Market News

Week ahead: Q2 earnings, auto sales data, FIIs activity, global cues among key market triggers to watch

.png)

6 min read | Updated on November 03, 2025, 09:33 IST

SUMMARY

Indian markets are entering the new week with several key triggers lined up, including quarterly earnings, monthly auto sales data and movements in oil and gas stocks, which are likely to set the tone. Persistent foreign institutional investor (FII) selling and global cues will also play a crucial role in shaping the trend.

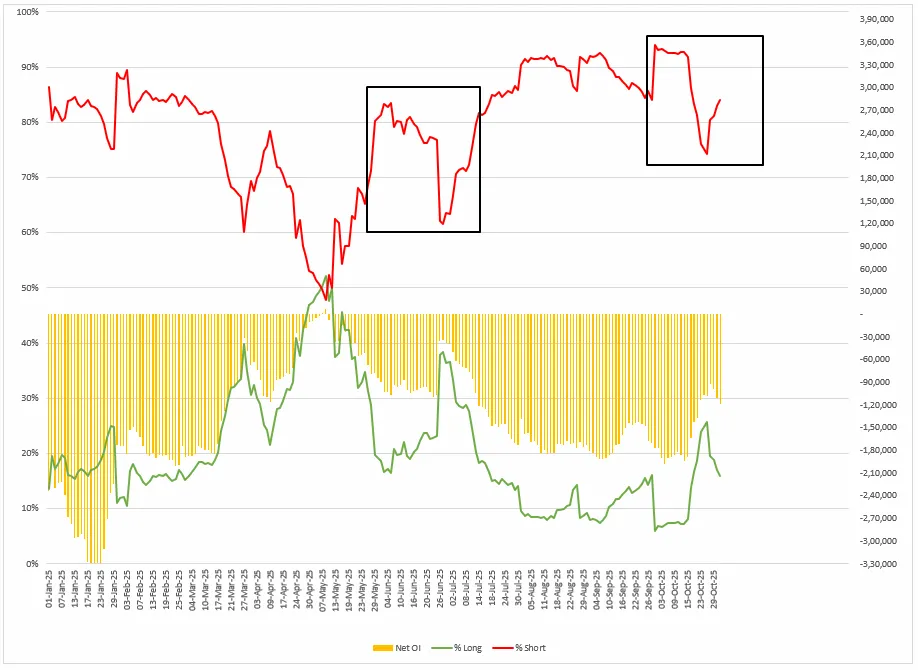

The long-to-short ratio for the November series now stands at 16:84 as FIIs are once again increasing their short positions.

Indian markets ended a volatile week on a softer note, snapping a four-week winning streak. Mixed corporate earnings, hawkish commentary from the U.S. Federal Reserve and continued foreign institutional investor (FII) selling weighed on sentiment. The NIFTY50 settled at 25,722, down 0.32%, while SENSEX closed at 83,938, marking a weekly decline of 0.5%.

Market activity was surrounded by speculation surrounding a potential increase in foreign direct investment (FDI) limits for public sector banks, as well as ongoing developments in U.S.-China trade relations, which contributed to cautious investor behaviour.

Mid and small cap indices managed to outperform their large-cap peers, with Midcap 150 index and Smallcap 250 index advancing 0.7% and 0.5%. On the sectoral front, the PSU Banks (+4.6%) led the way, followed by Oil & Gas (+3.1%) and Metals (+2.5%), all posting notable gains, while Auto (-1.0%) and Financial Services (-0.9%) declined the most.

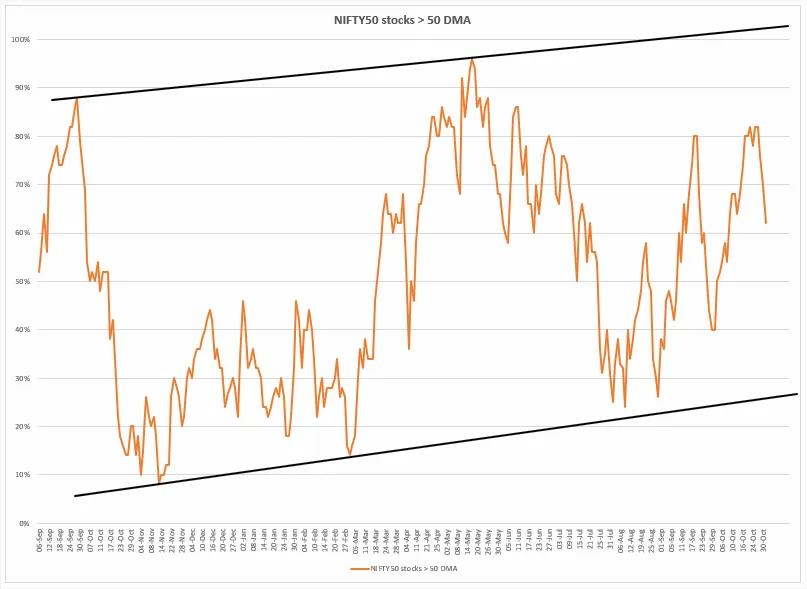

Index breadth

The percentage of NIFTY50 stocks trading above their 50-day moving average (DMA) has fallen from around 80%, indicating a slowdown following a strong rally in recent weeks. Although the reading remains comfortably above the mid-zone, suggesting that the uptrend is intact. Meanwhile, the declining slope indicates that short-term momentum is weakening.

Historically, a retreat from the 70–80% zone in this breadth metric often coincides with a pause or mild consolidation in the headline index. In short, while market breadth remains positive, it is no longer euphoric. This suggests a period of rotation and consolidation is likely, rather than an outright reversal.

FIIs positioning in the index

The FII index futures data indicates a change in sentiment, with foreign investors once again increasing their short positions following a brief period of short covering. The long-to-short ratio for the November series now stands at 16:84, reflecting renewed caution.

This mirrors the pattern seen earlier in the year, where an initial recovery in long exposure was followed by a sharp rise in shorts as the market approached overbought territory (first boxed zone). The increase in short contracts, alongside elevated open interest, suggests that FIIs are hedging aggressively rather than positioning for a sustained rally. Unless this trend reverses soon, it could weigh on market sentiment in the near term, keeping NIFTY vulnerable to profit-booking.

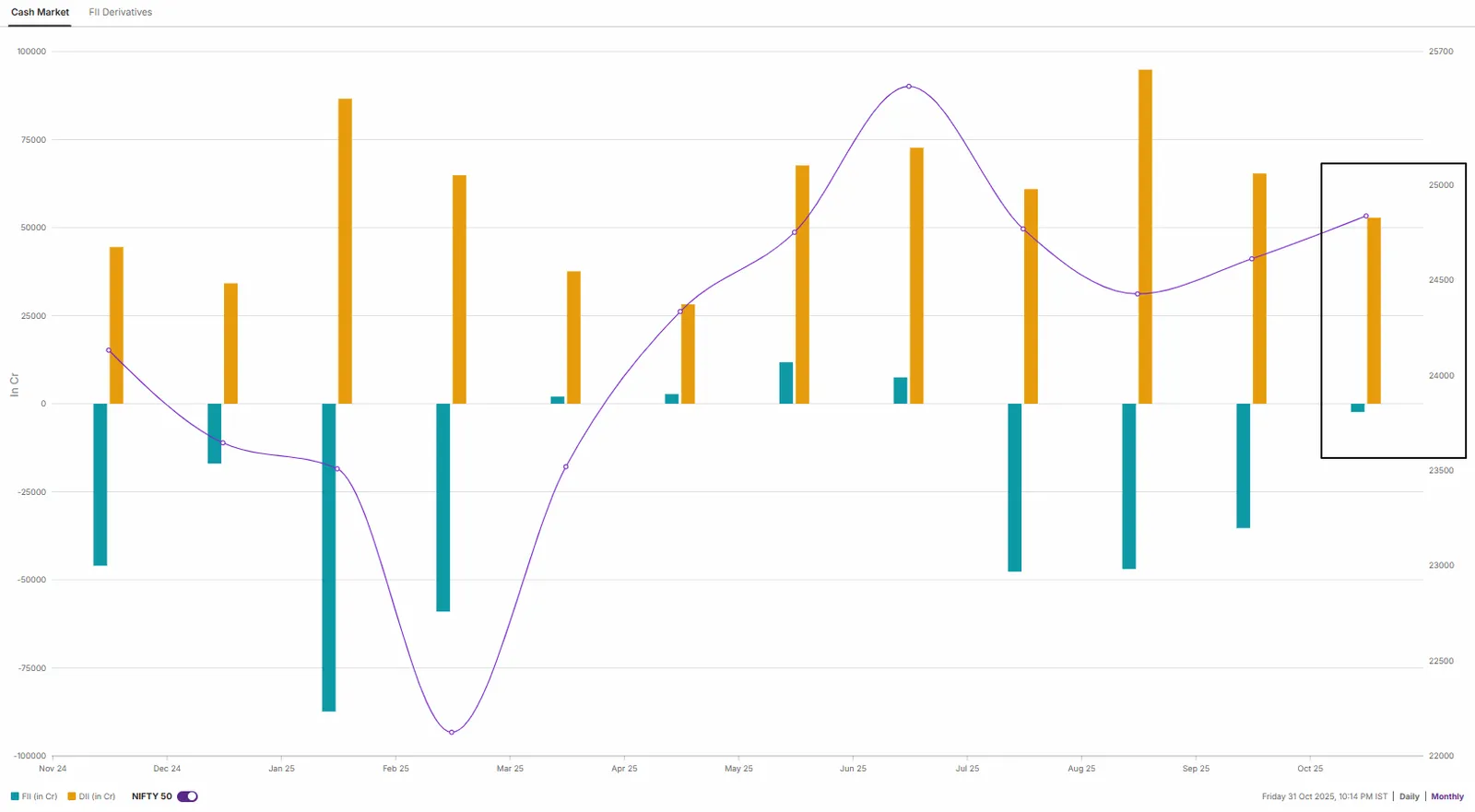

Foreign investors remained net sellers for the fourth month in a row and sold shares worth ₹2,346 crore. Despite stabilising market conditions and improving domestic sentiment, FIIs have continued to trim exposure. In contrast, Domestic Institutional Investors (DIIs) have maintained strong buying support (₹52,794 crore), helping the NIFTY50 hold firm near record levels.

NIFTY50 index

The NIFTY50 index has fallen back from the 26,000 mark after encountering resistance at its previous all-time high zone of 26,250. However, the pullback appears to be a healthy correction within an ongoing uptrend, as the index continues to trade comfortably above its 21-day and 50-day exponential moving averages (EMAs).

The immediate support zone is located around 25,500–25,400, which coincides with the 21-EMA and a significant horizontal level from the previous breakout. If the index closes decisively below this area, it could open the door to a deeper retracement. On the upside, 26,250 remains critical resistance. Breaking above this level would confirm the resumption of the uptrend and could pave the way for a new all-time high.

PSU banks were in the spotlight this week, with investor sentiment buoyed by the information that the foreign direct investment (FDI) cap for public sector lenders could be raised from 20% to 49%. This sparked heavy buying, driven by the expectation that such a move could unlock billions in passive inflows into the sector and strengthen the banks' capital positions. Improved earnings, healthy credit growth and attractive valuations also helped to reinforce optimism in PSU bank stocks.

The index's immediate resistance level is around 26,250, where sellers have repeatedly emerged. Conversely, the 25,400 zone is now a crucial support level. A sustained close below this level on the weekly chart would confirm further weakness and allow for a deeper pullback.

About The Author

Next Story