Market News

Week ahead: Q2 earnings, US Govt. shutdown and FIIs activity among key market triggers to watch

.png)

5 min read | Updated on November 09, 2025, 12:48 IST

SUMMARY

In the week ahead, market sentiment will depend on a variety of domestic and global factors, ranging from the outcome of the Bihar elections and the ongoing Q3 earnings season to concerns over an ongoing U.S. government shutdown and foreign institutional investor (FII) outflows

FIIs have continued their selling streak, offloading equities worth ₹1,632 crore so far in November. | Image: Shutterstock

Indian markets ended a turbulent week on a softer note, extending their losing streak for the second consecutive week. Mixed corporate earnings, persistent Foreign Institutional investor (FIIs) selling, and uncertainty over tariff discussions with the U.S. dampened sentiment. The NIFTY50 closed at 25,492, shedding 0.8%, while the SENSEX settled at 83,216, posting a weekly decline of 0.8%

Large-cap indices underperformed, while Mid and Small cap indices experienced milder declines. Sectorally, Consumer Durables (-2.5%), Defence (-2.1%) and Metals (-1.7%) witnessed losses, whereas PSU Banks (+2.0%) and Financial Services (+0.3%) emerged as the week’s brightest spots.

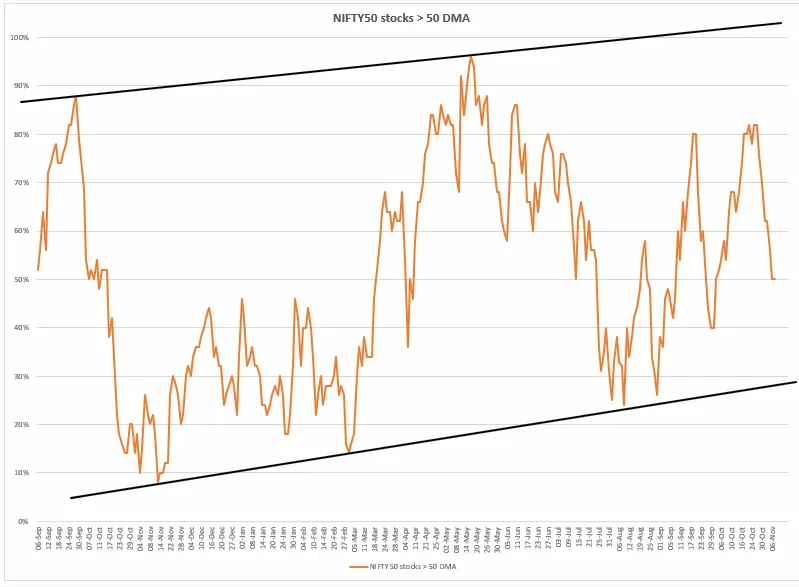

Index breadth

The percentage of NIFTY50 stocks trading above their 50-day moving average (DMA) is close to 50%, indicating a neutral market stance. This indicates that half of the index constituents are trading above their 50-DMA. This mid-zone often acts as a pivot point, with the market resuming its uptrend if breadth expands again or entering a correction if participation weakens further. A sustained move above 70% could confirm bullish momentum, whereas a drop below 50% would suggest emerging weakness in the broader market.

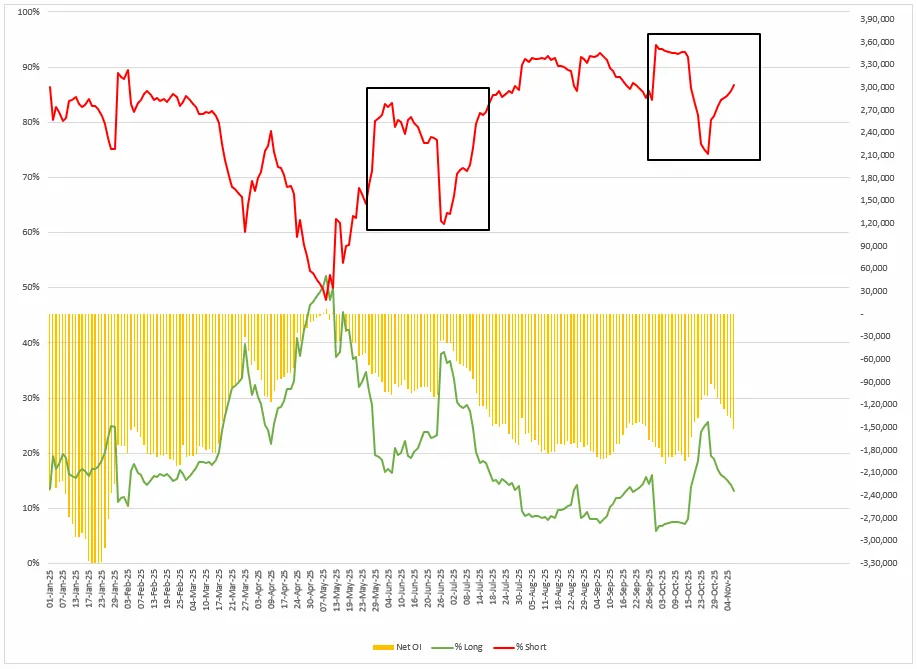

FIIs positioning in the index

This week's Foreign Institutional Investors (FIIs) futures positioning indicates a notable increase in short contracts, suggesting a cautious or bearish outlook despite the ongoing market rebound. As shown in the chart, the red line representing net short contracts, increased from 84% to 87% and the green line (% long) has fallen. Meanwhile, the orange bars representing overall open interest have expanded. This is a classic indication that FIIs are adding fresh shorts rather than covering them. It indicates that the current recovery may encounter resistance at higher levels.

In the cash segment, FIIs have continued their selling streak, offloading equities worth ₹1,632 crore so far in November, marking the fifth consecutive month of selling. This persistent outflow reflects their cautious stance amid global uncertainties.

By contrast, Domestic Institutional Investors (DIIs) have remained steady buyers, investing ₹16,677 crore in equities during the same period. These sustained inflows continue to offset the impact of FIIs withdrawals, demonstrating robust domestic participation.

.webp)

NIFTY50 index

For the second consecutive week, the NIFTY50 index witnessed pullback, but found support near its 50-day exponential moving average (EMA) at around 25,320. This level coincides with the lower trendline, making it an important short-term support zone. If the index closes decisively below this level, it could open the door to further downside. However, as long as the index remains above 25,300, the broader trend will remain structurally positive, supported by higher lows on the medium-term chart.

.webp)

.webp)

Meanwhile, in India, the release of the October Consumer Price Index on 12 November and Wholesale Price Inflation on 14 November is expected to set the direction of the market, particularly with regard to interest rate expectations and overall economic momentum. Additionally, the outcome of the Bihar Assembly elections, scheduled for 14 November 2025, will influence investor sentiment, given Bihar's political importance.

About The Author

Next Story