Market News

Will NIFTY break its all-time high this week? Key market triggers to watch

.png)

5 min read | Updated on November 23, 2025, 13:29 IST

SUMMARY

Indian markets may see bouts of volatility as global cues turn weak, even as domestic flows keep indices stable near record highs. NIFTY remains in a bullish structure above key EMAs, with 26,250 as resistance and 25,700 as crucial support. With major U.S. inflation data and India’s GDP release on Friday, markets are set for a data-driven week that could shape short-term sentiment.

Foreign investors continued to maintain a bearish bias in index futures through the past week. | Image: Shutterstock

Indian markets opened the week cautiously, with volatility increasing as global risk sentiment weakened and the rupee fell to a new record low. However, benchmark indices still managed to extend their winning streak into a second consecutive week. Despite some profit-taking and weak signals from global markets, steady domestic flows and pockets of sectoral strength helped benchmark indices remain stable near record highs.

NIFTY50 closed just above the 26,000 mark, registering a weekly gain of around 0.6%, and the SENSEX ended the week at 85,231, up 0.8%. Large-cap indices continued to drive the strength, even as the broader markets showed signs of fatigue. Mid- and small-cap indices underperformed amid valuation concerns.

Within the broader universe, performance remained highly sector- and stock-specific. IT (+1.6%) and Automobiles(+1.0%) outperformed the headline indices. Banks held their ground while sectors such as Real-Estate (-3.7%) and Metals (-3.3%) saw bouts of selling pressure.

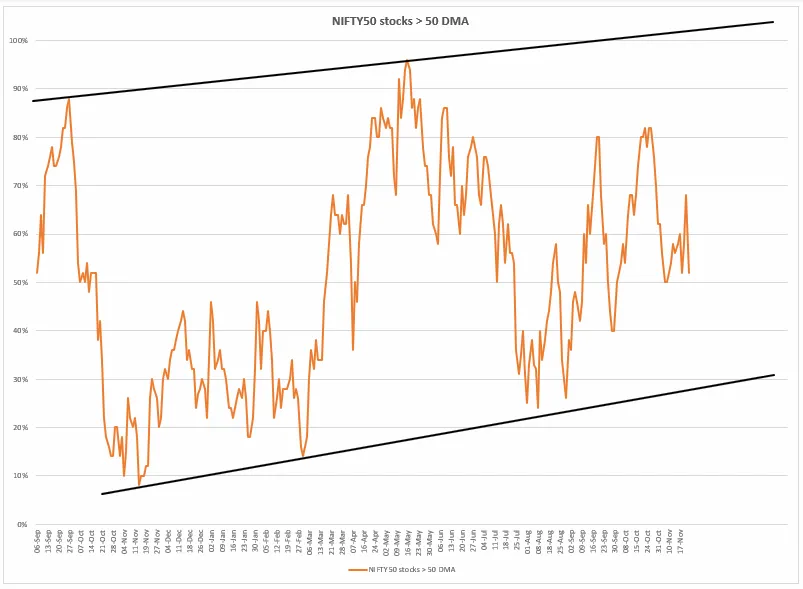

Index breadth

Market breadth for NIFTY50 has cooled off slightly over the past week, with the proportion of stocks trading above their 50-day moving average falling from around 70% to nearly 52%. This pullback follows a strong rebound in mid-November, when breadth briefly approached the upper end of its year-long rising channel. Despite the dip, the broader trend remains positive. In summary, while momentum has softened in the last few sessions, the NIFTY50 still retains a broad base of participants, and the current decline appears to be a healthy correction unless the percentage falls below 50%, which historically signals deeper corrections.

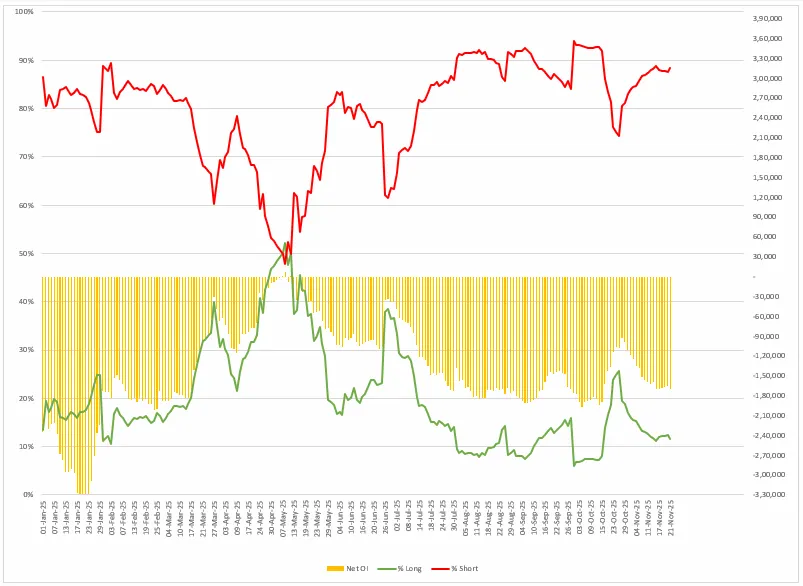

FIIs positioning in the index

Foreign investors continued to maintain a bearish bias in index futures through the past week, with the percentage of short positions staying elevated and inching closer to 90% compared to the previous week. The green line (% long) has slipped further, hovering closer to the lower end of its multi-month range, indicating limited conviction on the long side. Meanwhile, the red line (% short) remains dominant, signalling that FIIs are still positioned defensively despite the recent recovery in NIFTY.

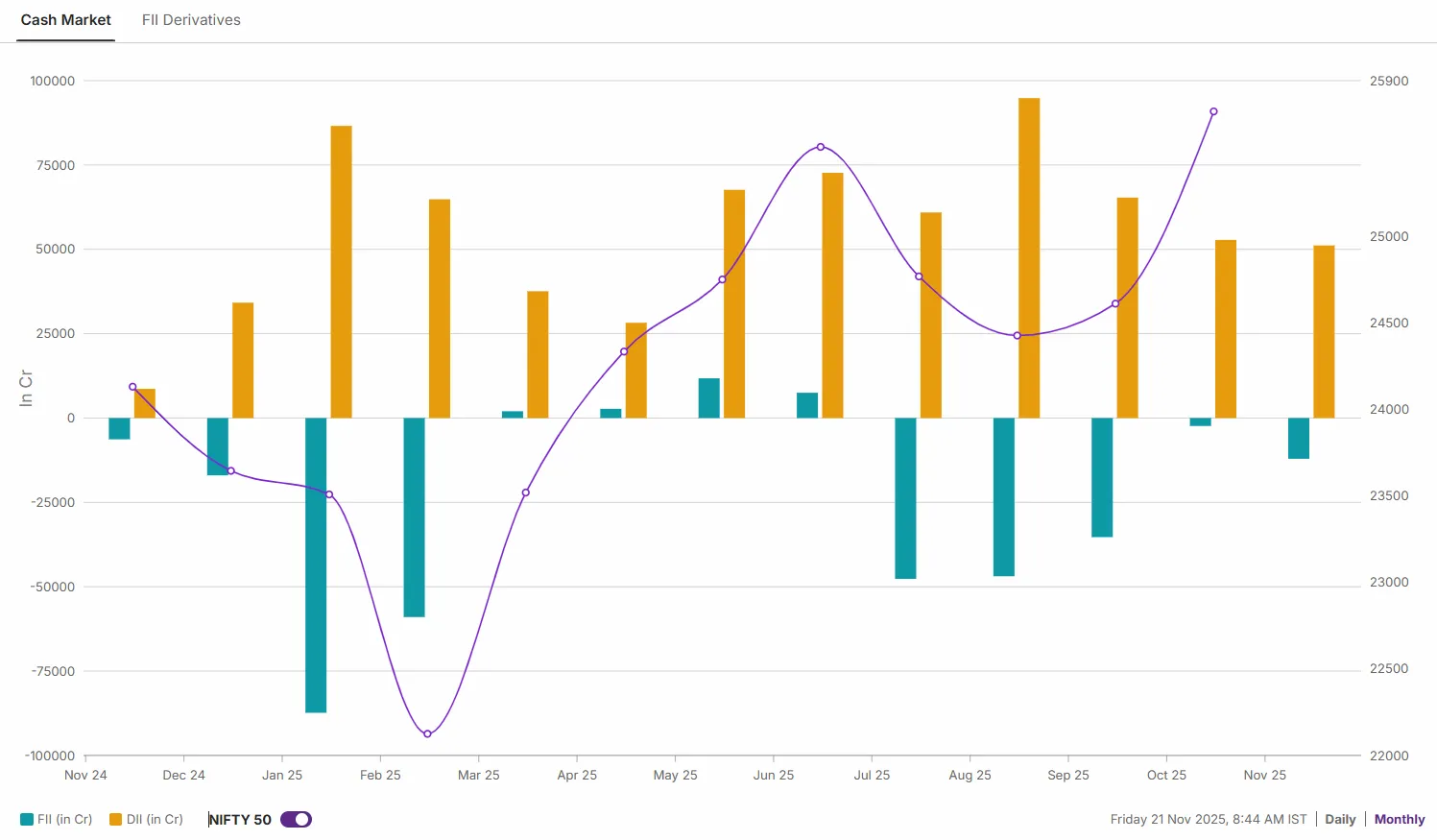

In the cash market, FIIs were net sellers in November, offloading equities worth ₹13,840 crore. However, domestic investors provided strong support by absorbing the selling pressure through net purchases of ₹54,321 crore.

NIFTY50 index

NIFTY50 index extended its upward movement, but encountered selling pressure near the 26,250 resistance level. Despite this pullback, the index continues to trade comfortably above the 21-day and 50-day exponential moving averages (EMAs), a sign that the short-term trend remains firmly bullish. Overall, the market is pausing near resistance this week, but is still holding its higher-high, higher-low structure. A close above 26,250 could trigger further gains, while a dip below 25,700 would signal weakness.

.webp)

.webp)

Back home, Friday’s India GDP (Q2) print will be a major domestic trigger. With the previous reading at 7.8%, markets will look for cues on whether India can sustain its strong growth momentum amid mixed global conditions. Overall, a data-heavy week where inflation, consumption, and growth signals from the U.S. will guide sentiment, while India’s GDP will set the tone for local markets.

About The Author

Next Story