Market News

Week ahead: RBI policy, US-India trade talks, Q1 earnings and FII activity among key triggers to watch out

.png)

5 min read | Updated on August 03, 2025, 14:02 IST

SUMMARY

In the coming week, key factors such as the RBI's policy decision, first-quarter corporate earnings, the performance of the Indian rupee and ongoing US–India trade talks will play a crucial role in shaping market trends. From the technical standpoint, the index has crucial resistance around the 25,200 zone. Unless it reclaims this zone on a closing basis, the trend may remain sideways to bearish.

NIFTY50 index ended lower for the fifth straight week, slipping nearly 5% over the past one month. | Image: Shutterstock

Indian markets extended their losing streak to five consecutive weeks, the longest since mid-2023. The extended bearish momentum came from renewed concerns over India–U.S. trade ties, following the imposition of steep U.S. tariffs of 25% on Indian goods.

These trade tensions, coupled with the Indian rupee slipping to 87.52 against the dollar, its lowest since December 2022 — resulted in aggressive selling by foreign investors. NIFTY closed the week at 24,565, down 1.1%, while SENSEX settled at 80,519, down 1.05%.

The broader markets remained under significant pressure for the second consecutive week. The NIFTY Midcap 150 index fell by 1.9%, while the Smallcap 250 index plummeted by 2.9%, once again underperforming large caps. This sharp decline in the broader market reflected caution among investors, indicating risk-off sentiment.

Sector-wise, the damage was broad-based. FMCG was the lone bright spot, gaining 2.9%, while the rest closed deep in the red. Realty index took the heaviest hit, declining 5.8%, followed by Defence, which was down 4.7%. Metals (-3.4%) and Pharma (-2.8%) weren’t spared either, facing steady selling pressure throughout the week.

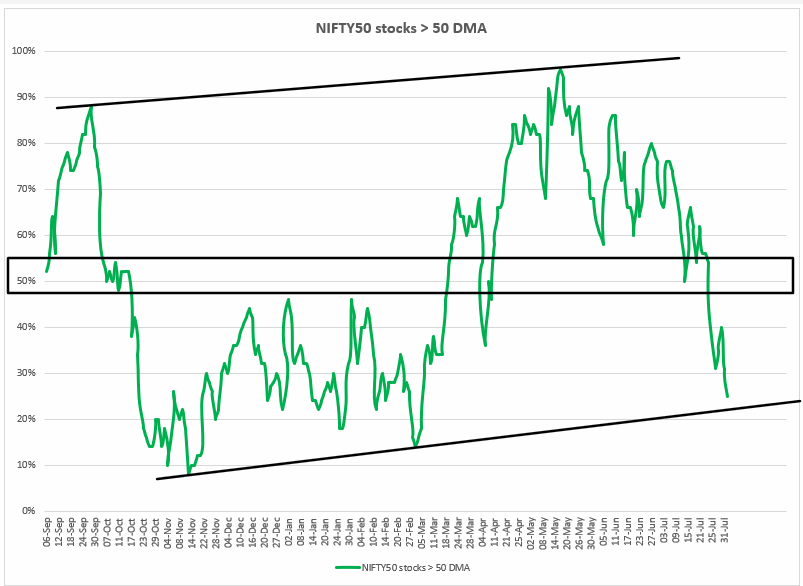

Index breadth

Market breadth stayed under pressure all week, with more than half of NIFTY50 stocks trading below their 50-day moving average (DMA). As shown in the chart below, just 25% of the index constituents are currently above 50 DMA, a level that’s remained below the crucial 50% mark since last week. Until this threshold is reclaimed, the broader trend is likely to remain weak.

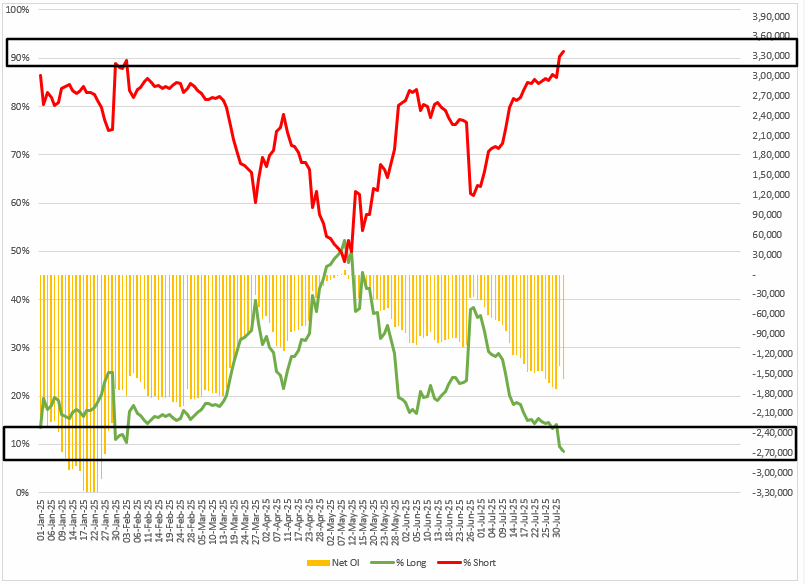

FIIs positioning in the index

Foreign Institutional Investors (FIIs) kicked off the August series with their most bearish stance on index futures, holding a long-to-short ratio of 9:91. This highlights a heavily skewed positioning toward the short side, signaling strong bearish sentiment in the derivatives segment historically.

Although the broader trend is bearish, it is worth noting that the current FIIs long-to-short ratio on index futures has entered a zone that is historically associated with potential reversals. In the sessions ahead, traders should watch this ratio closely for signs of short covering. If FIIs maintain their current positioning, the market is likely to remain sideways or bearish. However, any significant reduction in short positions could indicate the beginning of a reversal.

NIFTY50 index

The NIFTY50 index ended lower for the fifth straight week, slipping nearly 5% over the past one month. It has now dropped to its 21-week exponential moving average on the weekly chart and is hovering near the key support zone of 24,400. A decisive close below this level could trigger further downside, with the next support near 24,000. On the upside, immediate resistance is at 25,200. Unless the index reclaims this zone on a closing basis, the trend is likely to remain bearish.

.webp)

In the United States, several key earnings are on deck, including reports from Palantir, Advanced Micro Devices (AMD), Pfizer, Super Micro Computer, Walt Disney, McDonald's, Uber, Airbnb, Eli Lilly, and Warner Bros.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities, or trading strategies. The securities quoted are exemplary and not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Make your own decision before investing.

About The Author

Next Story