Market News

Week ahead: US–Venezuela tensions, Oil prices, FIIs activity among key market triggers to watch

.png)

5 min read | Updated on January 04, 2026, 12:31 IST

SUMMARY

As the new week begins, markets will react to rising tensions between the United States and Venezuela and consider their potential impact on oil prices. Movements in crude oil will remain a key driver of global risk sentiment. Meanwhile, in India, the activity of foreign institutional investors (FIIs) and ongoing Q3 earnings updates will influence stock-specific activity.

US forces conducted a large-scale operation in Venezuela in the early hours of January 3 and captured President Nicolás Maduro. | Image: Shutterstock

Indian markets started 2026 on a strong note, extending gains for the second consecutive week as the NIFTY50 reached a new record high and the rupee weakened further against the dollar. The NIFTY50 index ended the week 1% up, closing near 26,330 after reaching an intraday high of approximately 26,340. Meanwhile, the SENSEX jumped by around 0.7%, finishing in the 85,750–85,800 range, supported by robust domestic flows.

Market breadth remained positive through most sessions, indicating broad-based participation rather than a narrow, index-heavy move. Sectorally, Metals (+5.7%) and PSU Banks (+4.9%) led this week's momentum, with NIFTY BANK touching a new lifetime high. However, defensives like FMCG (-3.7%) and some consumption names relatively underperformed, suggesting an ongoing preference for cyclicals and rate-sensitive plays at the start of the new year.

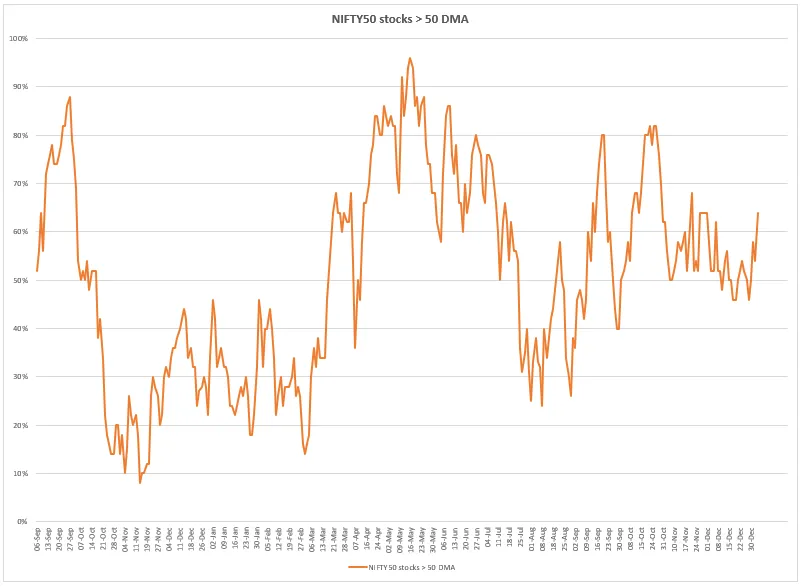

Index breadth

Market breadth showed a slight improvement this week, with the percentage of NIFTY50 stocks trading above their 50-day moving average moving towards the 55–60% range. This suggests that participation has marginally increased after remaining subdued in recent weeks. However, breadth remains well below the threshold of 70% seen during the stronger expansion phases earlier in the year. This indicates that the recovery in participation is still tentative.

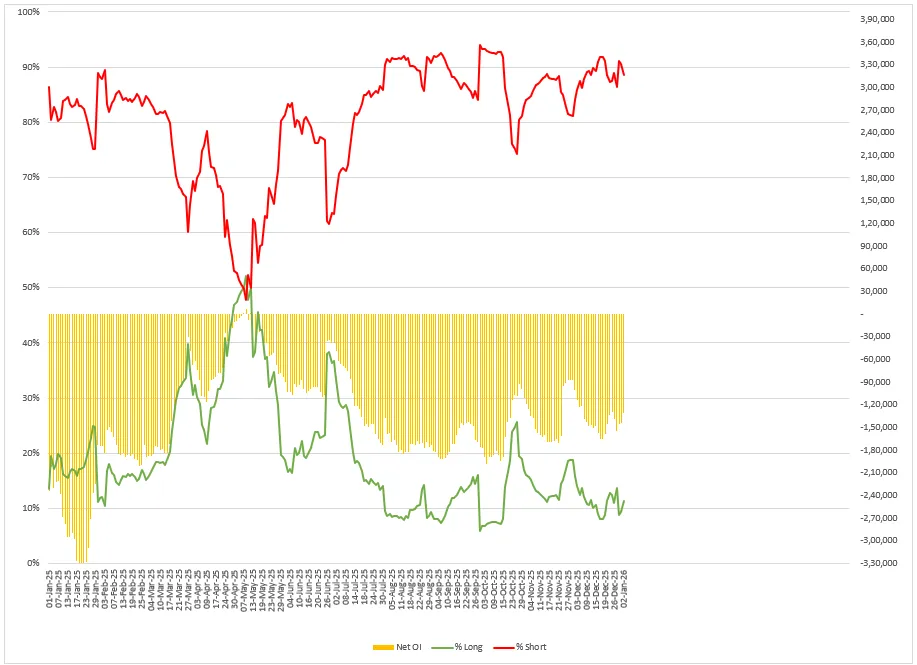

FIIs positioning equity and derivatives

The Foreign Institutional Investors (FIIs) began the January series with a defensive stance in index futures, as short positions continued to dominate at around 90% of total contracts, while long exposure stayed limited near 10%. Net open interest remained deeply negative, indicating that foreign investors are still using rallies to hedge risk rather than build fresh directional longs. This positioning suggests continued caution with FIIs likely waiting for a clearer macro or liquidity trigger before meaningfully shifting their stance.

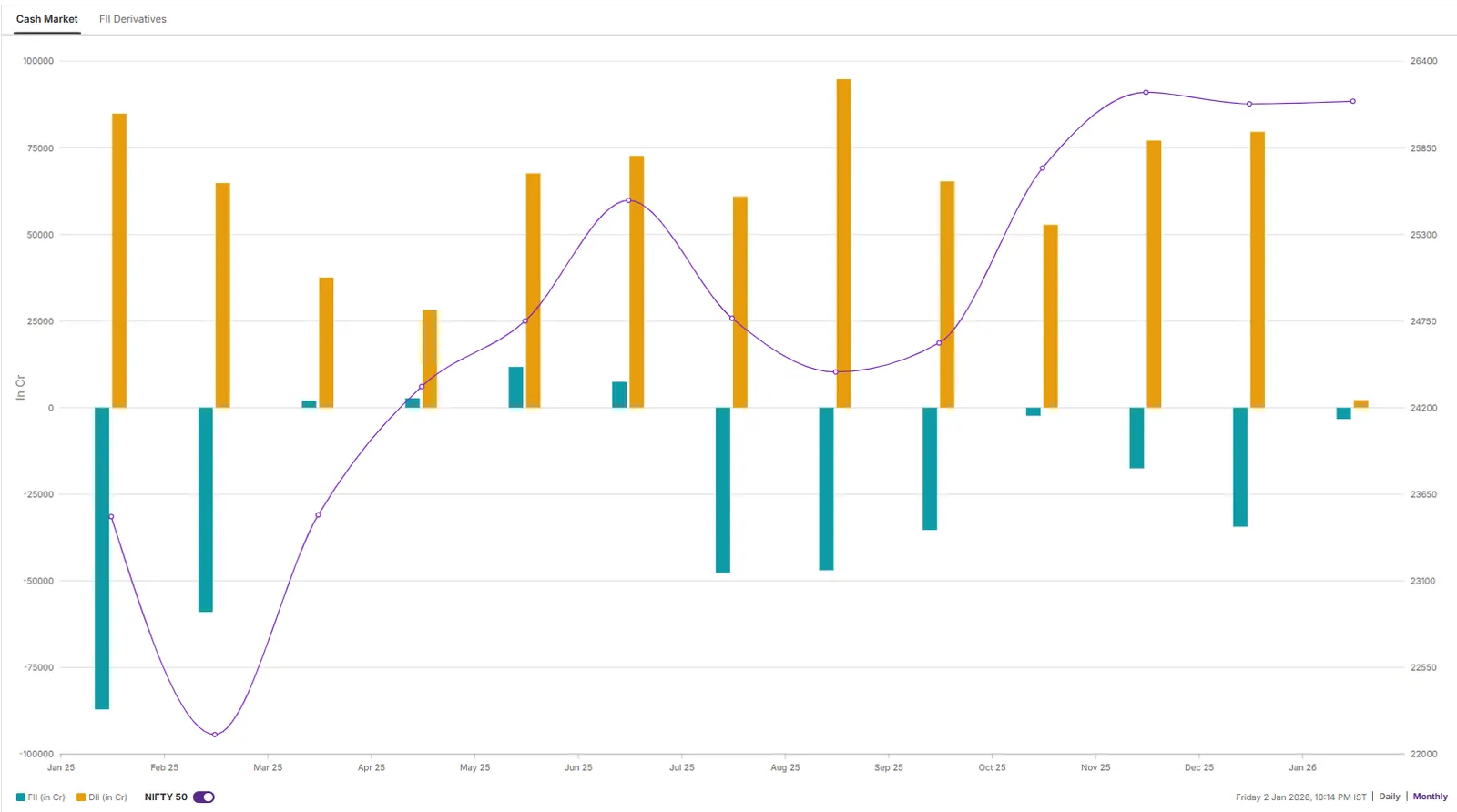

Meanwhile, in the cash market, FIIs ended the year on a negative note, offloading equities worth ₹34,300 crore in December 2025. For the full year, they remained net sellers for the second consecutive year, selling shares worth nearly ₹3 lakh crore once again. However, this selling pressure was fully absorbed by domestic institutional investors, who provided strong support with inflows of about ₹7.8 lakh crore, backed by steady domestic investor participation.

NIFTY 50 index

The NIFTY50 index has decisively broken out of its 36-session consolidation period, rising sharply and forming a strong bullish candle on the daily chart. This move signals a clear change in market sentiment, as the index has finally attracted sustained buying interest following weeks of limited price movement.

Notably, NIFTY closed at a new record high for the first time in over a year, ending the prolonged consolidation phase that began after the previous all-time high in September 2025. This breakout signals a resumption of the broader uptrend, suggesting that the market has absorbed selling pressure at higher levels and opening the door to further growth, provided that momentum and participation are sustained.

Meanwhile, in India, the Reserve Bank of India’s ongoing open market operations (OMOs) and foreign exchange (forex) swap operations will remain in the spotlight. The RBI’s role is crucial in providing liquidity, stabilising bond yields, and supporting the rupee amid ongoing foreign portfolio investor (FPI) outflows. Additionally, the Q3 corporate earnings season will begin, with DMart’s results expected later in the week.

Markets will also be closely watching geopolitical developments after the US President Donald Trump claimed that United States forces conducted a large-scale operation in Venezuela in the early hours of January 3, reportedly resulting in the capture of President Nicolás Maduro.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities, or trading strategies. The securities quoted are exemplary and not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Make your own decision before investing.

About The Author

Next Story