Market News

Week ahead: Reliance and HDFC Bank earnings, LG Electronics IPO listing, Trump’s China tariffs among key market triggers to watch

.png)

6 min read | Updated on October 12, 2025, 12:21 IST

SUMMARY

In the coming week, the Indian markets are expected to react to the global sell-off triggered by renewed trade tensions between the US and China. Meanwhile, back home, investors will be focusing on earnings from heavyweights such as Reliance Industries and HDFC Bank, as well as the latest inflation data.

Stock list

Tata Capital IPO and LG Electronics India IPO will make their market debut next week.

Indian markets extended their winning streak, closing comfortably in positive territory. The rally was driven by buying from Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs), alongside a positive start to the earnings season. The NIFTY50 rose by 1.5% to reach 25,285, while the Sensex jumped by the same amount to reach 82,500.

Meanwhile, in the broader market, the NIFTY Midcap 150 index rose 1.6% and the Smallcap 250 Index added 1.4%, while the Smallcap Index closed almost unchanged, with select stocks witnessing sharp moves. On the sectoral front, all the major indices ended the week in the green with IT surging nearly 5% during the week. Real-Estate and Private Banks also advanced over 2%.

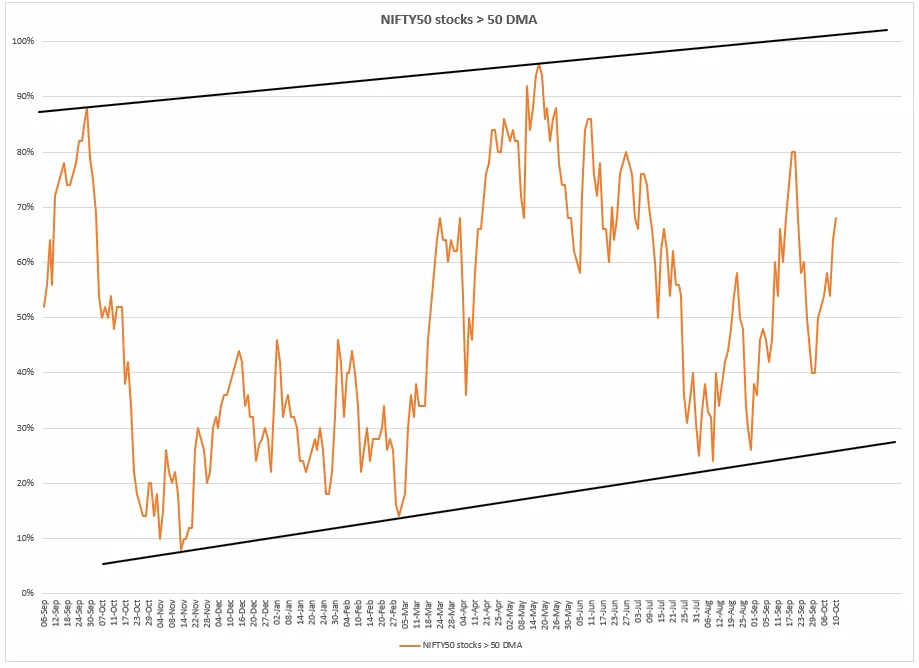

Market breadth

The week’s market breadth chart reading shows 65% of NIFTY50 stocks are now trading above their 50-day moving average, remaining comfortably above the threshold of 50%. The uptick in breadth illustrates a widening participation in the ongoing rebound, as more stocks consistently move above key technical support levels. Unless the market breadth weakens below 50% threshold, the broader structure may remain positive.

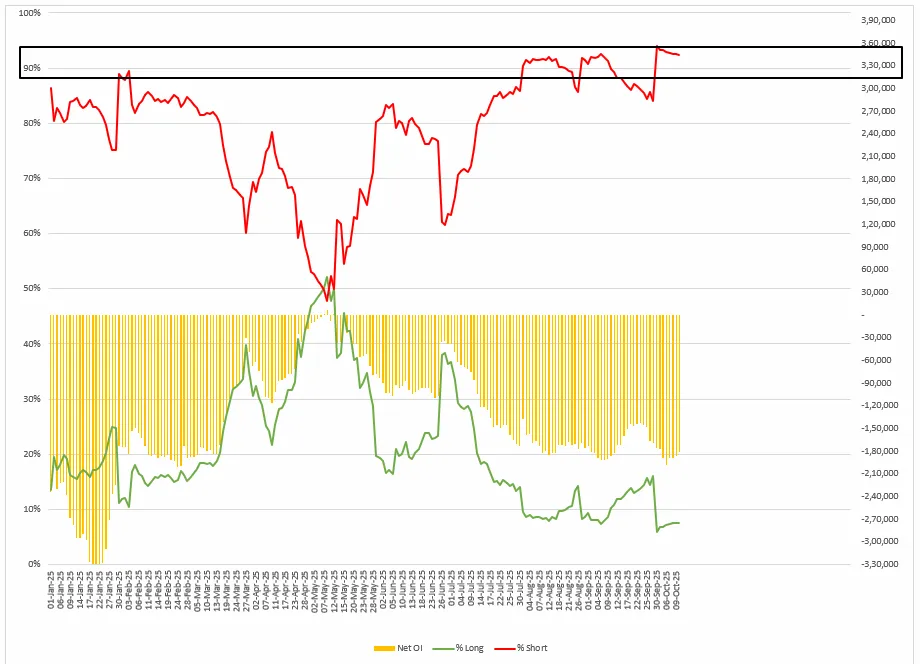

FIIs positioning in the index

The positioning of Foreign Investors (FIIs) in derivatives reveals that short interest remains persistently high in the October series. The FIIs' long-to-short ratio is still 8:92, with them holding an overwhelming majority of short contracts in index futures.

This ratio remains skewed, reflecting the bearish sentiment in derivatives trades over the past three months. However, the data also shows a marginal increase in long contracts, suggesting a subtle shift in positioning that may require closer attention.

There was a clear correlation between the increase in long contracts in index futures and renewed optimism in the cash market among FIIs. Last week, FIIs ended their three-month period of selling, becoming net buyers with equity purchases totalling ₹2,975 crore. Meanwhile, Domestic Institutional Investors (DIIs) maintained their supportive stance, adding a further ₹8,391 crore to their equity purchases over the same period. Going forward, the focus will be on whether FIIs can sustain this buying momentum or if last week's activity was merely a brief departure from their recent trend.

NIFTY50 index

The NIFTY50 index remains in a sideways-to-bullish formation as it approaches the upper trendline resistance zone between 25,400 and 25,500. This level has consistently acted as a major hurdle, and a sustained close above it would be essential to signal a breakout.

On the downside, the index finds strong support around the 21-day exponential moving average (EMA), which aligns closely with the 25,000 mark. A decisive close below this support would be an early indication of waning momentum and could open the door for further downside.

.webp)

.webp)

This development occurred just weeks before the scheduled meeting between President Trump and President Xi Jinping at the APEC summit in South Korea. The announcement of tariffs rattled global investors and triggered the steepest U.S. market selloff in six months. Major indices like S&P 500 (-2.7%) and Nasdaq Composite (-3.4%) tumbled as volatility spiked, reflecting concerns of renewed trade conflict between the U.S. and China.

On the global front, Goldman Sachs, JPMorgan Chase and Wells Fargo will announce Q3 results on Tuesday; ASML, Bank of America and Morgan Stanley on Wednesday, Charles Schwab and Taiwan Semiconductor Manufacturing on Thursday; and American Express on Friday to round off the week.

Besides this, Tata Capital IPO and LG Electronics India IPO will make their market debut in coming days. Tata Capital IPO, which was subscribed 1.95 times, will make its stock market debut on Monday, October 13 followed by LG Electronics India IPO, which secured a massive 54.02 times subscription, will start trading on the NSE and the BSE from Tuesday, October 14.

Meanwhile, in India the key inflation data releases for the upcoming week include the Consumer Price Index (CPI) scheduled for October 14 and the Wholesale Price Index (WPI) on October 15. The CPI inflation for September is forecasted at 1.9% year-on-year, indicating continued moderation within RBI’s target range. Meanwhile, the WPI inflation is expected to register a slight increase, reflecting ongoing price pressures in the wholesale segment.

However, without a decisive close above the resistance zone with strong trading volumes, the broader trend may remain range-bound. Immediate support on the downside is at the 21-EMA near the 25,000 level. A close below this level would be the first sign of weakness.

About The Author

Next Story