Market News

Week ahead: US Fed meeting, US-China trade talks, Q2 earnings, FIIs activity among key market triggers to watch

.png)

5 min read | Updated on October 26, 2025, 14:57 IST

SUMMARY

All eyes will be on the upcoming Trump–Xi Jinping meeting in the coming week, as it could influence trade and geopolitical sentiment across global markets. In terms of earnings, the focus will be on major tech companies such as Microsoft, Meta and Google. Domestically, the focus will shift to the automobile sector, where festive season demand trends and margin outlook will be key.

NIFTY50 technical outlook indicates a range-bound approach, with 25,400 emerging as a pivotal support level | Image: Shutterstock

Indian markets got off to an impressive start in the new Samvat year, achieving a fourth consecutive week of gains and hitting a new 52-week high. This positive trend was driven by anticipation of an imminent trade deal between India-U.S, short-covering by Foreign Institutional Investors (FIIs), and strong second quarter earnings across various sectors. The NIFTY50 index rose to 25,795, up 0.3%.

During the week, NIFTY Midcap 150 index with marginal gains of 0.5%, while the Smallcap 250 index managed a gain of 0.8%, outperforming the Midcap space. In terms of sectors, NIFTY IT, PSU banks and metal stocks were the star performers, posting weekly gains of between 1% and 3%.

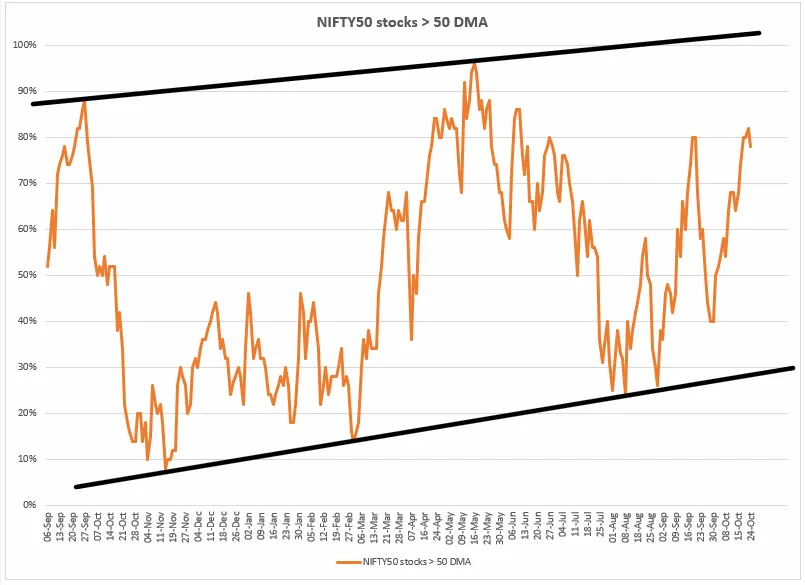

Market breadth

The chart below shows the percentage of NIFTY50 stocks that are trading above their 50-day moving average (DMA). The recent rise towards the upper band of 70–80% suggests increased participation across sectors, indicating that the ongoing NIFTY50 uptrend is driven by broader strength rather than a few major players. Historically, periods during which more than 80–90% of NIFTY50 stocks have traded above their 50 DMA have often indicated short-term overheating, typically followed by brief consolidation or correction periods.

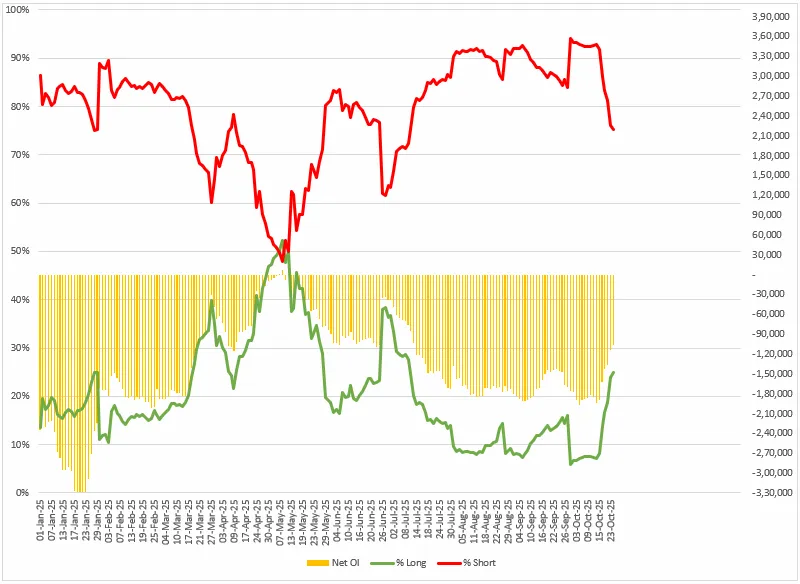

FIIs positioning in the index

The latest FII index futures positioning indicates an ongoing trend of short covering. The long-to-short ratio has improved further, reaching approximately 22:78 and extending the uptrend from the extremely bearish stance of 8:92 seen in October.

This indicates that foreign investors are gradually reducing their short positions. However, as shorts remain dominant, the positioning is still cautious, suggesting that FIIs are selectively adding longs rather than reversing their bearish bias entirely. Sustained follow-through in this ratio will be crucial in confirming a more permanent shift in sentiment.

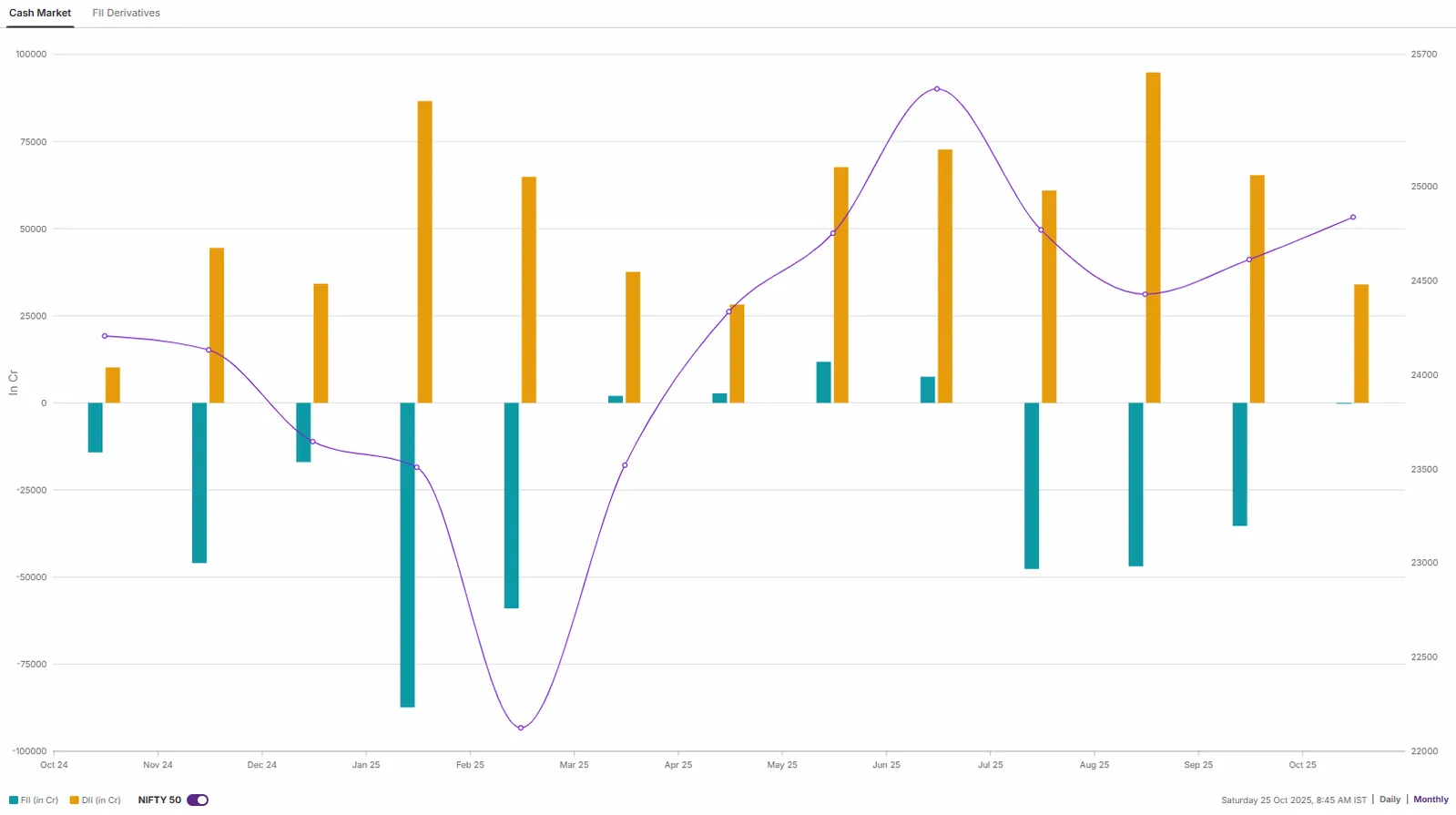

In October, FIIs activity was relatively subdued in the cash market, with net selling of around ₹244 crore. This pause follows months of heavy outflows and suggests that FIIs are adopting a wait-and-watch approach. Meanwhile, domestic investors have continued to provide steady support, cushioning market volatility. However, the absence of strong foreign inflows at this stage implies that recent market stability is more a result of a lack of selling than active buying.

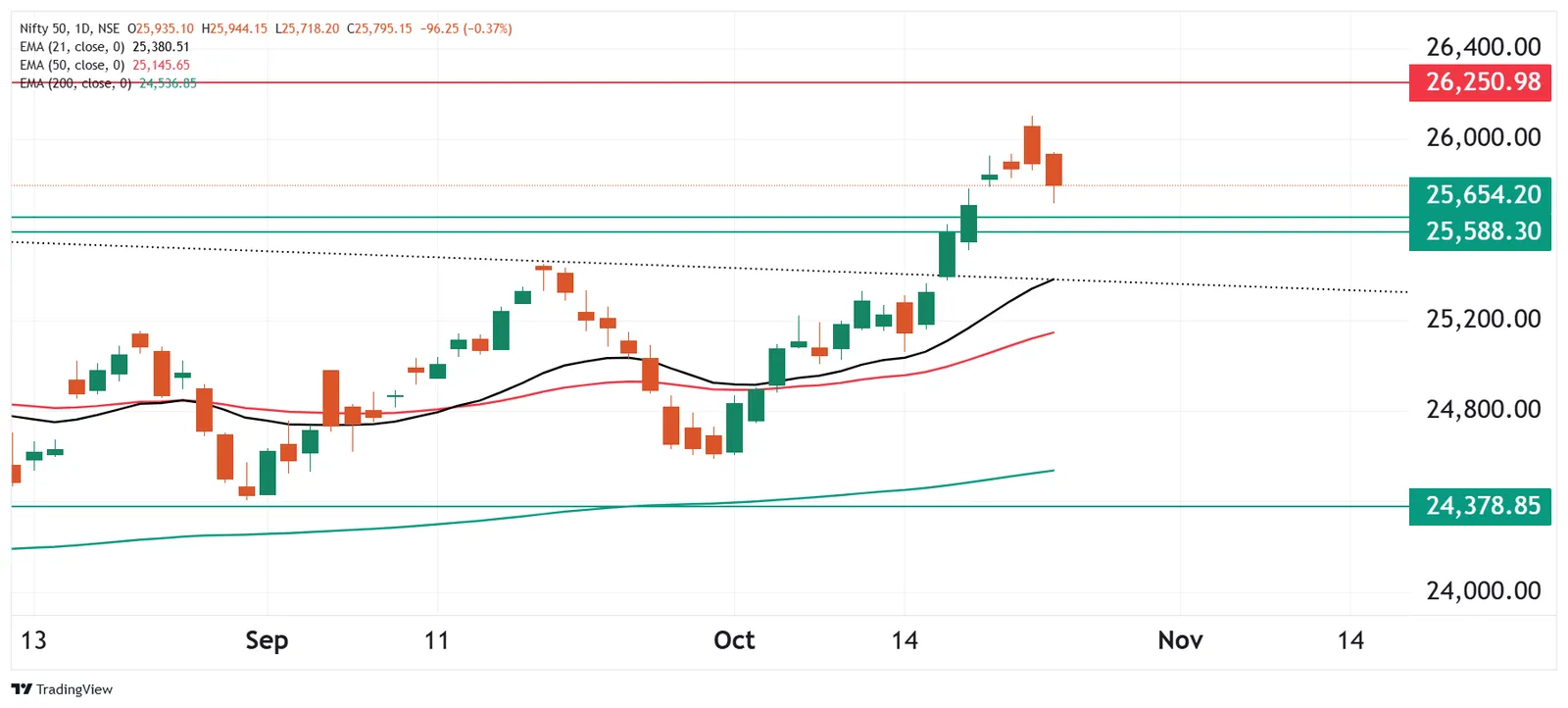

NIFTY 50 index

The technical outlook for NIFTY50 index indicates a range-bound approach, with 25,400 emerging as a pivotal support level. Unless NIFTY closes below this support zone, the bullish structure may get sustained. Last week, the index came under selling pressure after testing its previous all-time high zone and encountered resistance around the 26,200 level. For short-term clues, traders can monitor the 26,200–25,400 range. A breakout from this range will provide further directional clues.

About The Author

Next Story