Market News

Week ahead: Trump tariffs, TCS earnings, US-India trade deal & FII flows among key market triggers to watch out

.png)

5 min read | Updated on July 06, 2025, 14:23 IST

SUMMARY

The Indian markets enter a critical week with uncertainty over the India-U.S. trade deal, and the upcoming first-quarter results season is likely to influence investor sentiment. Meanwhile, the capital flows of foreign investors and profit-booking around 25,800 will remain in focus.

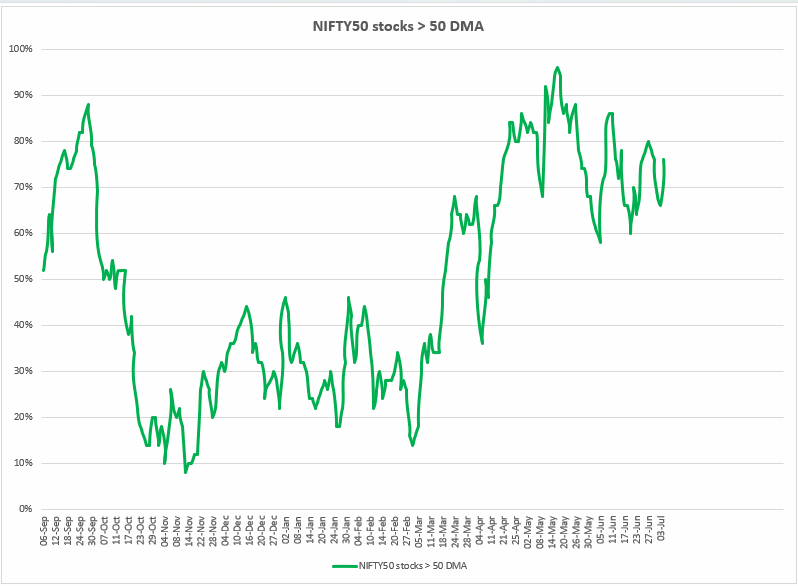

NIFTY50 stocks maintained its bullish momentum, with over 76% of its constituents trading above their 50-day moving average.

Indian markets snapped two weeks winning streak and took a breather after breaking out from five week long consolidation. The NIFTY50 index consolidated broadly in a range of 400 points and ended the week at 25,461, down 0.4%, while SENSEX dropped 0.7% to 83,432.

However, the broader indices outperformed their benchmark peers as investors stayed cautious ahead of the U.S. and India trade deal finalisation and July 9 tariff deadline. Both Midcap 150 and Smallcap 250 index gained 0.6% and formed a doji candle on the weekly chart.

Sectorally, Consumer Durables (+2.7%) and PSU Bank (+1.9%) advanced the most, while Real- Estate (-2.2%) and Private Banks (-1.5%) declined the most.

Index breadth

The breadth of the NIFTY50 stocks maintained its bullish momentum, with over 76% of its constituents trading above their 50-day moving average. The week began with the reading of 76%, which dipped to 66% during the weekly expiry of NIFTY50 options contracts. However, the index rebounded on Friday, closing the week back at 76%.

This indicates that the broader breadth remains positive and comfortably above the critical 50% threshold. As highlighted in our earlier blogs, the first sign of weakness will emerge only if 50% of NIFTY50 stocks sustain below their respective 50-day moving averages.

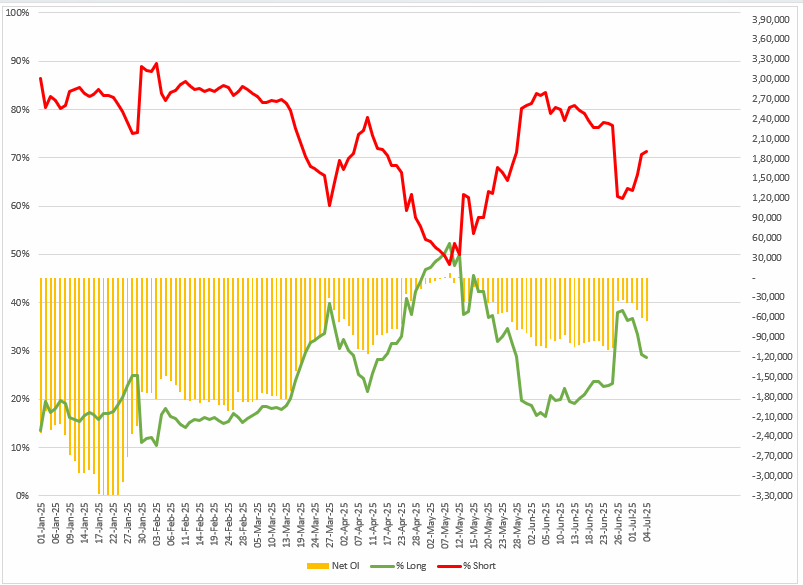

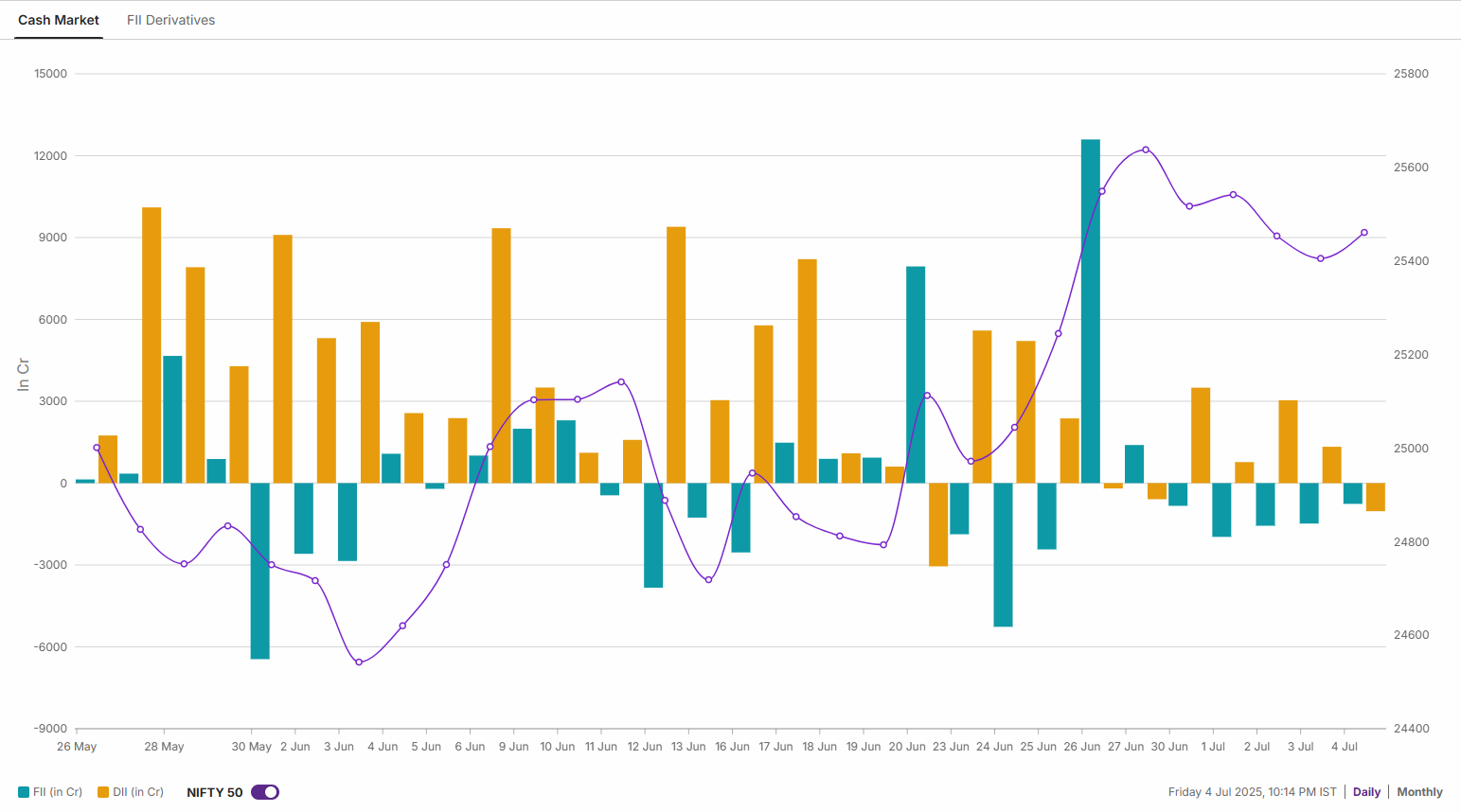

FIIs positioning in the index

Foreign Institutional Investors (FIIs) increased their bearish open interest on index futures by 50% and shifted the long-to-short ratio to 29:71. They started the July series with a ratio of 38:62 and the net open interest of -33,518 contracts. Last week, the net open interest of the FIIs on index futures stood at -65,687 contracts, indicating weakness.

Meanwhile, the cash market activity of the FIIs was in line with their bearish position on index futures as they offloaded shares worth ₹6,652 crore. On the flip side, the Domestic Institutional Investors supported the markets and purchased shares worth ₹6,831 crore.

NIFTY50

From the technical standpoint, the NIFTY50 index formed a pause candle on the weekly chart following a breakout of five week long consolidation. The index protected the crucial support zone of 25,200 on a closing basis and consolidated at higher levels. Meanwhile, the immediate resistance for the index remains around 25,800 zone. Unless the index breaches this consolidation range on the closing basis, the trend may remain sideways to bullish.

.webp)

NIFTY Oil & Gas

The NIFTY Oil & Gas sectors sustained bullish momentum after the crossover of 21-week and 50- week exponential moving averages and ended the week above previous week’s high. Majority of its constituents ended the week in the green except for Petronet LNG and Adani Total Gas. Meanwhile, Indraprastha Gas, Bharat Petroleum and Gujarat Gas advanced in the range of 4% to 5%.

.webp)

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities, or trading strategies. The securities quoted are exemplary and not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Make your own decision before investing.

About The Author

Next Story