Market News

Week ahead: India-US tariff standoff, GST council meeting, Auto sales data, and US Jobs report among key market triggers to watch out

.png)

6 min read | Updated on August 31, 2025, 15:30 IST

SUMMARY

This week, the markets will react to the new derivatives expiry schedule, GST Council meeting and the August auto sales data. The rupee hitting record lows and continued foreign institutional investor outflows will add to the cautious sentiment.

Foreign Institutional Investors (FIIs) have continued their net selling trend, maintaining a strong bearish stance in index futures for September series. | Image: Shutterstock

Indian markets were dominated by sharp selling pressure, with the NIFTY50 index tumbling below the 24,500 mark and losing over 440 points in just five sessions. Meanwhile, the Indian rupee came under renewed pressure, slipping past 87.70 and breaking through the critical 88 threshold, ending the week close to record lows against the U.S. dollar.

The key driver of weakness in both the equity market and the rupee was the imposition of additional U.S. tariffs of 25% on Indian exports, which caused investor sentiment to deteriorate and accelerated foreign capital outflows. In light of these developments, the broader markets experienced sharper corrections than the large-cap indices, reflecting a cautious stance among investors. The NIFTY Midcap 150 index fell 3.2%, closing at 20,750, and the NIFTY Smallcap 250 index declined 3.1%, to 16,507.

Sectoral performance remained bearish this week, led by steep declines in Real-Estate (-4.2%), Defence (-3.9%) and PSU Banks (-3.4%), which weighed on overall market breadth. In contrast, FMCG (+0.7%) stood out, bucking the trend with modest gains.

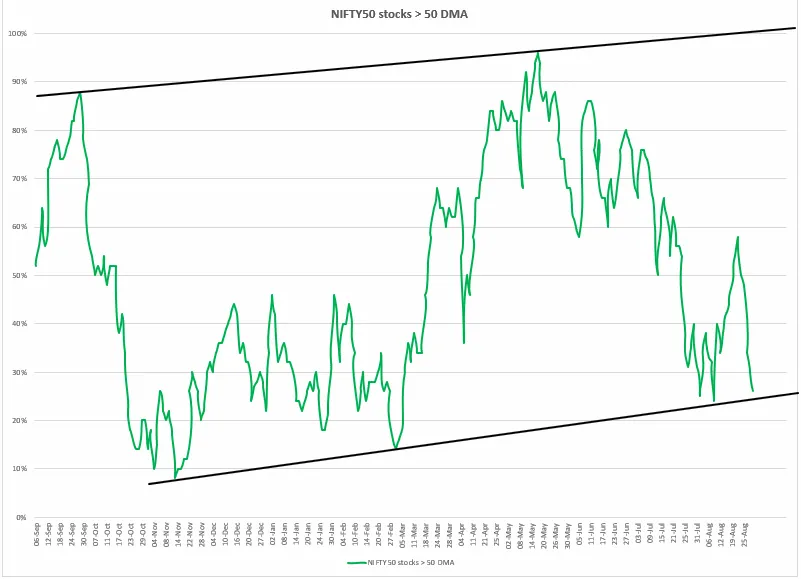

Index breadth

The NIFTY50 index's breadth retreated further, with the percentage of stocks trading above their respective 50-day moving averages dropping to around 26%, close to this year's lowest levels. Having briefly rebounded from the lows of late July, the breadth of the index has weakened again, indicating that short-term strength is limited to a narrow subset of stocks.

The fact that the breadth remains below the peaks observed in April and June highlights that the rally has yet to broaden significantly. For more convincing signs of market stabilisation and wider participation going forward, it will be necessary for improvement to be sustained above the 50% threshold.

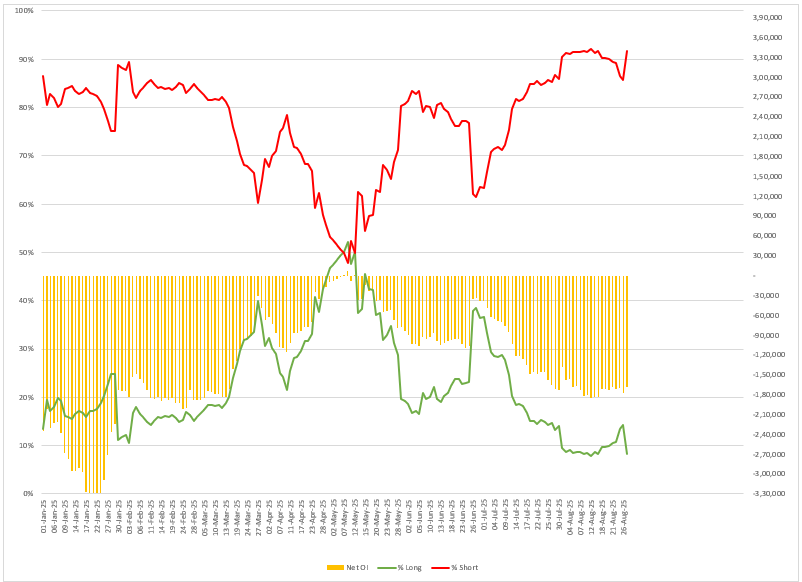

FIIs positioning in the index

The Foreign Institutional Investors (FIIs) have continued their net selling trend, maintaining a strong bearish stance in index futures for September series. Their long-to-short ratio remains heavily skewed, with short positions rising above 90% while long positions have plunged near 10%. Additionally, the net open interest has deepened further into negative territory, indicating aggressive shorting in the new expiry cycle. Despite extreme negative positioning persisting throughout August and now intensifying in September, FIIs have sustained their bearish stance, showing no shift in the sentiment.

This heightened bearishness continues to put pressure on the NIFTY50 at higher levels, making it difficult for the index to sustain rallies. Historically, such persistent and elevated short positioning suggests the potential for an abrupt reversal in sentiment, but for now, the selling pressure remains dominant at the start of the series.

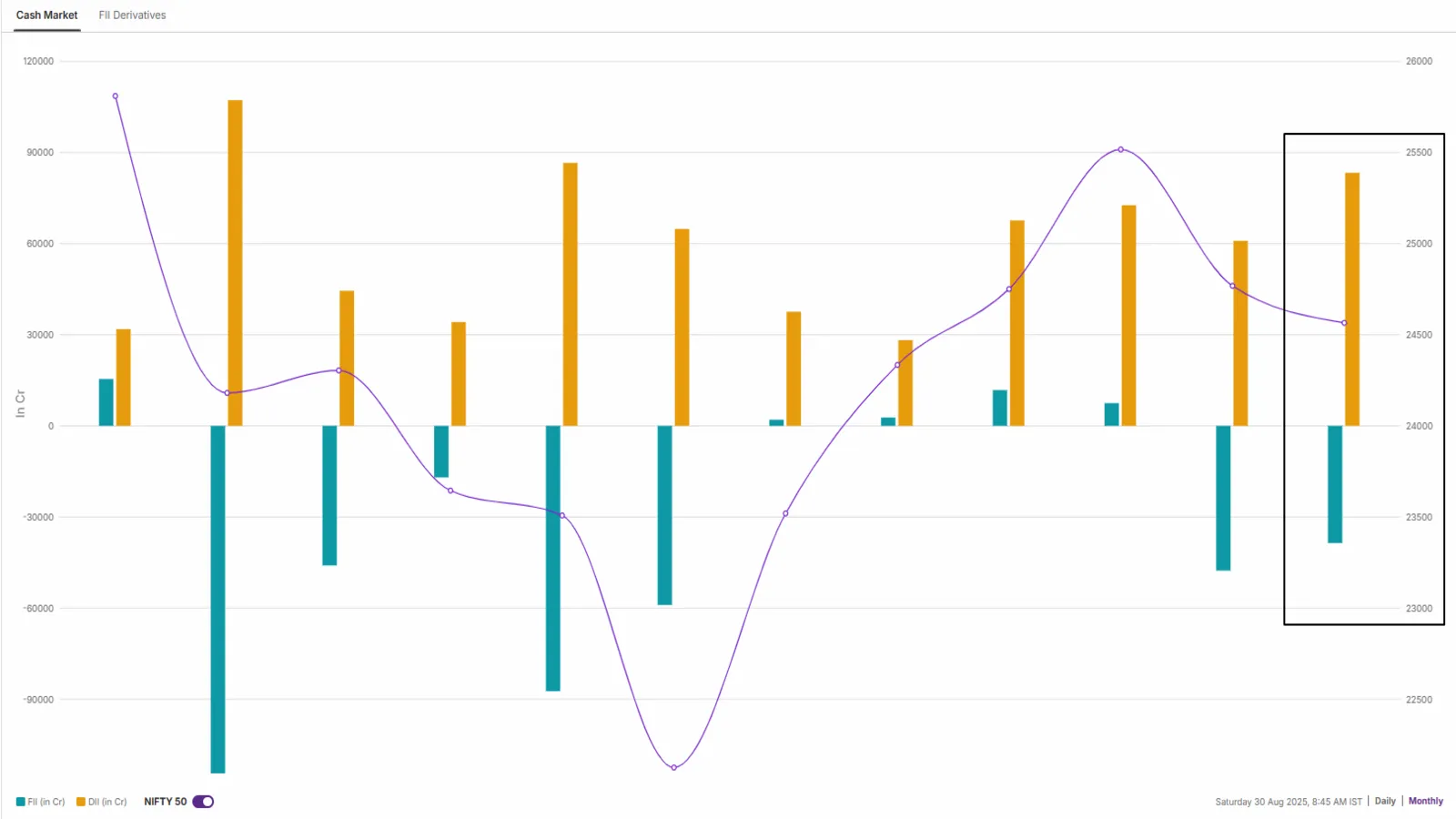

Their bearish stance in the derivatives market aligned with the cash segment activity, as FIIs sold shares worth ₹38,590 crore in August, a decline of 19% compared to July. In contrast, the Domestic Institutional Investors remained steady net buyers, purchasing shares worth ₹83,340 crore, offering much needed support to the market.

NIFTY50 index

The NIFTY50 index extended the losing streak for the second week in a row, confirming the shooting star candlestick pattern on the weekly chart. The index ended below the low of the bearish reversal pattern, indicating weakness.

On the daily chart, the index is trading below its 21-day and 50-day exponential moving averages (EMAs) and slipped below the immediate resistance zone of 24,850 on the closing basis. For the upcoming sessions, the index has immediate support around its crucial 200 EMA and 24,300 zone. A decisive close below this level will signal continuation of the bearish momentum.

In his speech at Jackson Hole, Federal Reserve Chair Jerome Powell described the current labour market as 'curious', characterised by low job growth but also muted layoffs, which keep the unemployment rate relatively low by historical standards. The report will be of key significance for policymakers and investors, as it will provide vital insights into the current state of the economy and inform future decisions made by the Fed.

Meanwhile, on the domestic front, the high-stakes GST Council meeting, chaired by Finance Minister Nirmala Sitharaman on 3–4 September, will be closely watched for progress on the proposed two-slab GST taxation regime. On Monday, auto companies will release their August sales data, and any surprises are likely to influence auto and ancillary stocks, as well as broader market sentiment.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities, or trading strategies. The securities quoted are exemplary and not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Make your own decision before investing.

About The Author

Next Story