Market News

Week ahead: Trump-Putin Alaska meet, Q1 earnings, tariff hikes, Inflation data among key market triggers to watch out

.png)

5 min read | Updated on August 10, 2025, 14:17 IST

SUMMARY

Indian equities may remain cautious next week amid escalating U.S.–India trade tensions after the Trump administration doubled tariffs on Indian exports. Key global triggers include the Trump–Putin summit and US inflation data. Technically, NIFTY faces stiff resistance at 25,200, and failure to close above this level could keep the trend sideways to bearish.

Foreign Institutional Investors (FIIs) maintained bearish stance in index futures, keeping the long-to-short ratio at a steep 8:92.

Indian markets experienced another volatile week, with benchmark indices recording their sixth consecutive weekly loss, the longest losing streak since 2020. Sentiment remained under pressure due to global trade tensions, disappointing earnings, ongoing Foreign Institutional Investor (FII) outflows and a weakening rupee.

The U.S. President Donald Trump recently doubled tariffs on Indian exports to 50% in response to India's continued energy imports from Russia, a sharp escalation that has increased pressure on Indian exporters. Sectors including textiles, seafood, gems and jewellery, auto ancillaries and chemicals have been among the hardest hit.

Against this backdrop, the NIFTY index slipped 0.8% to 24,363, while the SENSEX fell 0.9% to 79,857 over the week. Both benchmark indices have retreated nearly 5% from their June swing highs, highlighting sustained weakness. Broader markets also remained under pressure, with losses stretching into the third straight week. The NIFTY Midcap 150 index fell 1.1%, and the Smallcap 250 index shed almost 2%.

Sectorally, PSU Banks (+1.5%), Metals (+0.4%) and Automobiles (+0.2%) were the major indices which ended the week in green. Meanwhile, Pharma (-2.7%), Real-Estate (-2.4%) and FMCG (-2.3%) indices declined the most.

Index breadth

The breadth indicator, which tracks the percentage of NIFTY50 stocks trading above their 50-day moving average (DMA) , has declined sharply from its May peak of 96% to below 30%. This sustained decline points to weakening market participation, suggesting caution until breadth of the index stabilises or rebounds from lower support levels.

.webp)

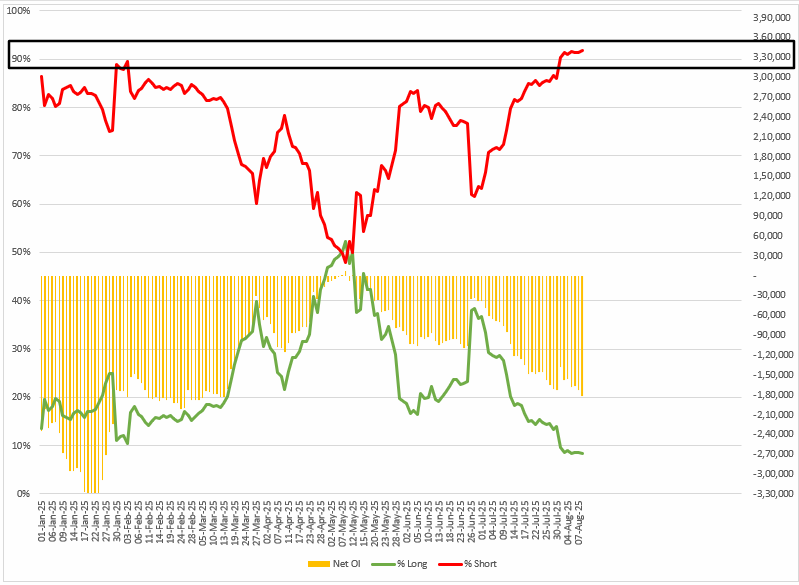

FIIs positioning in the index

Foreign Institutional Investors (FIIs) maintained their historically bearish stance in index futures, keeping the long-to-short ratio at a steep 8:92. Over the week, they increased their net bearish open interest by 16% to -1.8 lakh contracts. Historically, such extreme positioning has often coincided with reversal zones. If FIIs hold their current stance, the market is likely to stay sideways to bearish, but a sharp unwinding of shorts could signal the start of a potential reversal.

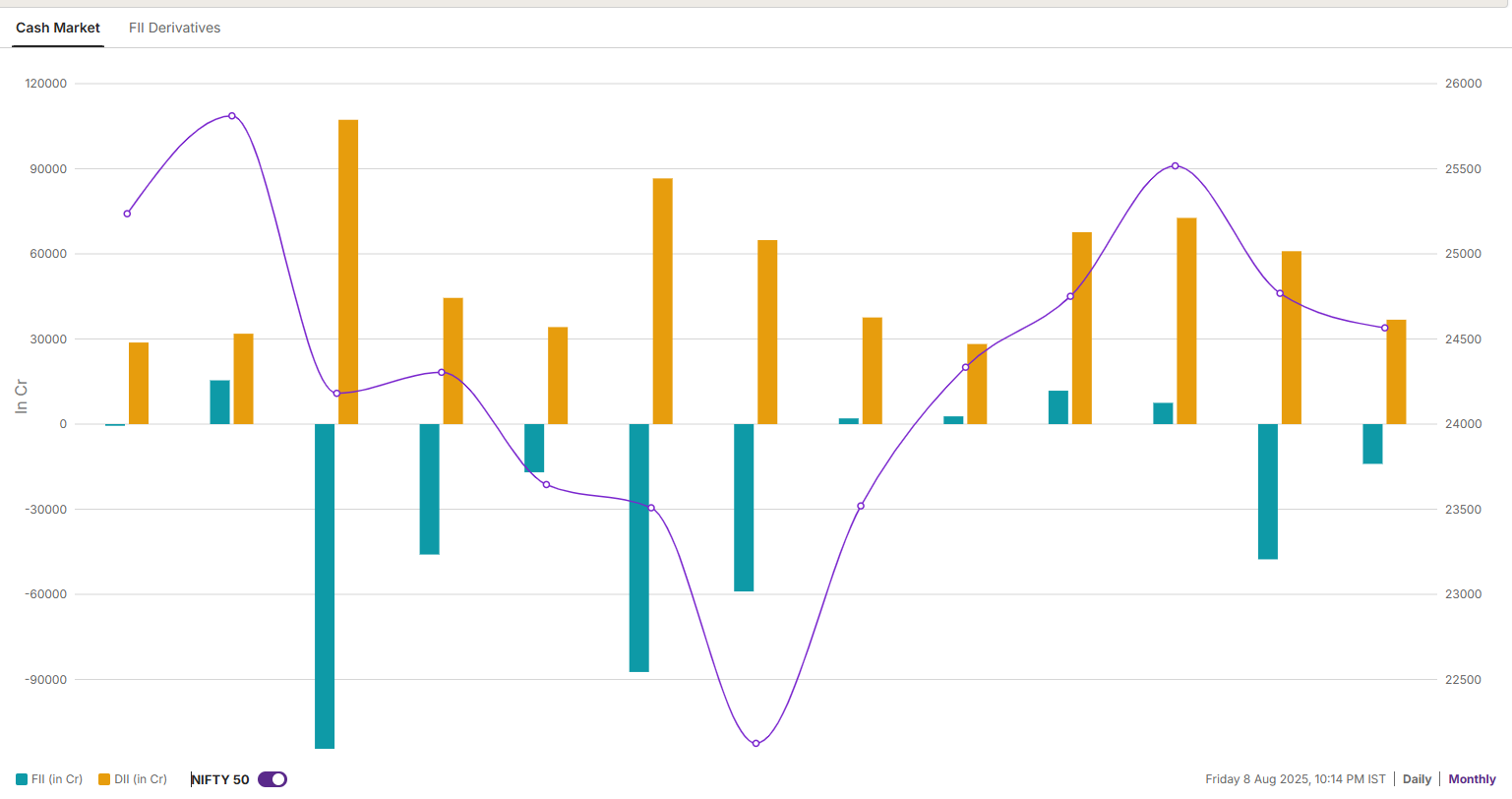

In the cash market, FIIs have started the August series on a negative note and have offloaded shares worth ₹14,018 crore. This comes after they remained net sellers in July and sold shares worth ₹47,666 crore.

NIFTY50 index

The NIFTY50 index sustained the bearish momentum for the sixth consecutive week, ending the session below previous week’s low. The index slipped below the crucial support zone of 24,450 and 24,500 on a closing basis, indicating weakness. Additionally, the index also closed below its 21-week exponential moving average (EMA), a crucial, reinforcing the likelihood of continued downside unless a sharp recovery emerges.

However, it is worth noting that the index has dropped over 5% in the past month and has slipped into short-term oversold territory. In the sessions ahead, the 24,000–23,900 zone will be a key support area to watch. A decisive close below this range could reinforce weakness, while a rebound from it may signal a temporary pause in the downtrend.

On the economic front, all eyes will be on July's inflation figures in the U.S which will be released on Tuesday. The data will be closely scrutinised for signs of whether tariff pressures are reigniting price increases and how this might affect expectations regarding Federal Reserve rate cuts.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities, or trading strategies. The securities quoted are exemplary and not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Make your own decision before investing.

About The Author

Next Story