Market News

Week ahead: U.S tariffs, Inflation data, Q3 earnings and FII selling to drive markets this week

.png)

4 min read | Updated on January 11, 2026, 12:12 IST

SUMMARY

In the coming week, markets will react to third-quarter earnings and U.S. inflation data. Alongside these, the Q3 earnings season in India and the Q4 earnings season in the U.S, led by major IT companies, banks, and Reliance Industries, are likely to influence stock-specific movements and set the tone for broader market sentiment.

Indian markets witnessed sharp selloff in the previous week amid fresh 500% tariff threats from the US. Image source: Shutterstock.

Indian markets ended a two-week winning streak with their sharpest weekly decline in over three months. The NIFTY50 and SENSEX fell in the range of 2.4–2.5%, closing at 25,683 and 83,576 respectively. The sell-off accelerated mid-week due to heavy FII outflows amid fear of steep U.S. tariffs under President Trump and disappointing Q3 earnings updates from index heavyweights such as HDFC Bank and Trent.

Meanwhile, the volatility index spiked to 11 (+15%) with the indices falling for five consecutive sessions, marking a clear shift from optimism to caution. The broader markets were also hit hard with NIFTY Midcap 150 and Smallcap 250 falling by 2.6% and 3.4% respectively.

Except for Defence (+1.3%) and Consumer Durables (+0.9%), all the other major sectors ended the week in the red. Energy (-5.1%), Oil and Gas (-5.7%) and Metals (-2.8%) declined the most. Amid dollar strength, the rupee weakened further, while FIIs remained net sellers.

On the global front, major U.S. banks will kick off the Q4 earnings season, with JPMorgan Chase reporting on Tuesday. It will be followed by Bank of America, Citigroup and Wells Fargo on Wednesday along with Goldman Sachs and Morgan Stanley on Thursday. These reports will reveal trends in loan growth, net interest margins, trading activity, and credit quality amid the Fed's path of rate cuts.

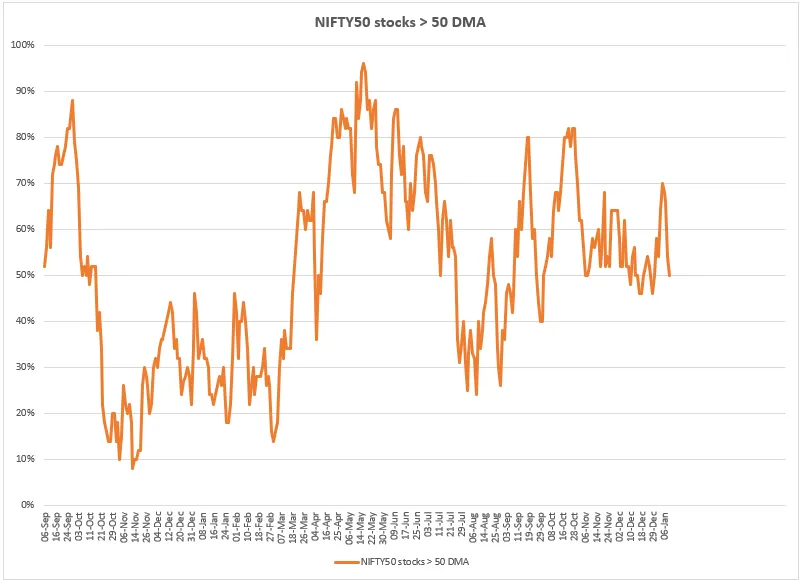

Market breadth

Market breadth saw a sharp reversal last week, with the percentage of NIFTY50 stocks trading above their 50-day moving average (DMA) falling quickly from 70% towards 50%. This suggests that the earlier expansion in market breadth was not built upon, as stocks that had moved above key averages were unable to sustain their gains.

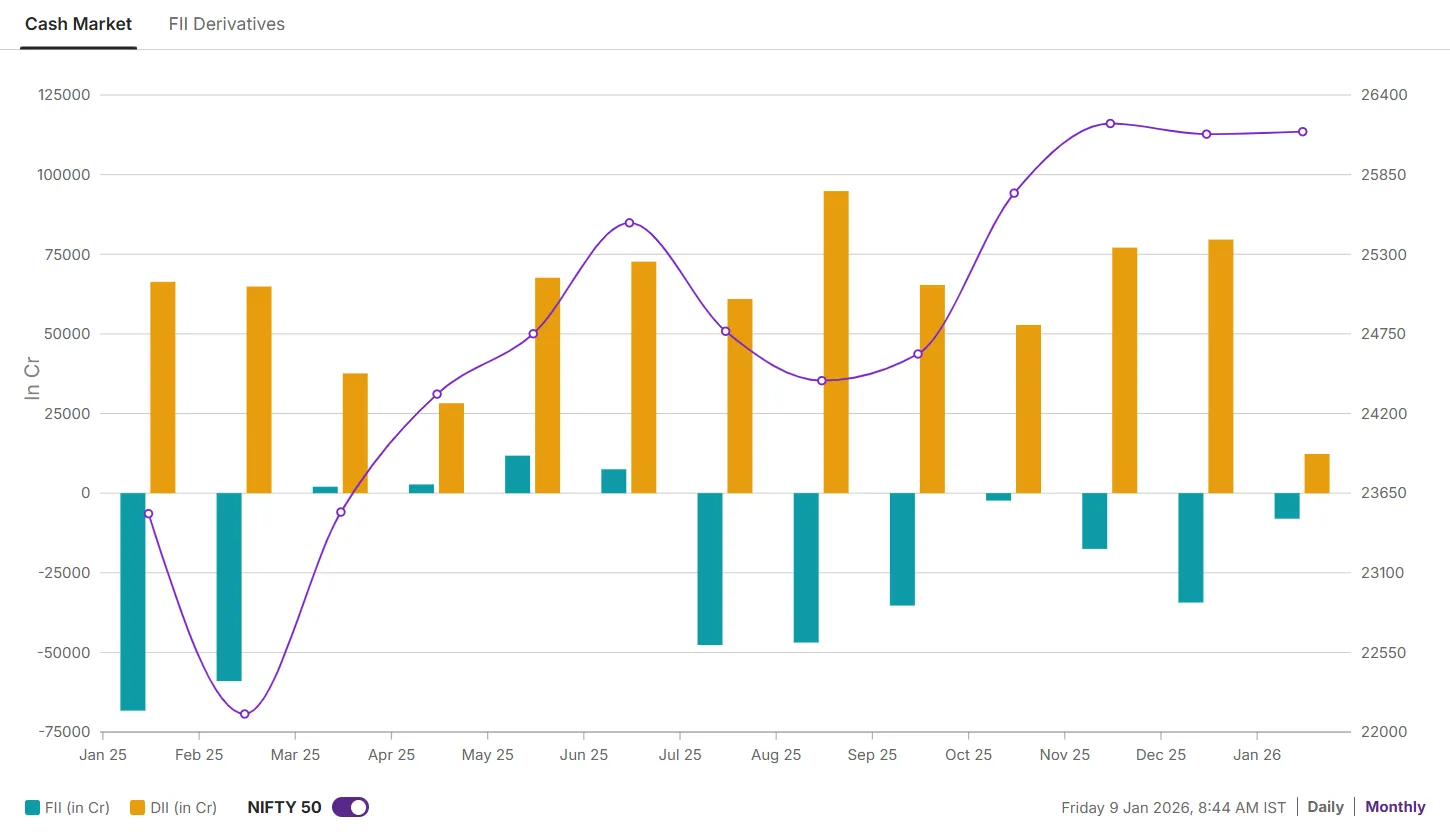

FIIs cash market and derivatives

Foreign Institutional Investors (FIIs) have started the year 2026 on a cautious footing, selling equities worth ₹8,017 crore so far in January. Their derivatives positioning reinforces this defensive stance with the long-to-short ratio in index futures heavily skewed towards shorts, as nearly 93% of the contracts remain net short. In addition, net open interest turned sharply bearish last week, reflecting an increase in short positions, particularly during the last two sessions. This built-up indicates that the FIIs remain unconvinced about the sustainability of the recent rally.

NIFTY 50 outlook

After a false breakout on 2 January, the index reversed all its gains and declined nearly 3% from its intraday peak. The index also slipped below the crucial support zone of 25,700 and broke the two month consolidation range on the downside.

On the daily chart, the index is trading below its key short-term exponential moving averages (EMA) like 21 and 50, indicating weakness. The next crucial support for the index is around 25,400. A close below this zone will signal further downside risk and probability of retracement towards the psychological support of 200 EMA. Conversely, the immediate resistance zone of 26,250 will now act as stiff resistance.

About The Author

Next Story