Market News

Week ahead: Rupee weakness, U.S. inflation, FII outflows and metal stocks to shape market direction

.png)

6 min read | Updated on December 14, 2025, 10:24 IST

SUMMARY

In the coming week, Rupee movement, U.S. inflation (CPI) data and continued FII outflows are likely to be the key drivers of market direction. At the same time, a softer U.S. dollar could offer selective support to metal stocks, while the broader index may remain sensitive to global cues and currency trends.

The broader indices also witnessed selling pressure with Midcap 150 and Smallcap 250 index declining 0.2% and 0.5% respectively. | Image: Shutterstock

Indian markets ended the week on a negative note, as investors reacted to a record-low rupee and continued selling by foreign institutional investors (FIIs). The benchmark indices experienced significant volatility during the week but largely remained within a range, suggesting consolidation at higher levels. The NIFTY50 and SENSEX closed the week at 26,047 and 85,268 respectively, down approximately 0.5%.

The broader indices also witnessed selling pressure with Midcap 150 and Smallcap 250 index declining 0.2% and 0.5% respectively. Both the indices tested crucial support zones and rebounded sharply during Friday’s session, indicating support based buying. Meanwhile, the rupee slid to a new record low of around 90.62 against the U.S. dollar, before closing just above the day's lowest point. This keeps currency risk firmly in focus. However, this pressure was partly offset by robust domestic fund flows, which helped to mitigate the negative impact on equities.

Price action was mixed across sectors. The defence index dropped by around 3%, while the Media, PSU Banks, IT and FMCG indices declined by between 1% and 1.7%. Conversely, metals gained around 2%, while Consumer Durables added approximately 0.4%, highlighting an ongoing shift towards sectors that can better withstand or benefit from a weaker rupee.

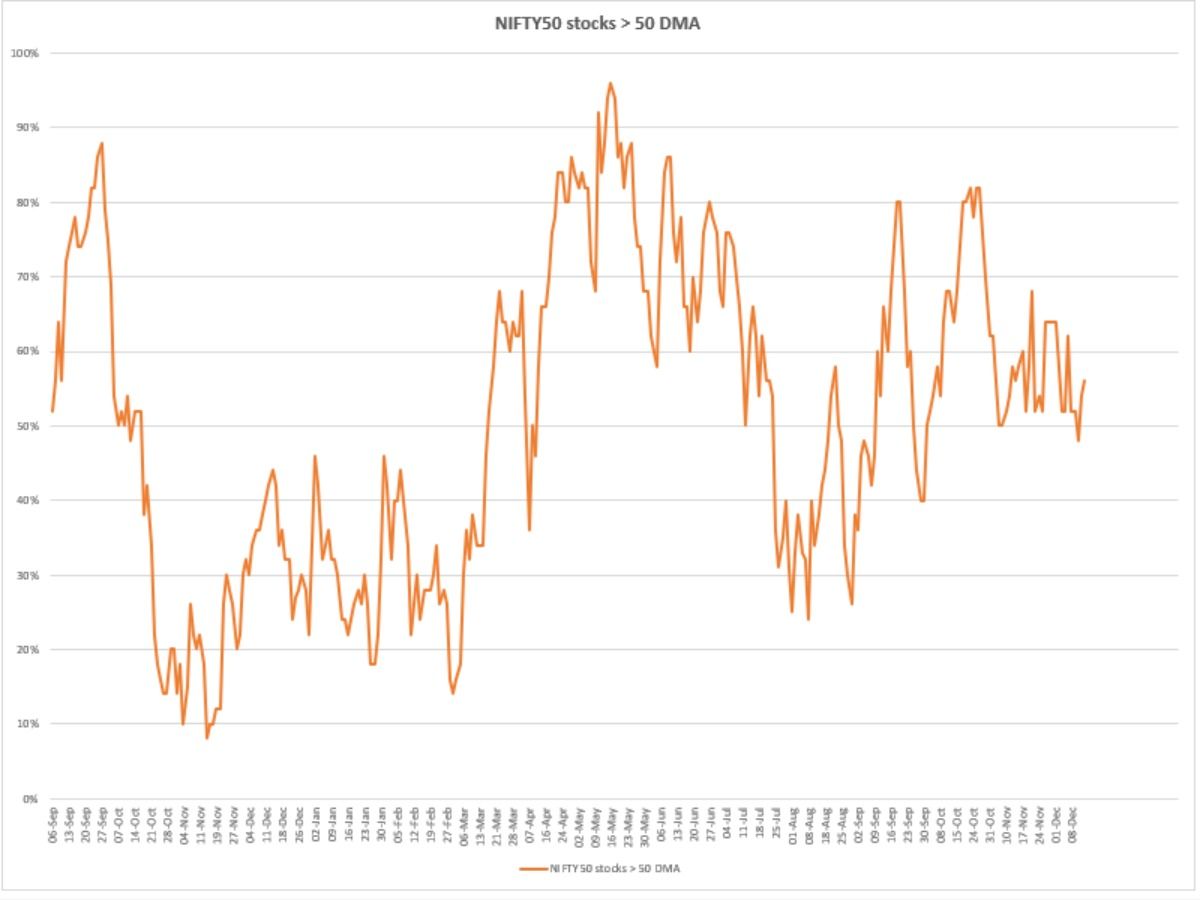

Index breadth

The NIFTY50 index remained largely range-bound last week, with 50–60 per cent of stocks trading above their 50-day moving average (DMA). Notably, the breadth index briefly dipped below 50 per cent, indicating a brief period of weak participation. However, this dip was swiftly bought into and breadth moved back into the supportive zone. Overall, participation remains stable enough to prevent a deeper decline, but the lack of decisive expansion beyond this range continues to signal muted momentum rather than a strong directional move.

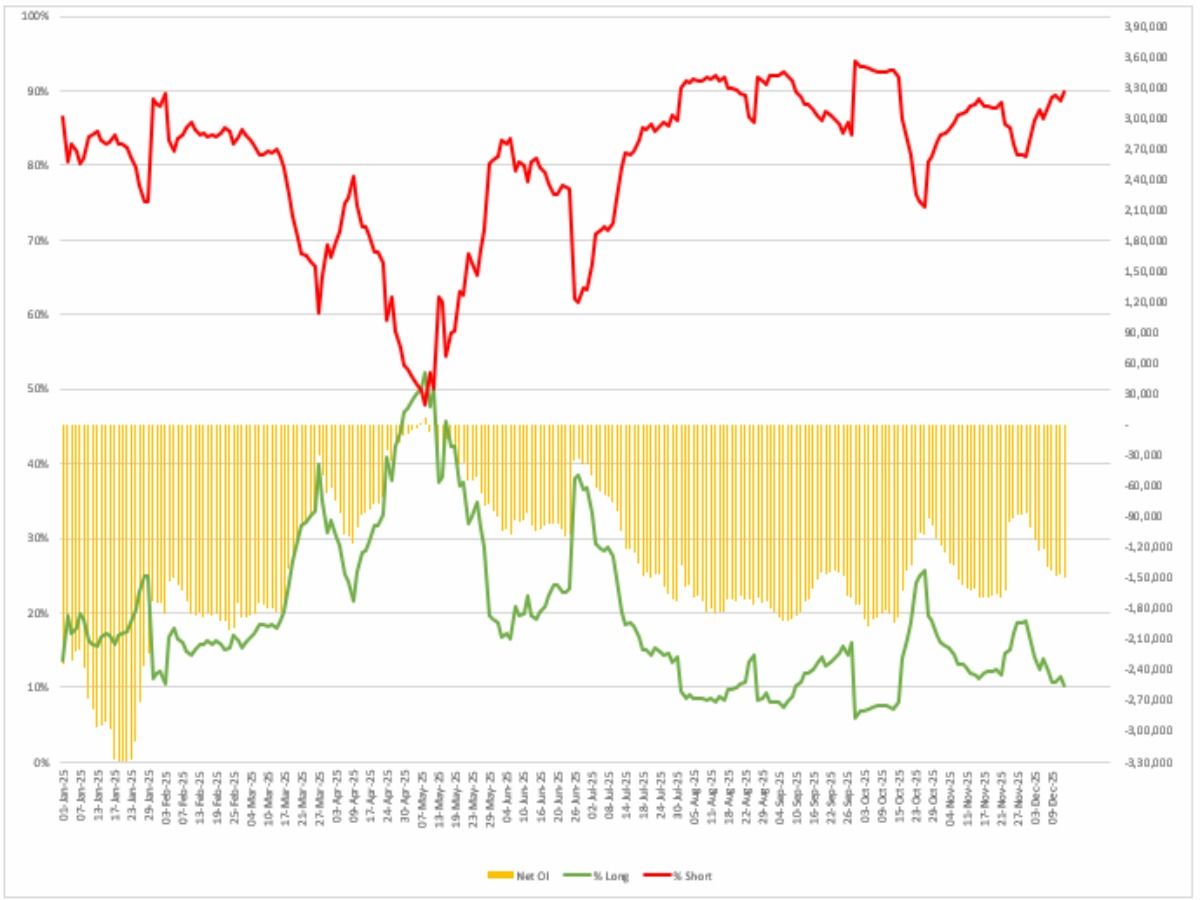

FIIs positioning equity and derivatives

Over the past week, Foreign Institutional Investors' (FIIs) positioning remained skewed towards the short side, with bearish exposure increasing further. The number of net short contracts rose from around 1,38,000 to almost 1,50,000, pushing the proportion of short positions up from approximately 88 per cent to almost 90 per cent. This indicates a steady accumulation of short bets throughout the week. Unless these significant short positions are covered, the index may face bouts of selling pressure at higher levels.

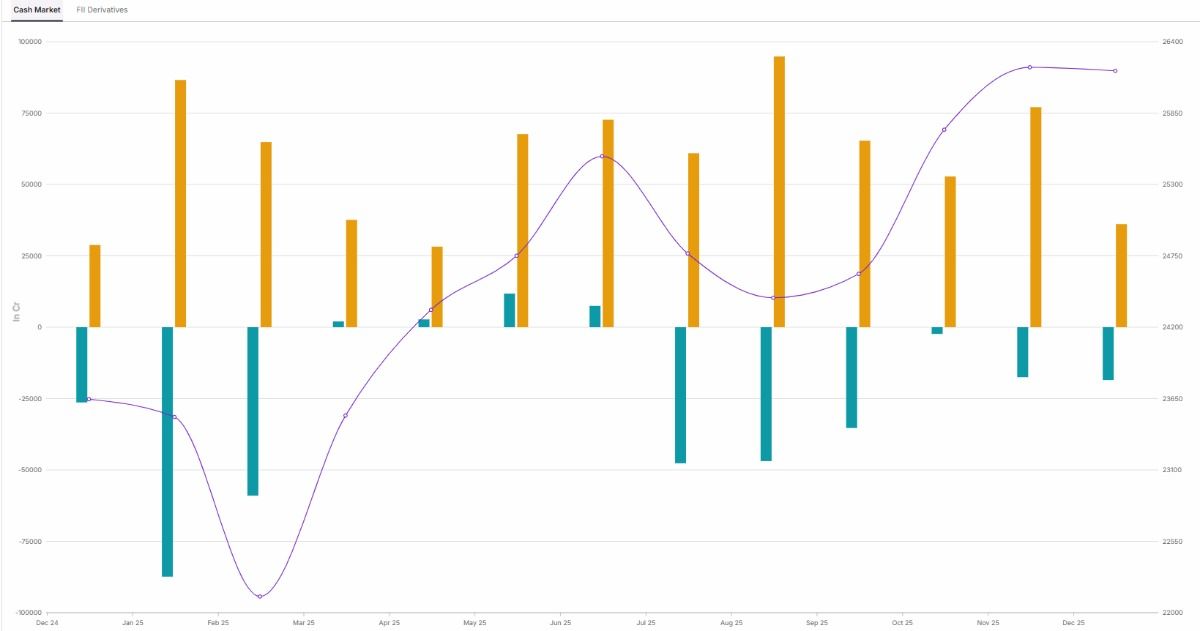

In the cash market, FIIs selling pressure intensified in December, reinforcing the cautious approach observed in the derivatives market. So far this month, FIIs have sold equities worth over ₹18,000 crore — higher than the outflows recorded in November. This persistent selling suggests that overseas investors are continuing to reduce their exposure, even though the market is holding near all-time high.

Conversely, Domestic Institutional Investors remain a clear counterbalance. Their buying has provided steady support and helped to absorb the selling pressure from FIIs. They have bought shares worth ₹39,970 crore and have prevented sharper downside movements in the index.

NIFTY 50 index

The NIFTY50 index has been consolidating within a narrow range. Attempts to move higher have been met with resistance near the 26,250 zone, which coincides with the previous all-time high zone. Conversely, each dip towards the 50-day exponential moving average (EMA) attracted buying interest, suggesting that this zone is acting as short-term support.

While the index continues to trade above the 21-day EMA, suggesting that the broader trend remains intact, the inability to sustain above the key support level highlights a sense of hesitation. Overall, the price action reflects a phase of indecision and consolidation, in which the market is absorbing selling pressure.

Meanwhile, attention on the domestic front will turn to wholesale price inflation (WPI) data and the minutes from the RBI’s monetary policy meeting. The WPI data will provide insight into input cost pressures, particularly in manufacturing-related sectors. The RBI minutes will also be analysed for commentary on currency weakness, inflation risks, and the policy outlook.

About The Author

Next Story