Market News

Week ahead: Israel-Iran war, crude oil prices, six new IPOs, monthly expiry among key market triggers to watch out

.png)

5 min read | Updated on June 22, 2025, 11:49 IST

SUMMARY

For the upcoming week, all eyes will be on the Middle East conflict as the U.S. forces attack three nuclear facilities in Iran. The U.S. President, in his address to the nation, said that the U.S. armed forces hit the Natanz, Fordo and Isfahan sites, with Fordo being the main target.

NIFTY50 index maintained positive momentum last week, with an average of 68% of its stocks trading above their 50-day moving averages.

Indian markets extended the consolidation for the fifth straight week but managed to end on a positive note. The NIFTY50 index sustained its positive momentum despite rising geopolitical tensions in the Middle East, rising crude oil prices and weakening Indian Rupee.

In contrast, broader markets cooled off as investors locked in gains after a strong rally since April 2025. With the escalation in hostilities between Israel and Iran and a spike in crude oil prices, the NIFTY Midcap 150 index slipped 0.6%, while the Smallcap 250 index dropped 1.7%.

Among sectors, NIFTY Infrastructure (+1.7%), Private Banks (+1.6%), and Automobiles (+1.5%) led the gains. On the flip side, PSU Banks (-1.3%) and Energy (-0.6%) were the biggest laggards.

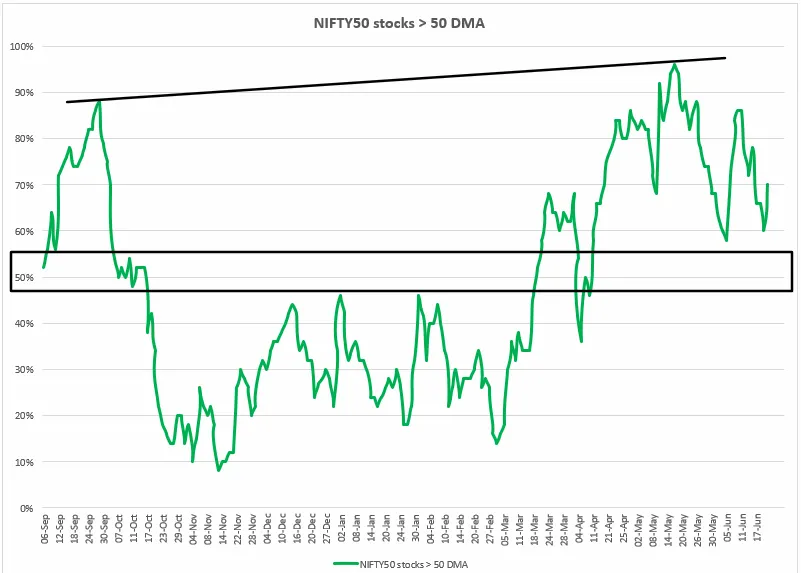

Index breadth

Throughout the week, the NIFTY50 index maintained positive momentum, with an average of 68% of its stocks trading above their 50-day moving averages. As highlighted on the chart below, the breadth of the index is currently sustaining above the 50% threshold since March 2025. This suggests that the index is still strong, and the first sign of weakness will appear if it falls below this threshold.

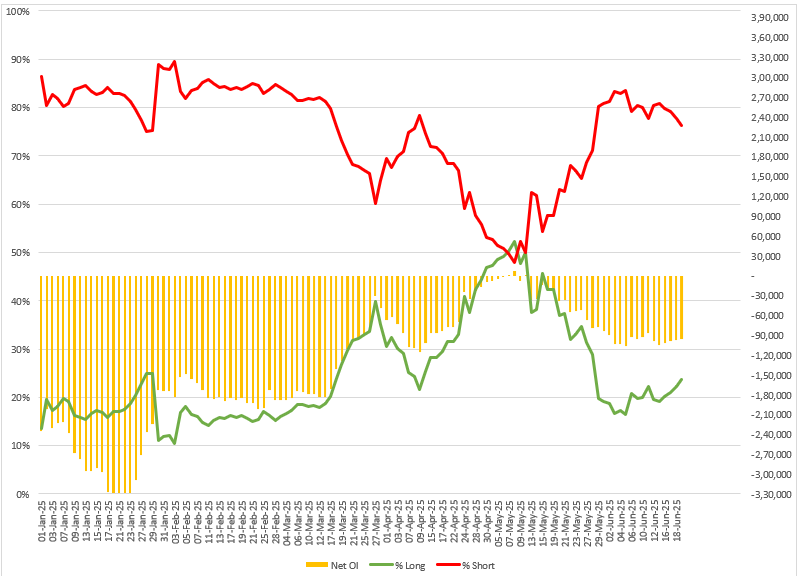

FIIs positioning in the index

Foreign Institutional Investors (FIIs) sustained their bearish bets throughout the June series on index futures. They sustained their bearish bets with a long-to-short ratio broadly in the range of 22:78 through the week, indicating bearish sentiment.

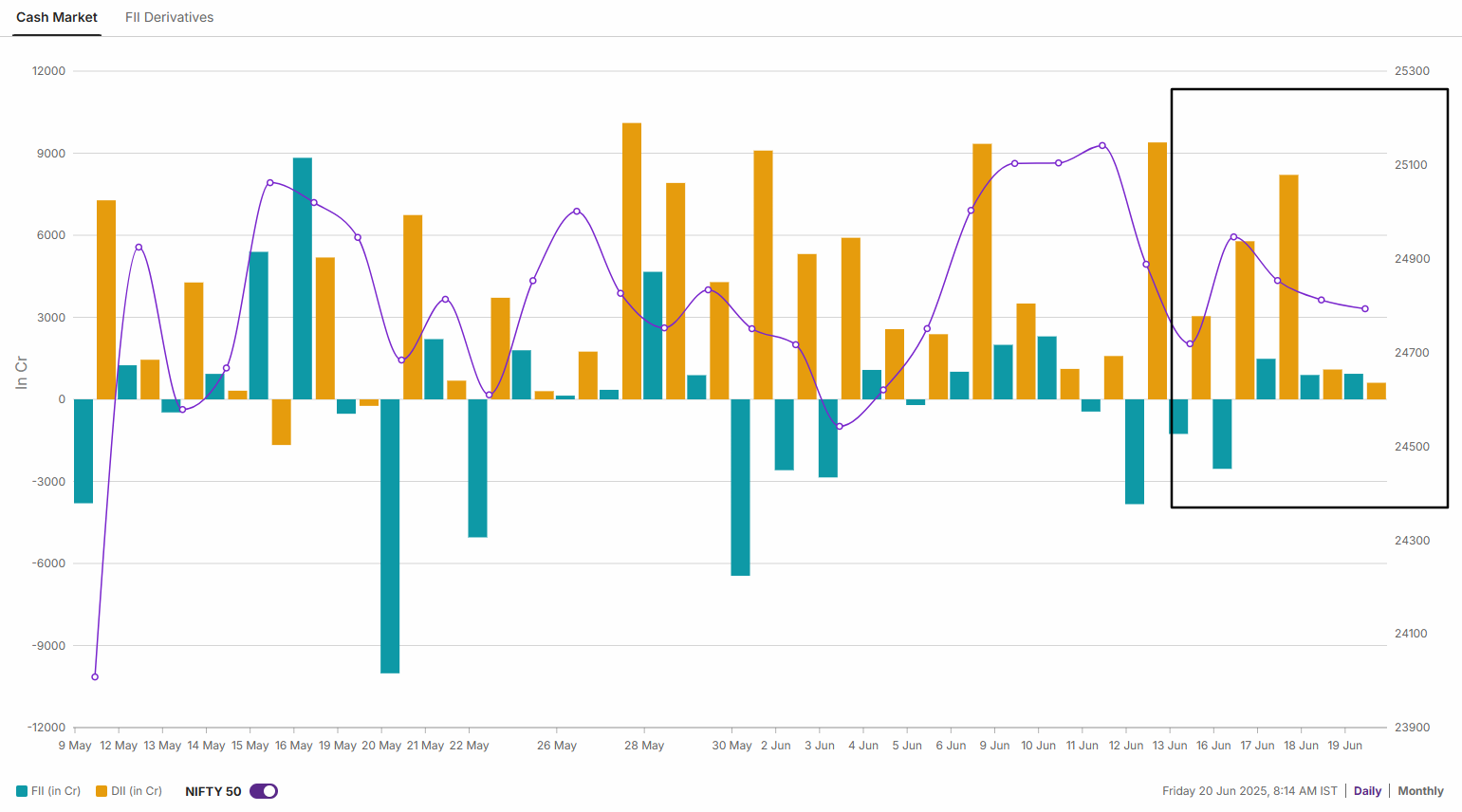

Meanwhile, in the cash market, FIIs were net buyers for the second week in a row, picking up ₹9,222 crore worth of shares—₹7,940 crore of that on Friday alone. The domestic institutional investors sustained their buying momentum and bought shares worth ₹11,672 crore.

NIFTY50

The NIFTY50 index extended the consolidation for the fifth week in a row and sustained its bullish momentum at higher levels. The index formed a bullish harami candlestick pattern on the weekly chart and is formed when a small bullish candle is completely contained within the previous larger bearish candle. The pattern gets confirmed if the close of the subsequent candle is above the reversal pattern.

For short-term clues, traders can monitor the immediate resistance zone of 25,250 and the support zone of 24,500. A close above or below these levels on a closing basis on the daily chart will provide further directional clues.

BANK NIFTY

The BANK NIFTY index also formed a bullish harami candlestick pattern on the weekly chart and extended the consolidation for the second straight week. For the upcoming sessions, traders can monitor the high and the low of the bearish candle formed during the week ending June 14. A break above the high or the low of the bearish candle will provide further directional clues.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities, or trading strategies. The securities quoted are exemplary and not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Make your own decision before investing.

About The Author

Next Story