Market News

Week ahead: US Fed meeting, Crude oil spike, geopolitical tensions among key market triggers to watch out

.png)

5 min read | Updated on June 15, 2025, 13:06 IST

SUMMARY

The upcoming week features several important market triggers, including escalating Israel-Iran tensions, a sharp surge in crude oil prices driven by geopolitical risks, and the U.S. Federal Reserve's policy decisions. From the technical standpoint, the NIFTY50 index is trading within the range of 25,200 and 24,400. A break of this range will provide further clues.

Foreign Institutional Investors (FIIs) remained net short on the index futures and sustained their bearish bets.

Indian markets fell over 1% during the volatile week ending 13 June, erasing the previous week’s gains. Rising geopolitical tensions following Israel’s strike on Iran hit markets, sending crude oil prices soaring. Additionally, trade talks between U.S. and China trade talks created uncertainty.

The broader markets also came under selling pressure, breaking their winning streak. The NIFTY Midcap 150 index dropped over 1%, while the Smallcap 250 index declined 0.4%. Meanwhile, heightened geopolitical tensions pushed the volatility index up 3% to 15, signalling choppy sessions ahead.

Sectorally, except for IT (+3%) and Pharmaceuticals (+1.3%), all the major sectoral indices ended the week in the red. Real-Estate (-3%) and PSU Banks (-2.3%) were the top losers.

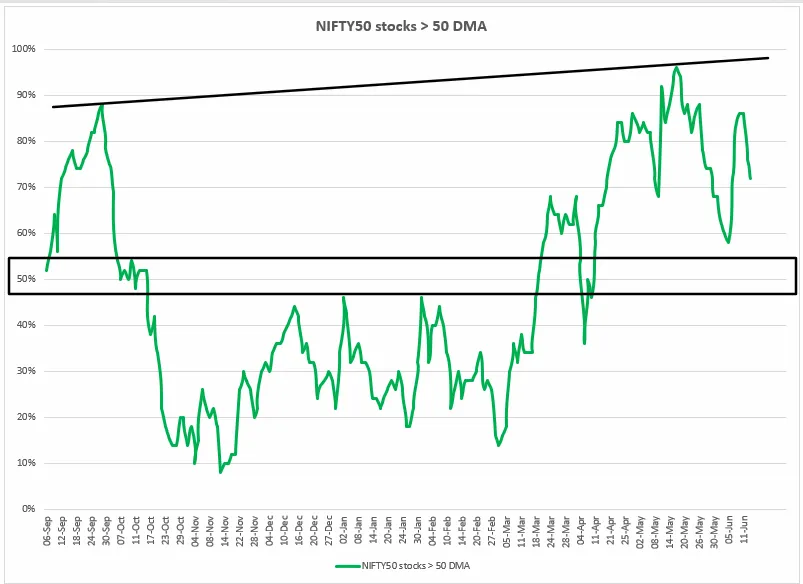

Index breadth

The NIFTY50 showed strong breadth last week, with 80% of its stocks trading above their 50-day moving averages. However, by the end of the week, that figure dropped to 72%. Following the recent rally, breadth is likely to fluctuate between 90% and 50%. A dip below 50% would be an early warning sign of market weakness.

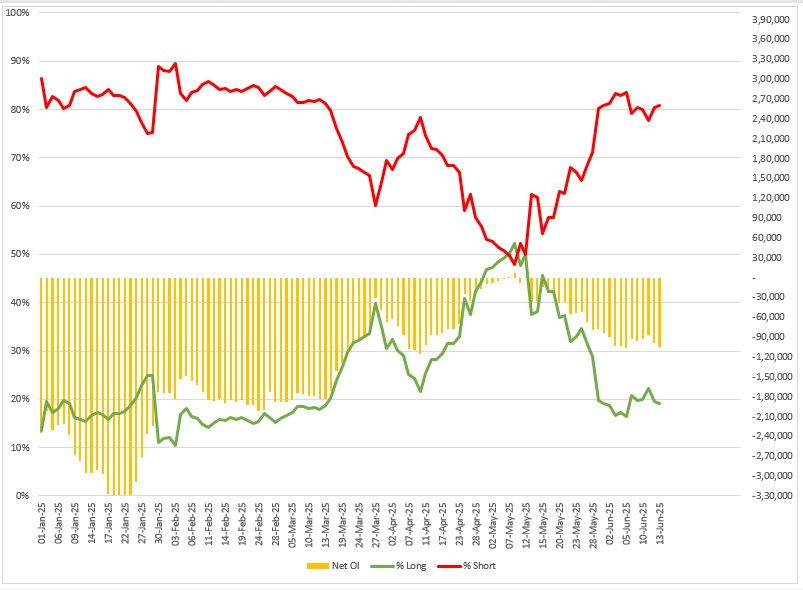

FIIs positioning in the index

Foreign Institutional Investors (FIIs) remained net short on the index futures and sustained their bearish bets. They sustained the long-to-short ratio at 19:81, similar to the start of the June series, indicating that their broader positioning on the index remains bearish. Additionally, the net open interest of the FIIs in index futures now stands at -1.04 lac contracts, which is 12% from last week.

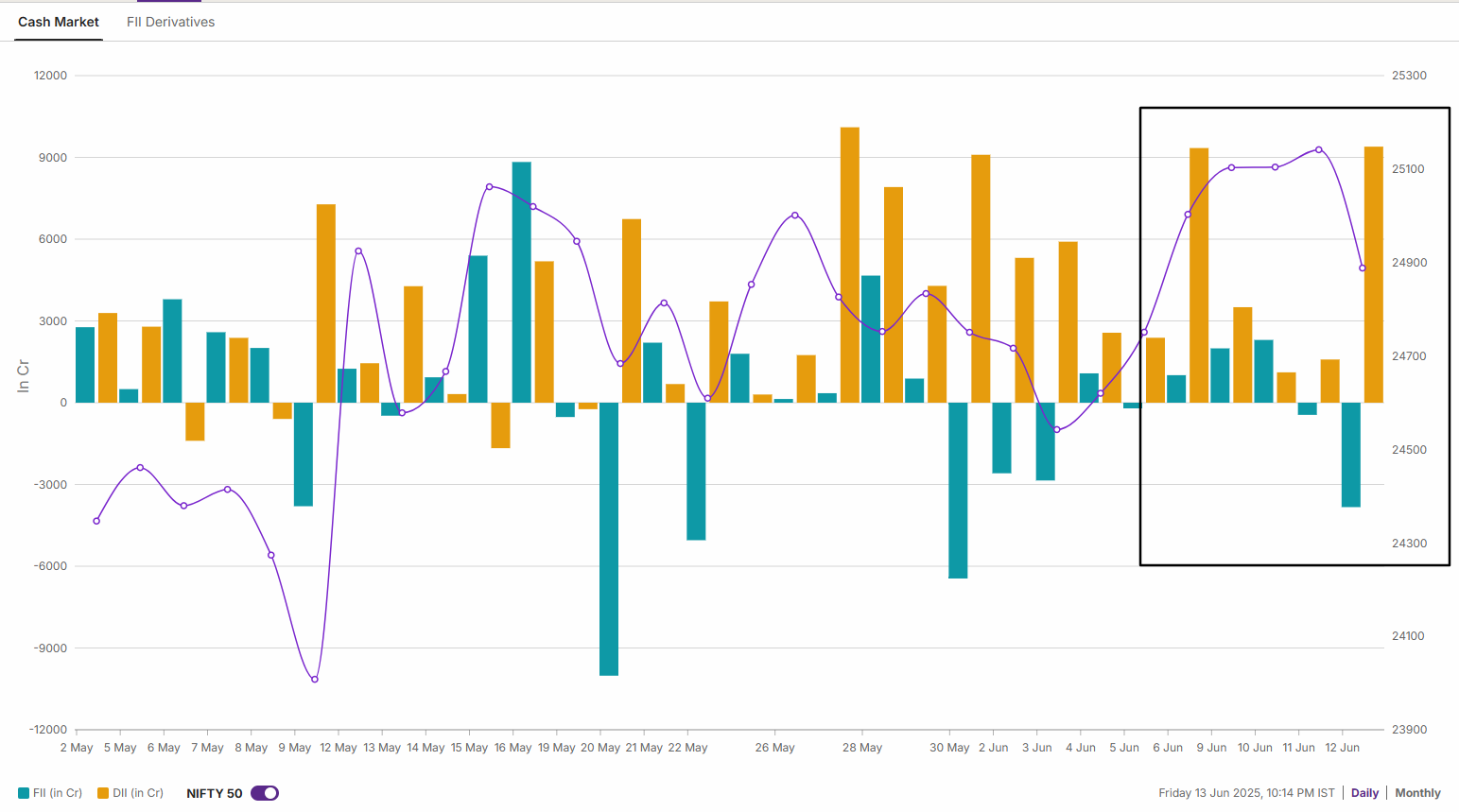

In the cash market, Foreign Institutional Investors (FIIs) stayed net sellers last week, offloading shares worth ₹1,215 crore—though the selling pressure eased compared to the previous week. On the other hand, Domestic Institutional Investors (DIIs) continued to support the market, buying shares worth ₹18,501 crore.

NIFTY50

The NIFTY50 index failed to provide the follow-through momentum after breaking four weeks' consolidation and slipped into the consolidation zone of 24,400 and 25,200. The index formed a bearish candle on the weekly chart and failed to capture the crucial resistance zone of 25,200 on a closing basis.

For the upcoming week, the resistance for the index remains around 25,200, while immediate support is around 24,400 zone. A break of this range on a daily closing basis will provide further directional clues.

BANK NIFTY

The BANK NIFTY snapped its four week winning streak after hitting a fresh record high. The index witnessed profit-booking around the psychological level of 57,000. The index formed a bearish engulfing candle on the weekly chart, indicating weakness in the short-term.

Meanwhile, it is important to note that the crucial support for the index remains around 54,000, its previous all-time high. Unless the index breaks this zone on a closing basis, the long-term trend may remain bullish. However, in the short-term the psychological level of 57,000 may act as immediate resistance.

Meanwhile, the Bank of Japan and the Bank of England will hold their monetary policy meetings between 16 and 19 June. Experts believe that both the central banks are expected to keep interest rates unchanged. On the domestic front, the Wholesale inflation print and minutes of the RBI's June meeting will be in the spotlight.

For the upcoming sessions, the index has slipped back into the range of 25,200 and 24,400 in the last three weeks. This indicates that the index may oscillate in this range and can remain volatile. A break of this range on a daily closing basis, supported by a strong candle will provide strong directional clues.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities, or trading strategies. The securities quoted are exemplary and not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Make your own decision before investing.

About The Author

Next Story