Market News

Week ahead: Rupee weakness, FIIs activity, US jobs data among key market triggers in the final week of 2025

.png)

6 min read | Updated on December 28, 2025, 11:31 IST

SUMMARY

Indian markets enter the new week in consolidation mode, with NIFTY holding within the 25,700–26,250 range amid subdued participation and thin post-holiday volumes. While FII positioning remains bearish, steady domestic flows continue to provide stability. The week ahead will be driven by RBI bond purchase measures, Fed meeting minutes and U.S. labour data, which could offer the next directional cue.

FIIs maintained a bearish outlook on index futures, with short contracts accounting for almost 90% of total positions. | Image: Shutterstock

Indian markets ended the truncated week on a subdued note, with benchmark indices achieving only modest gains amid ongoing FII selling, a weak rupee and continued uncertainty surrounding the India–U.S. trade deal. The NIFTY50 index added 0.2% for the week to end around 26,042, while SENSEX rose 0.1% to 85,041. The range-bound movement and low holiday volumes kept overall movement contained.

The broader markets also sustained the positive momentum with Midcap 150 index gaining 0.2% to 22,190 for the week and Smallcaps 250 index advancing 1.2% to 16,614. Meanwhile, the volatile index closed the week at historic lows of 9.12, down 4% for the week.

The sectoral picture was mixed, reinforcing the sense of consolidation. The Defence and metal stocks led the gains. The Nifty Defence index rose by over 3% and the Nifty Metal index increased by around 2.7%. In contrast, there was modest profit-taking in PSU banks, IT and pharma stocks, with the Nifty PSU Bank index slipping close to 1%, and the Nifty IT and Nifty Pharma indices easing by around 0.3%.

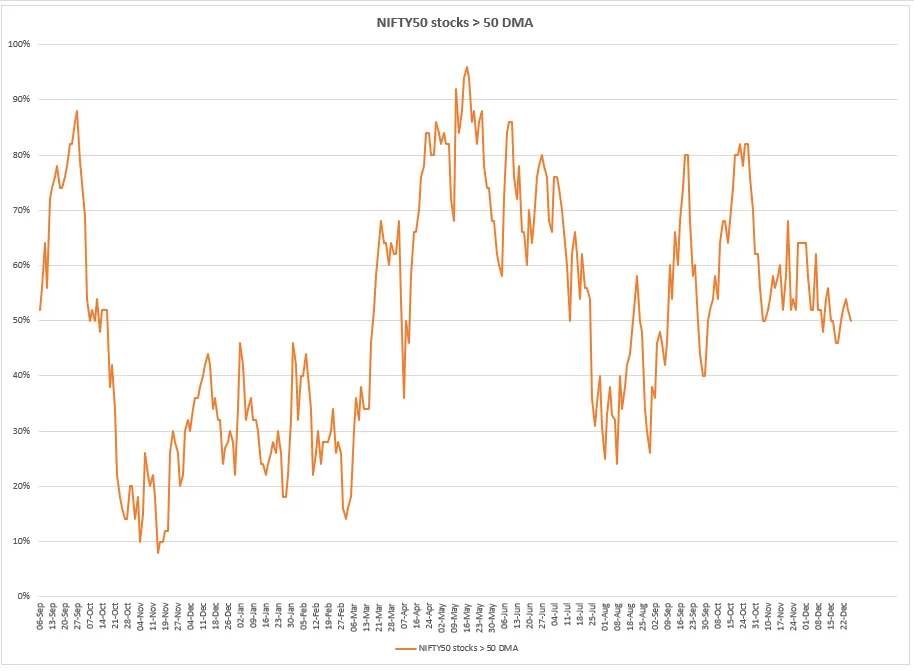

Index breadth

NIFTY’s market breadth remained subdued this week, with the percentage of NIFTY50 stocks trading above their 50-day moving average (DMA) remaining in the 45–50% range. This suggests that participation remained limited, even though the index continued to consolidate at higher levels. The inability of the market breadth indicator to reclaim the 60% mark highlights ongoing internal fatigue. This suggests that only a few heavyweight stocks are supporting the index. While this does not signal an outright breakdown, it does suggest a cautious undertone, whereby upside momentum is likely to remain limited unless broader participation improves.

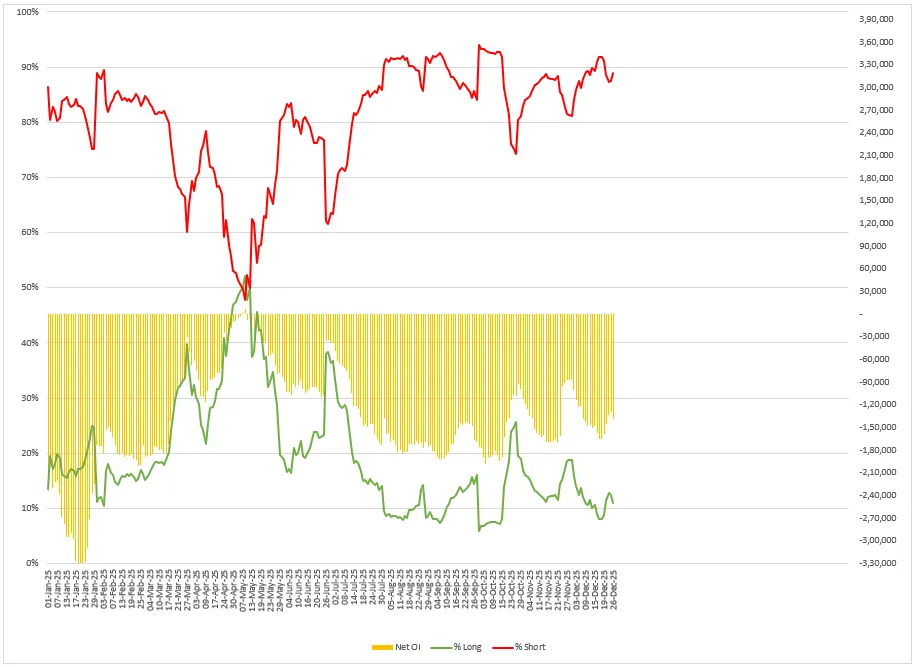

FIIs positioning equity and derivatives

Foreign institutional investors (FIIs) maintained a bearish outlook on index futures, with short contracts accounting for almost 90% of total positions. This highlights continued caution, as FIIs prefer to hedge rather than make aggressive bullish bets. Net open interest also remained deeply negative, suggesting that FIIs are exploiting market strength to offload equities at higher levels. Overall, this positioning is consistent with NIFTY’s ongoing consolidation, suggesting that FIIs are waiting for a clear trigger before changing their approach.

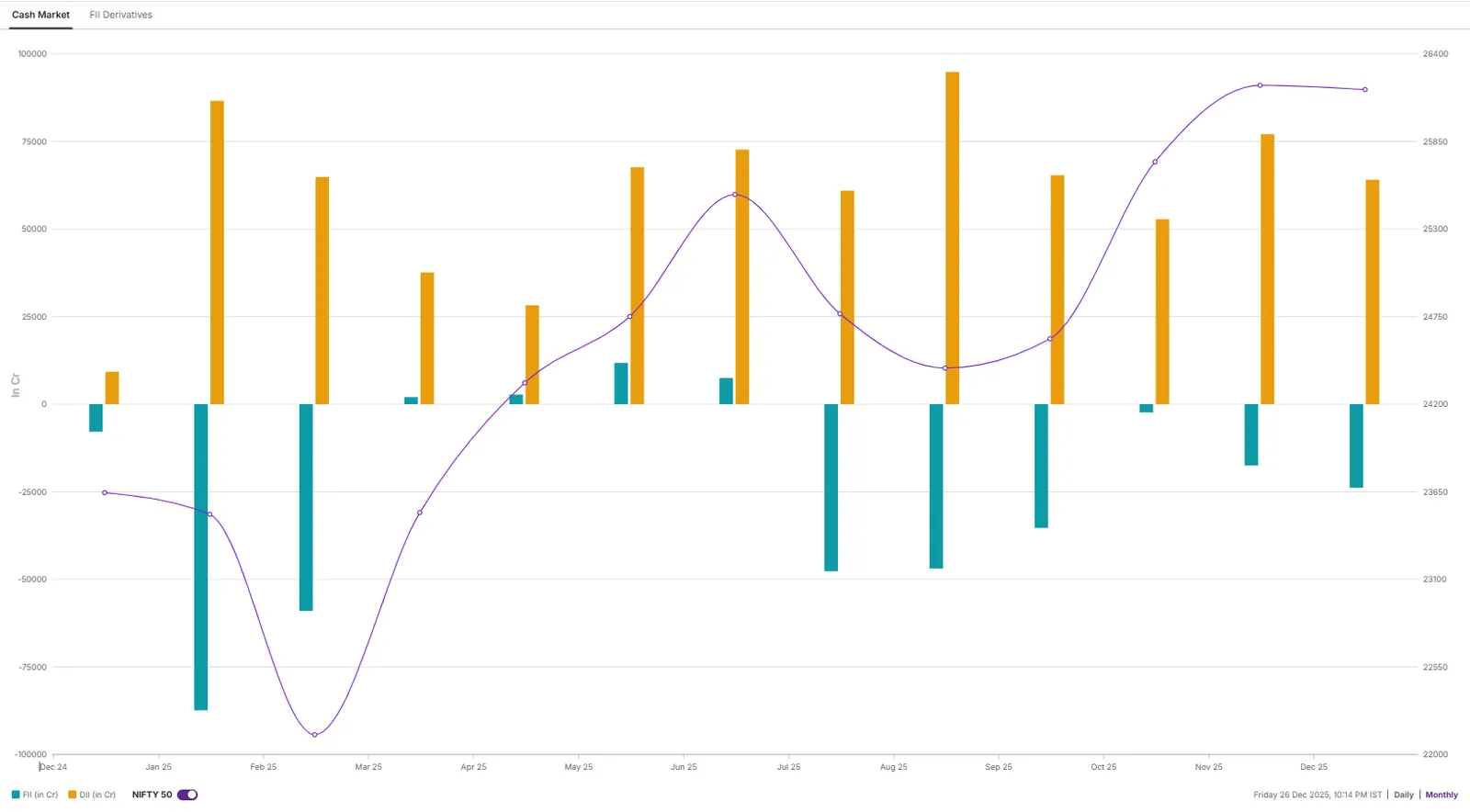

Meanwhile, in the cash market, FIIs have sold shares worth ₹23,830 crore so far in December, marking their highest monthly selling since September 2025. On a year-to-date basis, foreign investors have offloaded equities worth ₹2.9 lakh crore, reflecting a persistently cautious stance on Indian equities. In contrast, domestic institutional investors (DIIs) have continued to provide strong support, buying shares worth ₹64,000 crore in December and ₹7.72 lakh crore for the year so far. This sharp divergence highlights that while foreign investors remain bearish, domestic flows are acting as the key stabilising force for the market.

NIFTY 50 index

The NIFTY50 index spent the week consolidating near the 26,000 zone, once again failing to sustain moves toward the upper end of the range. The index faced selling pressure near 26,250, reinforcing this area as a strong resistance, while declines continued to find support around the 25,700–25,750 zone, which coincides with the rising 50-day EMA.

Price action remained choppy, highlighting indecision and lack of follow-through from both buyers and sellers. Despite the short-term consolidation, the broader structure remains positive as NIFTY continues to trade above its key moving averages. A sustained breakout above 26,250 is needed to revive momentum, while a breakdown below 25,700 could invite short-term pressure.

In the United States, the latest meeting minutes from the Federal Reserve will be a key global indicator, as investors seek clarity on the timing and pace of potential rate cuts in 2026. Alongside this, weekly jobless claims will provide an up-to-date picture of the U.S. labour market. Any signs of weakness could strengthen expectations of a softer growth outlook and increase the likelihood of earlier or more substantial policy easing.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities, or trading strategies. The securities quoted are exemplary and not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Make your own decision before investing.

About The Author

Next Story