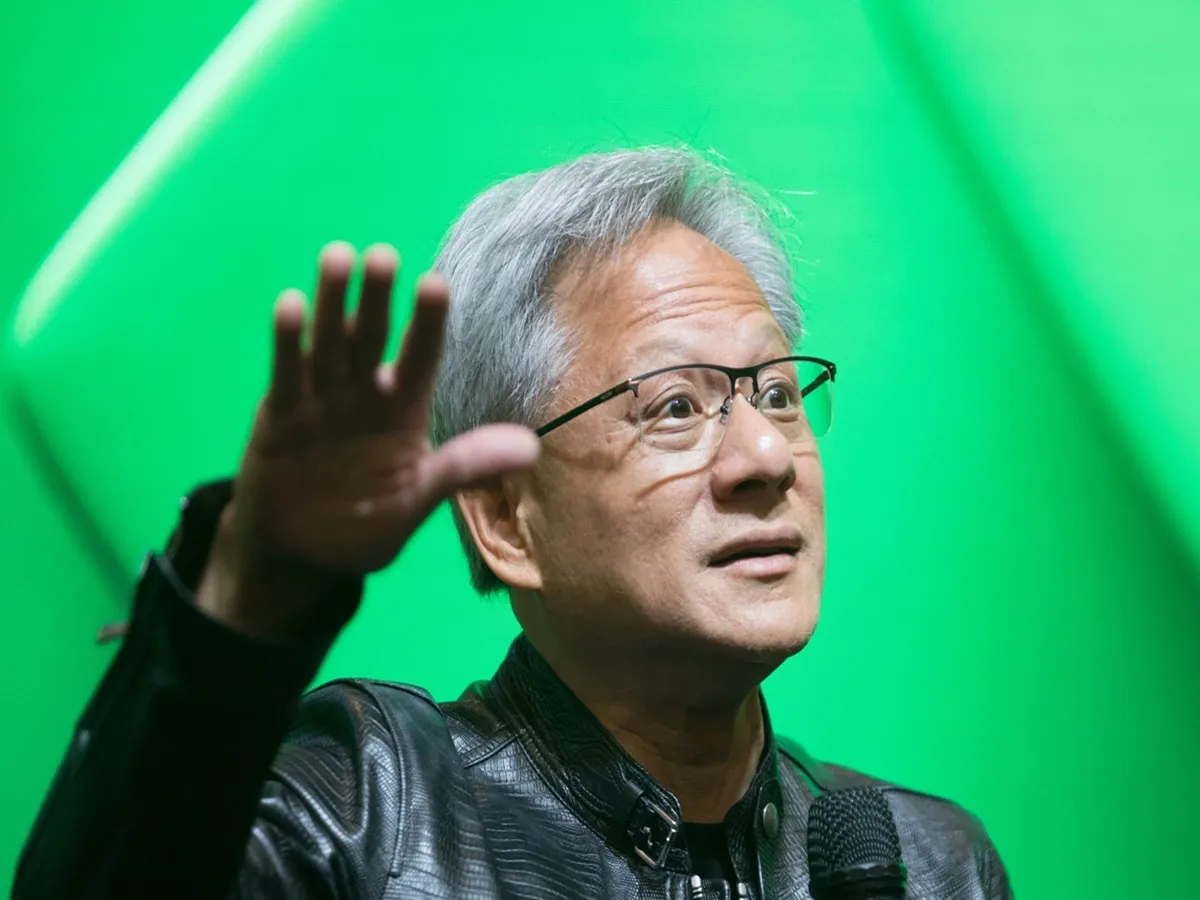

Nvidia, Nokia shares: The US market rally on Tuesday was led by AI giant Nvidia, which made a flurry of announcements Tuesday at its GTC conference, including its partnership with Finnish company Nokia. Nvidia plans to invest $1 billion in Nokia, stating it will use the proceeds to partially fund its AI plans.

The clampdown poses a major setback for Nvidia at a time when CEO Jensen Huang is seeking to salvage its China business.

The S&P 500 rose 0.23% to settle at 6,890.89. It had surpassed the 6,900 level for the first time on an intraday basis earlier in the day. The Nasdaq Composite advanced 0.80% to finish at 23,827.49, while the Dow Jones Industrial Average gained 161.78 points, or 0.34%, to settle at 47,706.37.

The market rally was led by AI giant Nvidia, which made a flurry of announcements Tuesday at its GTC conference, including its partnership with Finnish company Nokia. Nvidia plans to invest $1 billion in Nokia, stating it will use the proceeds to partially fund its AI plans.

The two companies have agreed on a strategic partnership to jointly develop next-generation 6G technology. They will collaborate on AI networking solutions and explore opportunities to integrate Nokia’s data centre switching and optical technologies into Nvidia’s future AI infrastructure, said a report by AnewZ.

Following the announcement, Nokia’s shares rose by as much as 26%. The stock eventually ended 20% higher.

Microsoft shares ended around 2% higher. The tech behemoth is slated to release its earnings after the bell on Wednesday. The stock, along with Apple, crossed $4 trillion in value during Tuesday’s session. On Tuesday, OpenAI announced it has completed its recapitalisation, a move that sets up Microsoft for a windfall, with it holding roughly 27% of the for-profit arm, OpenAI Group PBC.

As part of the arrangement, OpenAI and Microsoft announced changes to their partnership that leave the tech giant with a 27% stake in the ChatGPT maker.

The deal changes the relationship between the two companies. They first partnered in 2019, when OpenAI was a non-profit artificial intelligence (AI) research organisation.

Under the terms, Microsoft can now pursue artificial general intelligence – sometimes defined as AI that surpasses human intelligence – on its own or with other parties, the companies said.

Apple shares are continuing a sharp rebound, buoyed by strong iPhone 17 sales – including in China, a key market where the company has previously underperformed.

Related News

About The Author

Next Story