Market News

Week ahead: Trump's steel tariffs, RBI interest rate decision, Auto sales and FII inflows among key triggers to watch out

.png)

5 min read | Updated on June 01, 2025, 13:37 IST

SUMMARY

Over the weekend, US President Donald Trump announced 50% tariffs on steel imports. These tariffs will come into effect from June 4. Experts believe that India, which exports iron, steel and aluminium products worth $4.56 billion to the US in FY25, will be directly impacted. Higher tariffs will threaten the competitiveness and profitability of Indian metal exporters.

Foreign Institutional Investors (FIIs) started the June series with a long-to-short ratio of 19:81, indicating a generally negative outlook on the index.

Markets ended the last week of May series on the subdued note amid renewed concerns of U.S. tariffs and foreign institutional investors turning net sellers. Investor sentiment also remained tepid ahead of the GDP data release.

The GDP data released after market hours on Friday indicate that GDP growth slowed to 6.5% in FY25. However, the annual figure was marginally higher than the expectation of 6.3%. Additionally, the GDP growth rate in the January-March quarter stood at 7.4% of FY24-25.

The broader markets outperformed the headline indices, with NIFTY Midcap 100 index rising by 1.2% and Smallcap 100 gaining 1.3%. Sectorally, only PSU Banks (+4.0%) and Real-Estate (+1.3%) closed the week firmly in the green, while all other major indices faced profit-booking. FMCG (-2.1%) and Automobiles (-0.8%) were the top laggards.

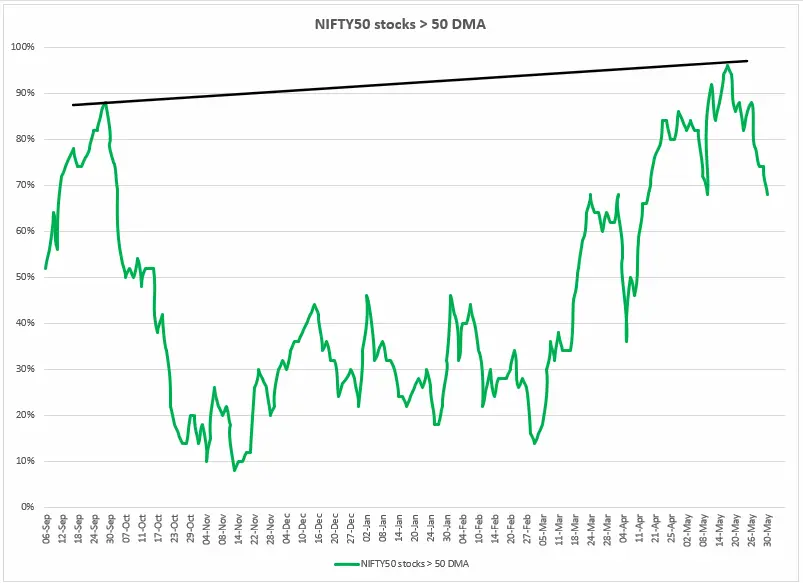

Index breadth

The breadth of the NIFTY50 index further cooled, dropping from 88% to 68%. Last week, over 88% of NIFTY50 stocks were trading above their 50-day moving average (DMA). The index began the week with 88% of stocks above the 50-DMA, but this figure steadily decreased, dropping to 68% by the end of the week. This signals a broad-based consolidation.

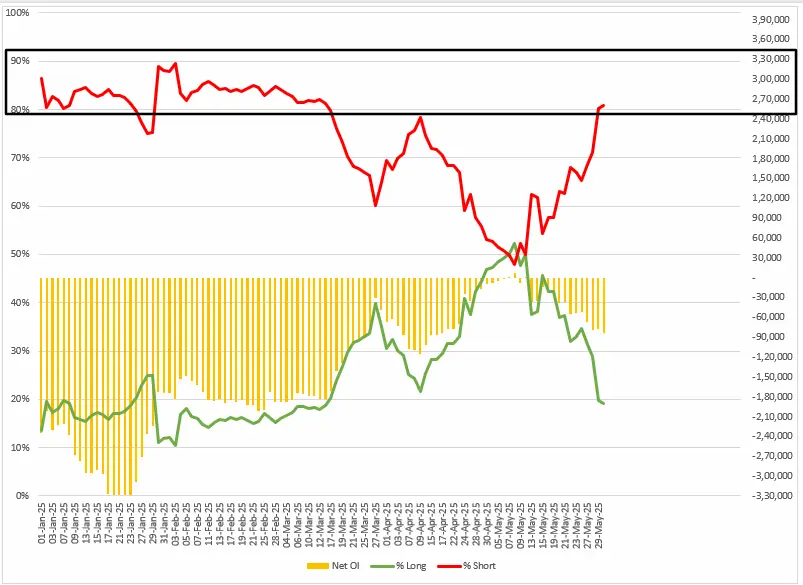

FIIs positioning in the index

Foreign Institutional Investors (FIIs) started the June series with a long-to-short ratio of 19:81, indicating a generally negative outlook on the index. Their net open interest in index futures is -83,000 contracts. Historically, when FIIs begin a series with a long-to-short ratio above 20:80, they rarely push it beyond 90%, which suggests limited follow-through.

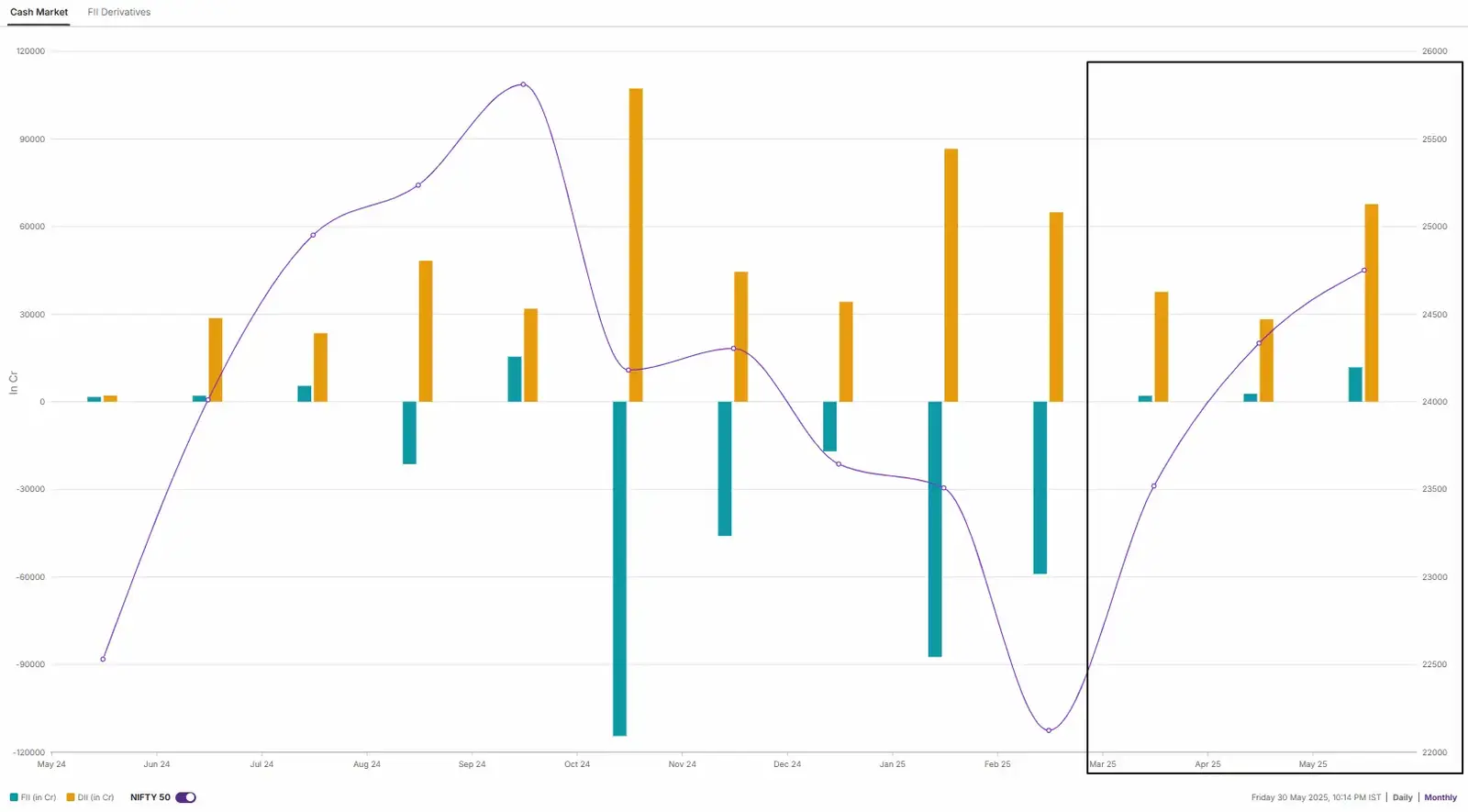

FIIs neutral positioning on the index futures was in line with their cash market activity. They remained net buyers for the third month in a row and bought shares worth ₹11,773 crore. On the flip side, the DIIs sustained their buying momentum and purchased shares worth ₹67,472 crore.

NIFTY 50 index

The NIFTY50 index failed to cross the immediate resistance of 25,200 zone and formed a second inside candle on the weekly chart. The index traded in a narrow range of broadly 500 points throughout the week, indicating consolidation at higher levels. Meanwhile, the short-term trend of the NIFTY50 index remains range-bound with immediate resistance around 25,200 and support around 24,350. A breakout of this range on a daily closing basis will provide further directional clues.

PSU Bank index

The NIFTY PSU Bank index extended the bullish momentum after breaking out from the falling wedge pattern and reclaiming 21-week and 50-week exponential moving averages. It is a bullish chart pattern involving two converging, downward-sloping trend lines. In this pattern, the price makes lower highs and lower lows, indicating decreasing selling pressure and the potential for an upside trend reversal.

Unless the index slips below the ₹6,500, the index may sustain its bullish momentum. All the constituents of the index ended the week in green with Canara Bank, UCO Bank and Punjab National Bank advancing in the range of 7% to 5%.

On the global front, the jobs report on Friday will highlight insight into hiring. Experts believe the May jobs report is expected to show an increase of 1,30,000 jobs, which would represent a slowdown from the 1,77,000 jobs created the previous month.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities, or trading strategies. The securities quoted are exemplary and not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Make your own decision before investing.

About The Author

Next Story