Market News

Week ahead: Q1 earnings, Auto sales data, Fed policy, India-U.S. trade talks to drive market sentiment

.png)

6 min read | Updated on July 27, 2025, 19:33 IST

SUMMARY

In the coming week, the NIFTY50 index will react to the key first quarter earnings from ITC, Hindustan Unilever, Maruti Suzuki, Mahindra & Mahindra, NTPC, Asian Paints and Coal India. On the technical front, the index has crucial resistance around 25,250, while support is around 24,500 zone. A break of these levels will provide further directional clues.

The 50-share NIFTY jumped 122.30 points or 0.49% to 25,090.70. | Image: Shutterstock

Indian markets marked their longest weekly losing streak of 2025, as both the NIFTY and SENSEX closed the fourth consecutive week in the red. The sharp decline was driven by sustained foreign fund outflows, mixed corporate earnings and ongoing uncertainties surrounding the India–U.S. trade deal. Against this backdrop, the NIFTY ended the week at 24,837, down 0.3%, while the SENSEX settled at 81,463, also down 0.3%.

Meanwhile, the broader markets saw significant selling pressure last week. The NIFTY Midcap 150 index slid 1.6%, while the Smallcap 250 index fared even worse, tumbling 3%. Overall, the retreat in both Mid and Small cap spaces highlighted the risk-off sentiment in the market.

On the sectoral front, it was a challenging week for the majority of sectors, with only Pharma (+0.3%) and Private Banks (+0.2%) managing to eke out modest gains. High volatility persisted throughout the week. Initial optimism, fuelled by positive results from major banks such as HDFC and ICICI, was overshadowed by disappointing earnings in the IT sector and wider global concerns. Real-Estate (-4.9%) stocks led the deckline, followed by IT (-4.0%) and FMCG (-3.4%) pack.

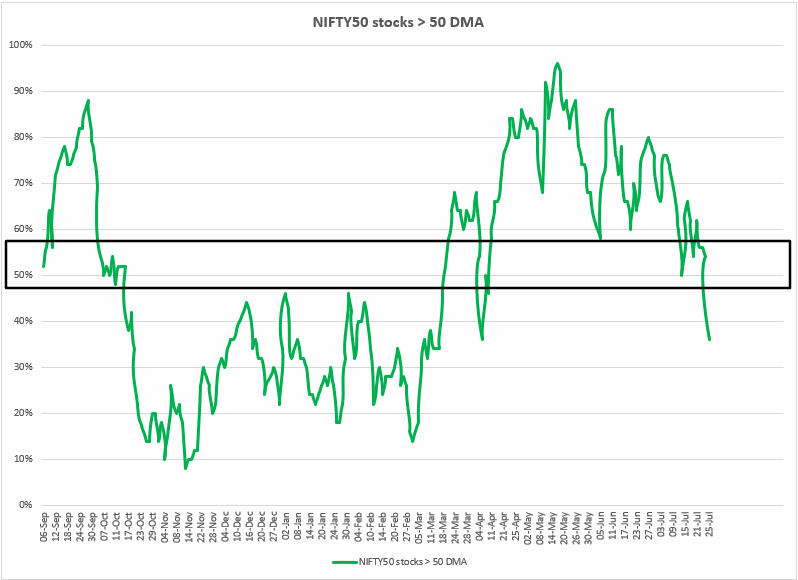

Index breadth

The NIFTY50 index showed a notable lack of breadth, with the proportion of stocks trading above their 50-day moving averages falling sharply. While 62% of NIFTY50 components were above this key technical level at the start of the week, persistent selling saw this figure halve to 36% by Friday.

Additionally, the breadth indicator slipped below the crucial 50% threshold for the first time in three months, signalling a clear loss of momentum. Unless the index regains this threshold, the overall trend is likely to remain under pressure.

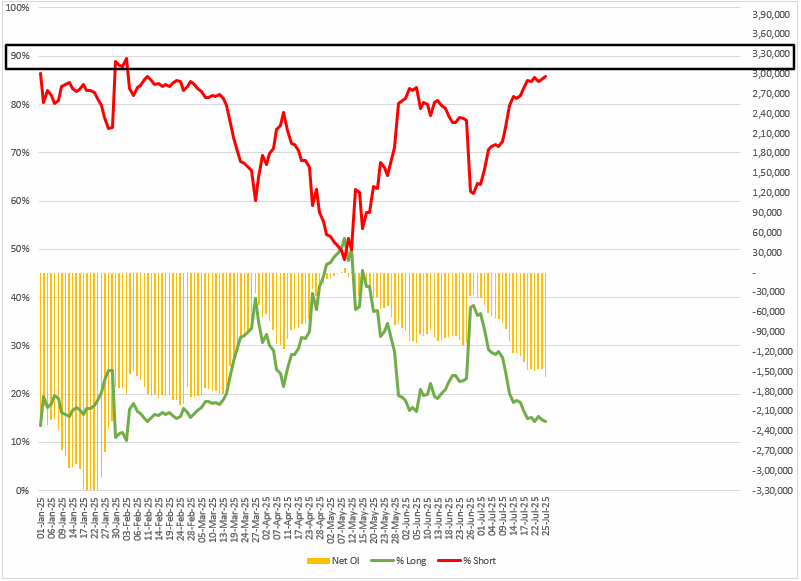

FIIs positioning in the index

Foreign Institutional Investors (FIIs) sustained and increased their bearish bets on the index futures this week, pushing the long-to-short ratio to 15:86. Net open interest surged 9% to -1.58 lac contracts, indicating the strength of bearish sentiment across the derivatives.

As highlighted in our last week’s blog, FIIs bearish positioning and the stretched long–to-short ratio had reached their historical highs. Although the positioning of FIIs suggests continued downside risk, traders should be aware of the possibility of sharp short-covering. A sudden unwinding of short positions could trigger a significant rally, so it is important for market participants to be ready to adapt as the market changes.

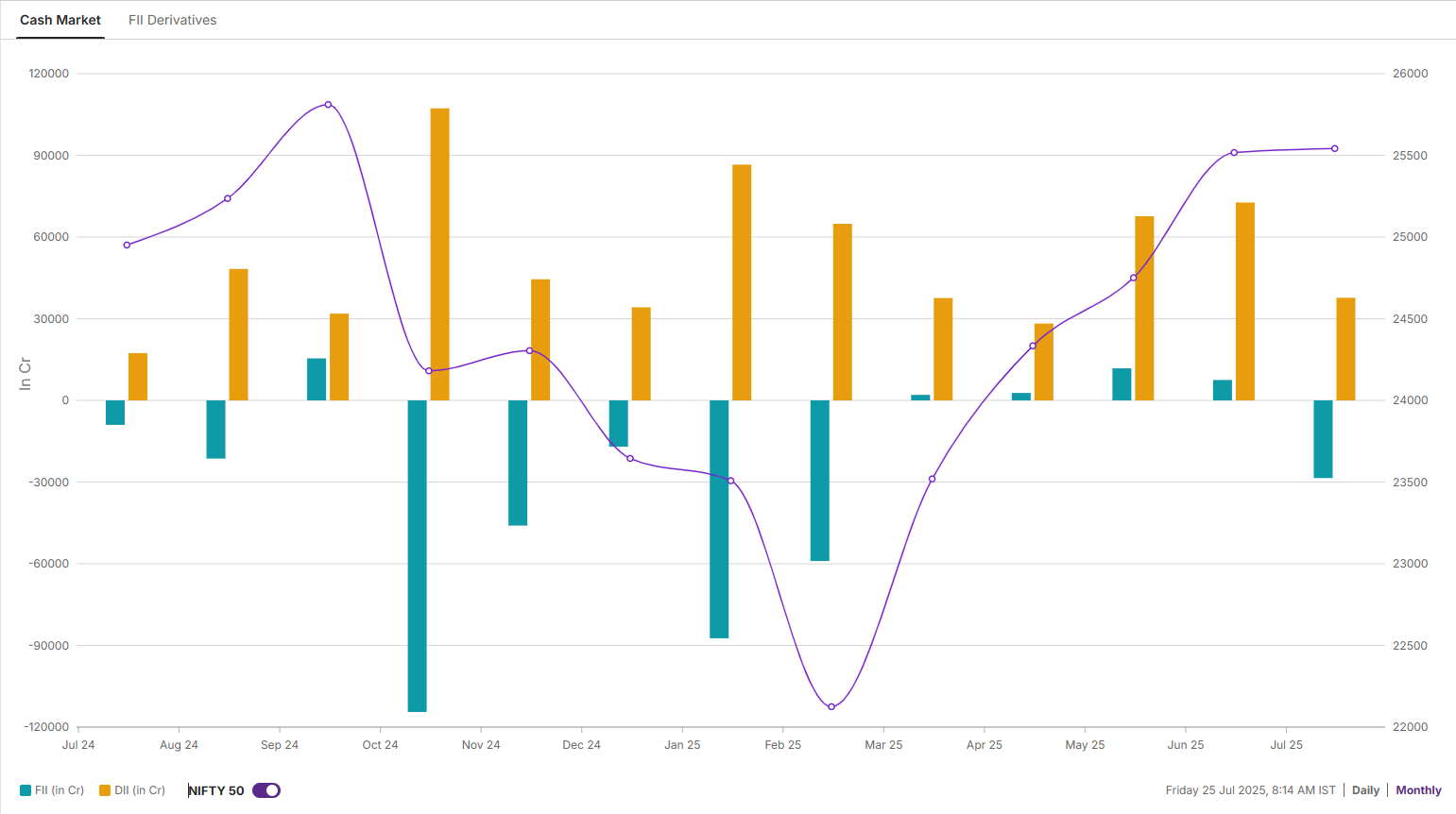

Throughout the July series, FIIs were net sellers in the cash market, offloading shares worth ₹28,500 crore. This marked a reversal from the previous four months, when FIIs were net buyers, purchasing shares totalling over ₹23,000 crore. However, their selling in July effectively erased these earlier gains, signalling a notable shift in sentiment. Meanwhile, the Domestic Investors supported the market as they remain net buyers and have bought shares of over ₹37,500 crore.

NIFTY50

The NIFTY50 index has declined for the fourth consecutive week, forming a fourth bearish candle on the weekly chart. However, following a sharp fall, an inverted hammer candlestick pattern has now formed. This is a bullish reversal pattern, which typically appears at the end of a downward trend, indicating that selling momentum is weakening and buyers are entering the market.

The pattern is confirmed when the following candle closes above the high of the reversal pattern. Traders should closely watch for a close above the 25,250 level, as this would signal and validate a trend reversal. Conversely, a close below 24,700 would indicate continued downside pressure and further weakness.

📌Spotlight: The real-estate sector fell by almost 5% last week, forming a bearish candle on the weekly chart. This decline was driven by disappointing earnings from Oberoi Realty and Lodha Developers, which triggered a sell-off across the sector. In this context, shares of Lodha Developers, Oberoi Realty, Prestige Estates and Godrej Properties declined in the range of 5% to 11%.

🗓️Key events in focus: Globally, the Federal Open Market Committee (FOMC) meeting, scheduled for Tuesday and Wednesday, will be in focus. This will be followed by a press conference of Fed Chair Jerome Powell. As per the CME FedWatch Tool, the odds of an immediate rate cut remain slim at just 2.6%. However, the September meeting is seen as much more likely to result in action, with a rate cut priced in at around 64%.

Investors will also be closely monitoring Thursday's inflation data and U.S. jobs report. Both releases have the potential to significantly impact the market, offering new insights into the direction of the Fed’s policies. On the domestic front, the attention will shift to the automobiles sales data of July 2025, which will be released on 1 August.

📈📉Earnings blitz: The first-quarter earnings season for FY26 is entering its final stretch, with a host of major companies set to announce their results. Key names on investors’ radar include IndusInd Bank, GAIL, Asian Paints, NTPC, Varun Beverages, Larsen & Toubro, Power Grid, Tata Steel, Mahindra & Mahindra, Maruti Suzuki, Hindustan Unilever, Coal India, ITC, and Tata Power.

In the United States, around 150 companies in the S&P 500 are set to report their earnings for the second quarter, including tech giants Meta, Microsoft, Amazon and Apple. Key reports to watch include those from Procter & Gamble and Visa on Tuesday, Meta and Microsoft on Wednesday, and Amazon, Apple and Mastercard on Thursday. The week will close with reports from oil giants Chevron and Exxon Mobil on Friday.

🗓️Earnings overview: On Saturday, Kotak Mahindra Bank and IDFC First Bank announced their first quarter earnings of FY26. Kotak's results for the first quarter showed a 7% Year-on-Year (YoY) decline in net profit to ₹3,282 crore, excluding the one-time gain from the sale of its insurance business. This decline in profit was primarily driven by a significant increase in provisions and contingencies, reflecting elevated credit costs.

Meanwhile, IDFC First Bank reported a sharp 32% yYoY drop in net profit to ₹463 crore. This was mainly due to elevated credit costs and stress in its microfinance portfolio.

📓✏️Takeaway: The NIFTY50 index slipped below its 50-day exponential moving average on 25 July, confirming the bearish engulfing pattern. The index is making a lower low and lower high structure on the daily chart with immediate resistance around the 25,250 zone. Unless the index reclaims this zone on a closing basis, the trend may remain sideways to bearish. Meanwhile, the next crucial support is around 24,500 zone. A break below this level will signal further weakness.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities, or trading strategies. The securities quoted are exemplary and not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Make your own decision before investing.

About The Author

Next Story